Back

Replies (1)

More like this

Recommendations from Medial

Aakash kashyap

Building JalSeva and... • 1y

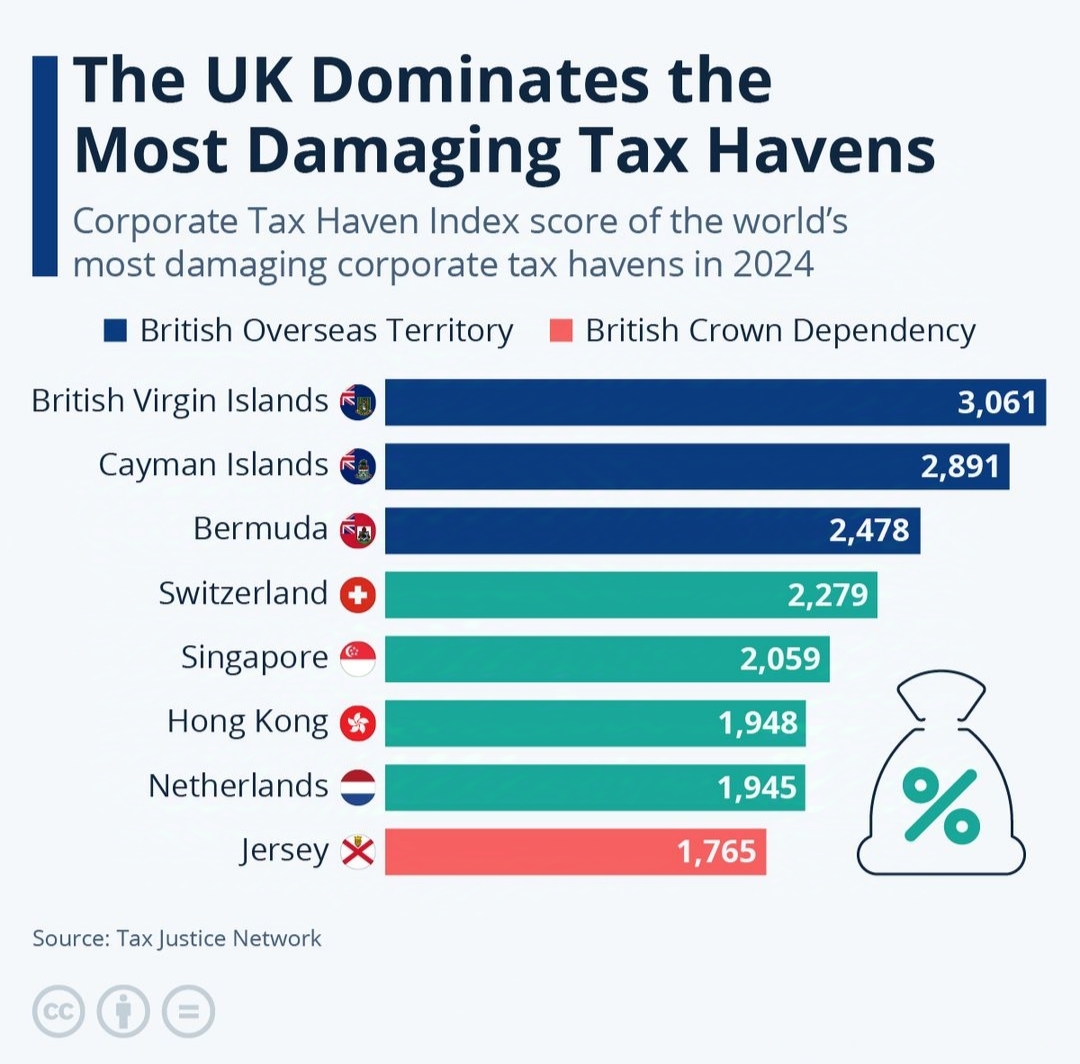

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

Sameer Patel

Work and keep learni... • 1y

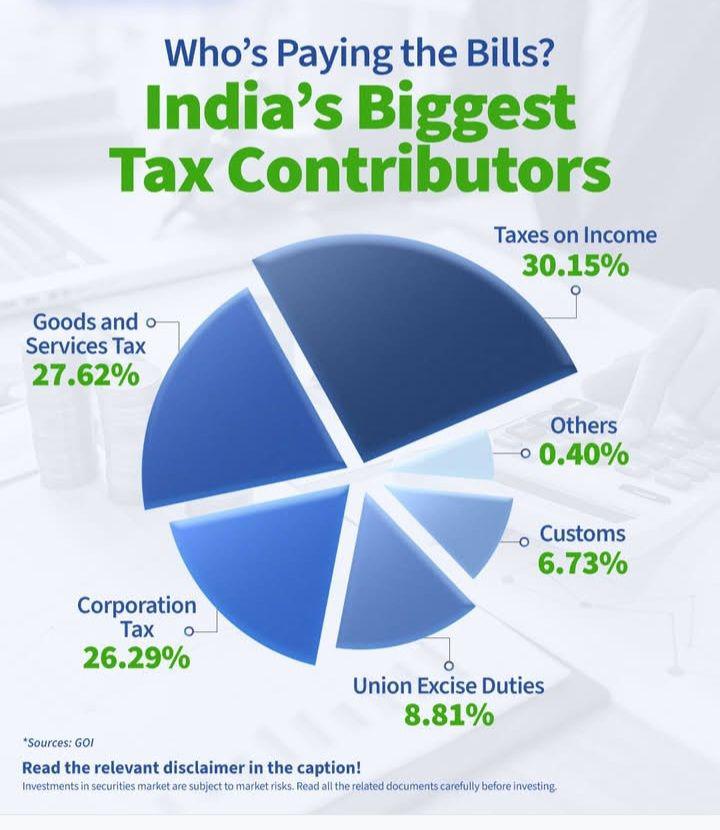

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreAASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)