Back

EKyc Hub

Streamline Your KYC ... • 1y

🔍 Streamline Your Verification Processes with ekychub.in At eKYC Hub, we understand that accurate and efficient verification is crucial for businesses to maintain trust and comply with regulations. Our platform offers seamless solutions for: ✔️ Bank Account Verification: Instantly validate account details to ensure secure transactions. ✔️ Aadhaar Verification: Simplify customer onboarding with quick and reliable Aadhaar integration. ✔️ PAN Verification: Verify PAN details in real-time for smooth KYC compliance. ✔️ GST Verification: Authenticate GST details to keep your business processes in sync with tax regulations. Our services are designed to deliver: 🔒 Enhanced Security | ⚡ Real-time Processing | 📊 Compliance & Accuracy 📩 Explore our platform today at ekychub.in and discover how we can transform your verification process! #DigitalVerification #eKYC #BankAccountVerification #AadhaarVerification #PANVerification #GSTVerification #SecureOnboarding

More like this

Recommendations from Medial

CA Jasmeet Singh

In God We Trust, The... • 11m

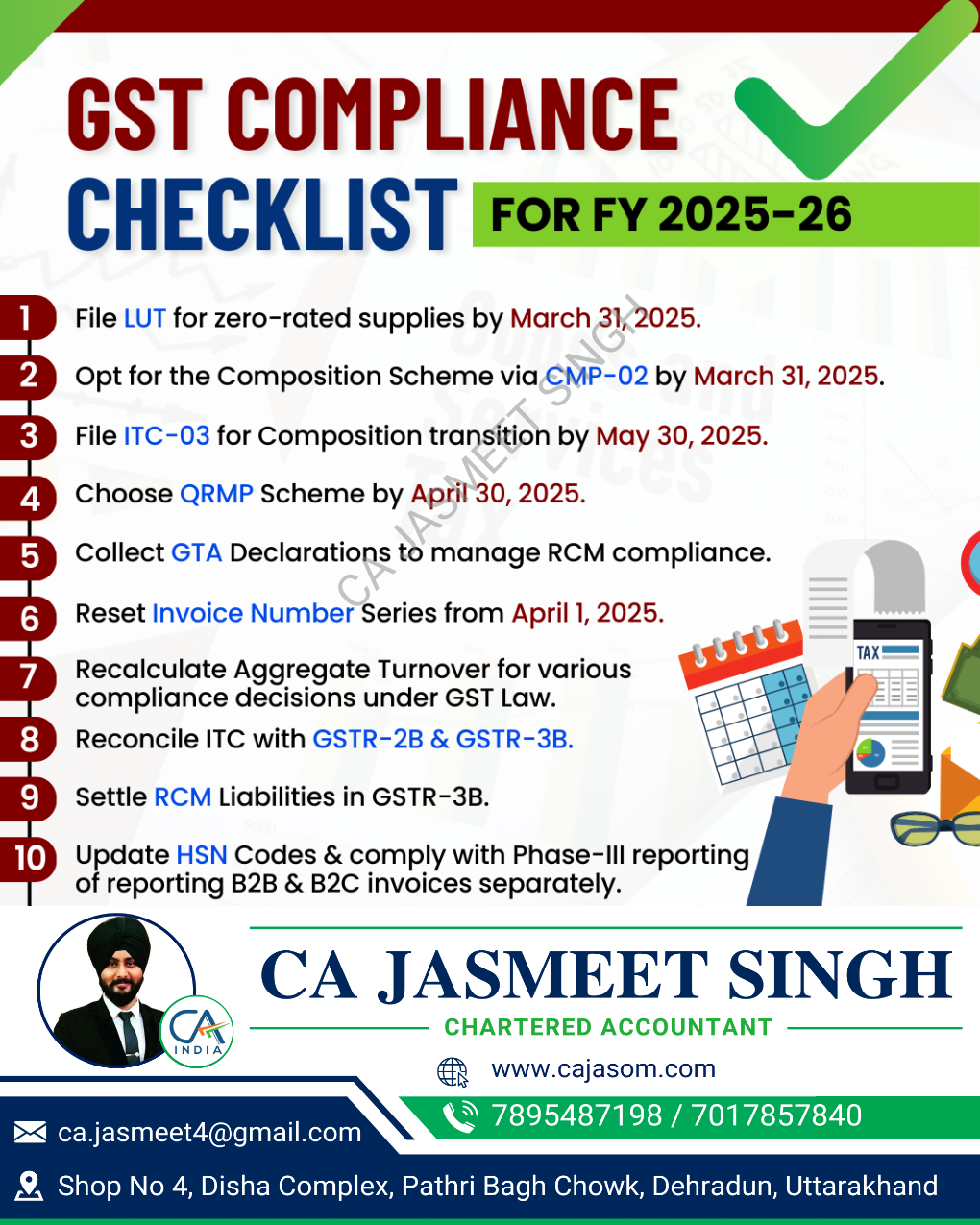

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

calculus

Your Bottom Line Our... • 8m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

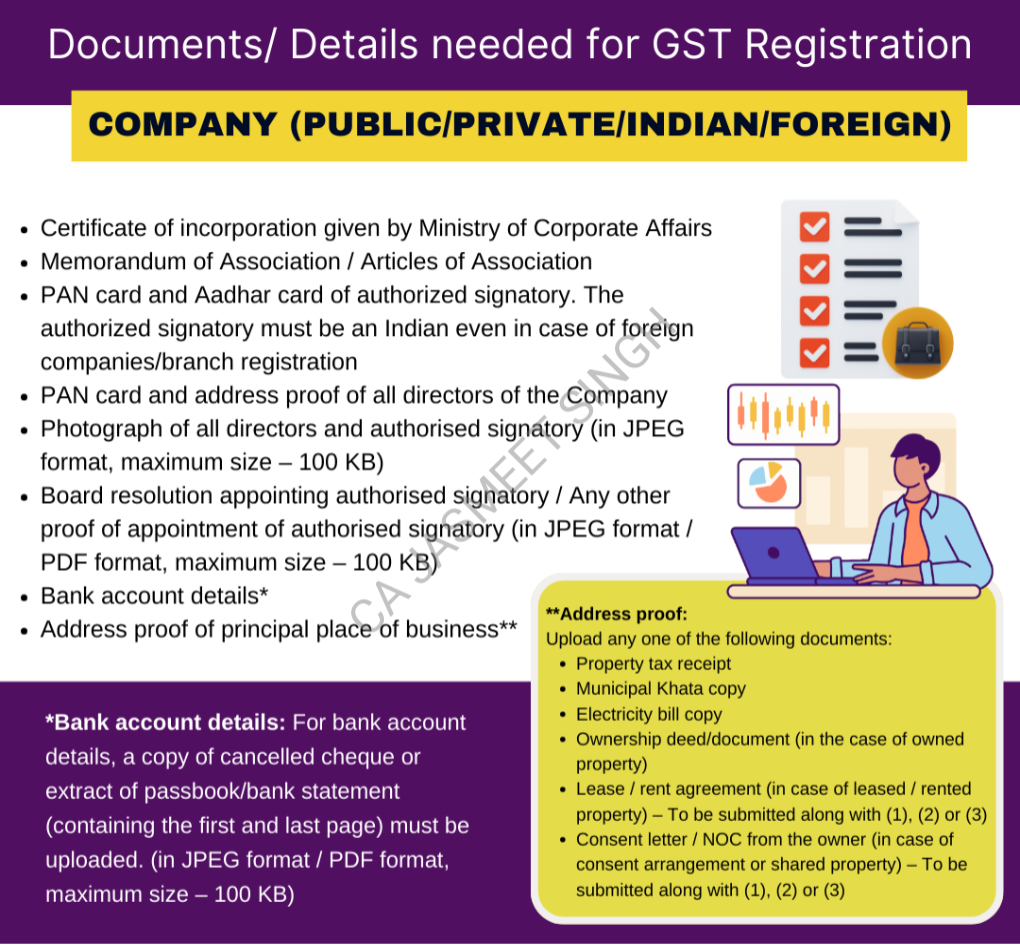

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

CA Sumit Chandwani

The New way of Compl... • 10m

🚀 The Role of Financial Strategy in Business Growth Managing a business involves countless decisions—budgeting, fundraising, compliance, and financial planning. One common challenge I’ve observed is that many startups and SMEs struggle with financi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)