Back

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreChandrakant Patanwadia

Business ideas • 1y

Business Plan for Agriculture with ₹10 Lakh Idea: Invest in 2 acres of high-demand vegetable farming (tomatoes, bell peppers, spinach) with organic practices and modern irrigation. Capital Investment: Land preparation: ₹1,00,000 Seeds, fertilizers

See MoreAccount Deleted

Hey I am on Medial • 11m

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

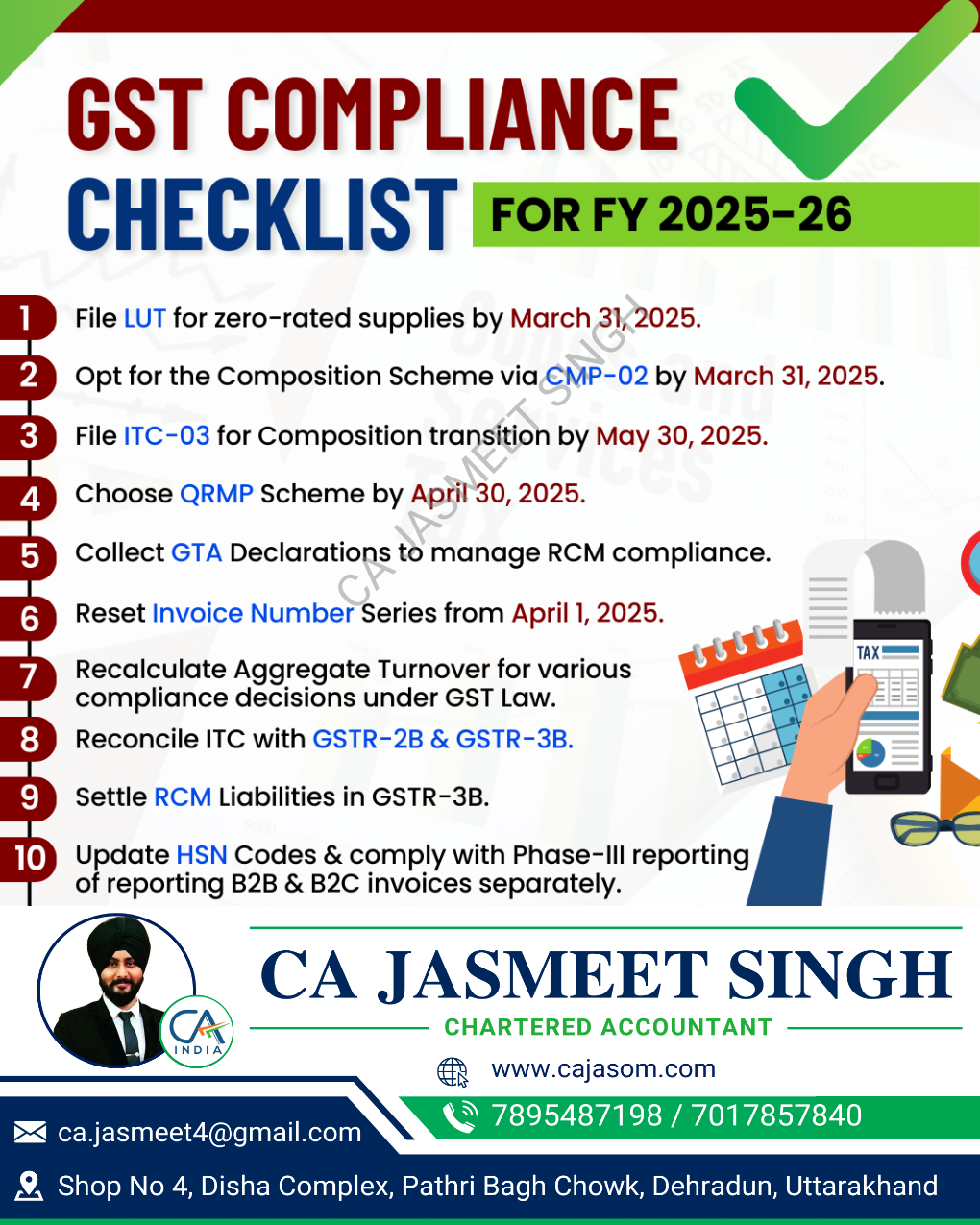

CA Jasmeet Singh

In God We Trust, The... • 11m

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)