Back

Gautam Verma

Game and kamao • 1y

it is easy to run business if the business related to online only and can I need gst for service based as a startup I don't think so because the net money collection for my company not exceed 7 lakh for next 2 years

Replies (2)

More like this

Recommendations from Medial

Durgesh M.

Member - Culture and... • 2y

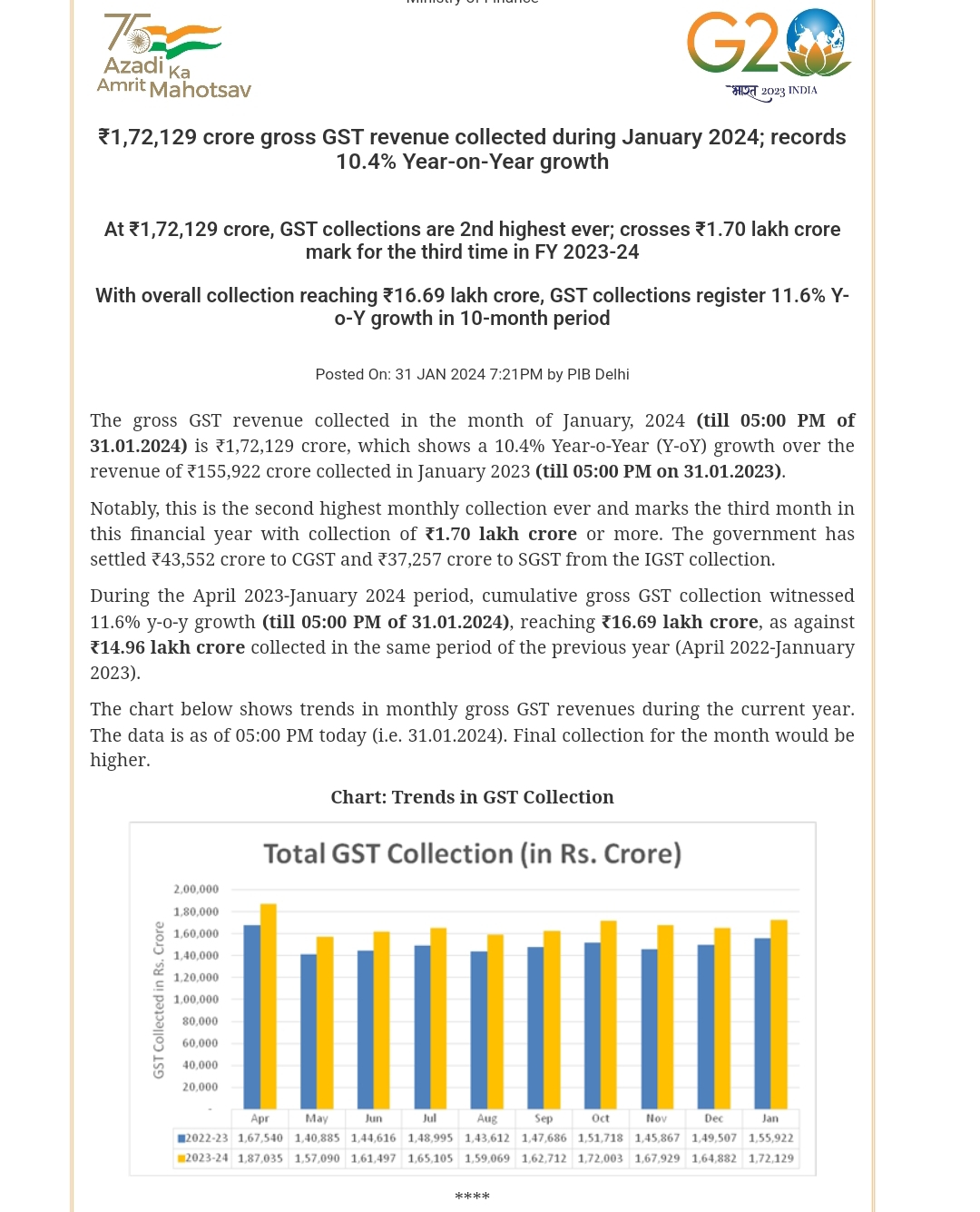

Delhi's coffers are clinking! The GST collection has surpassed the ₹1.72 lakh crore, reflecting an impressive growth trajectory and Delhi showing a double digit YoY growth. I am trying to decipher the drivers behind this surge. - Is it increased com

See More

Prem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreDigambar Bandi

Hey I am on Medial • 1y

Hy....I have idea for new trending business is service provider like online goverment services I need investment for 50 lakh...rs.. example(normaly one nominal health card any online service provider rs 50 charge to printed investment (2 rs card...3

See MoreAccount Deleted

Hey I am on Medial • 9m

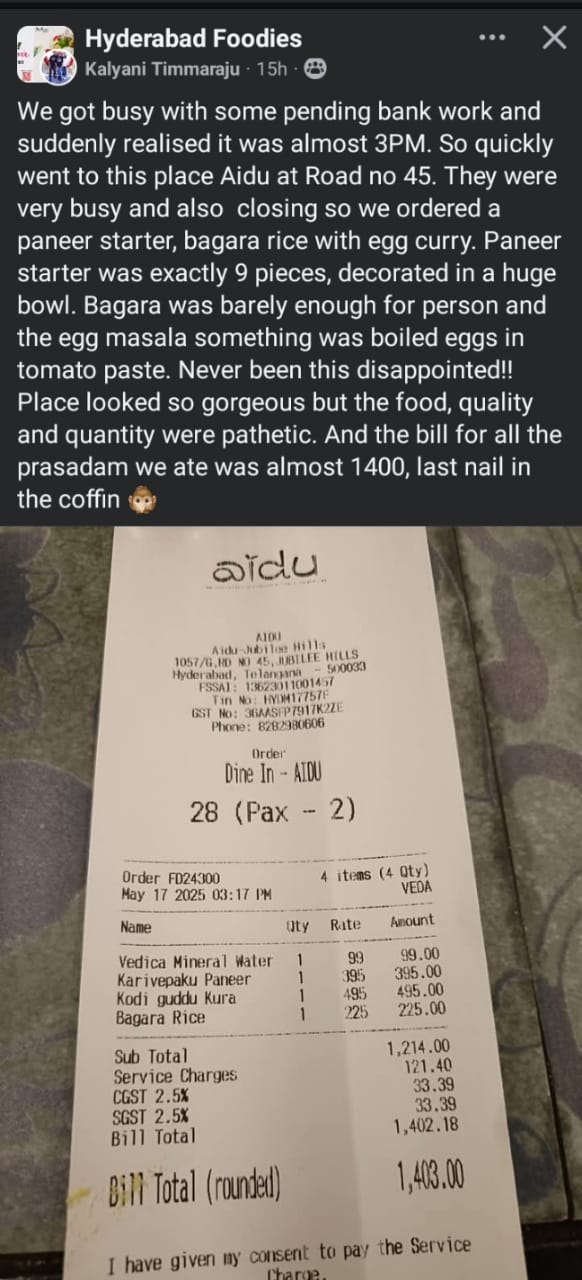

Why should you pay gst and sgst on service charges? That is illegal. If you are not happy why should you agree to pay service charges? I see they got cheated.. Tax should be on bill.. which means 1214 * 5% which 60.70 but they added gst on service c

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)