Back

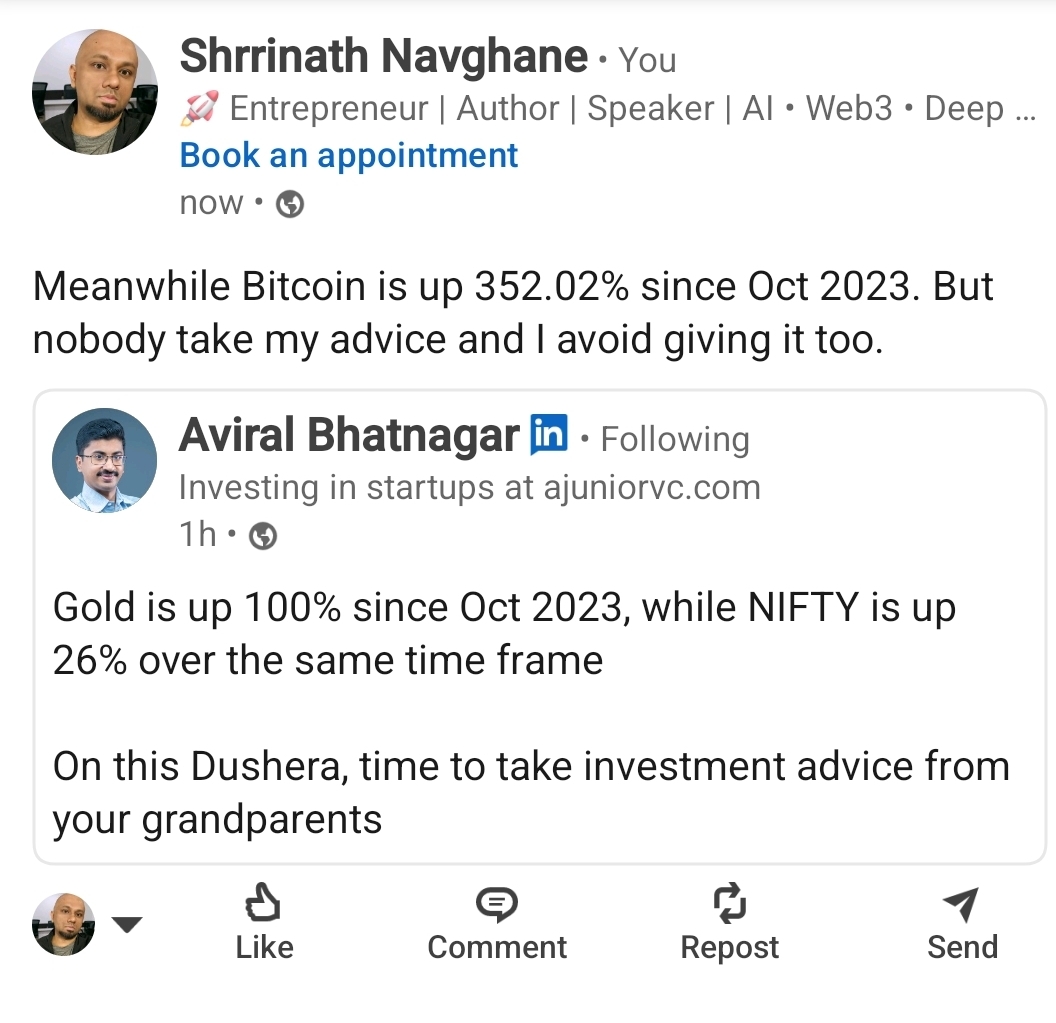

Shrrinath Navghane

•

NexLabs • 4m

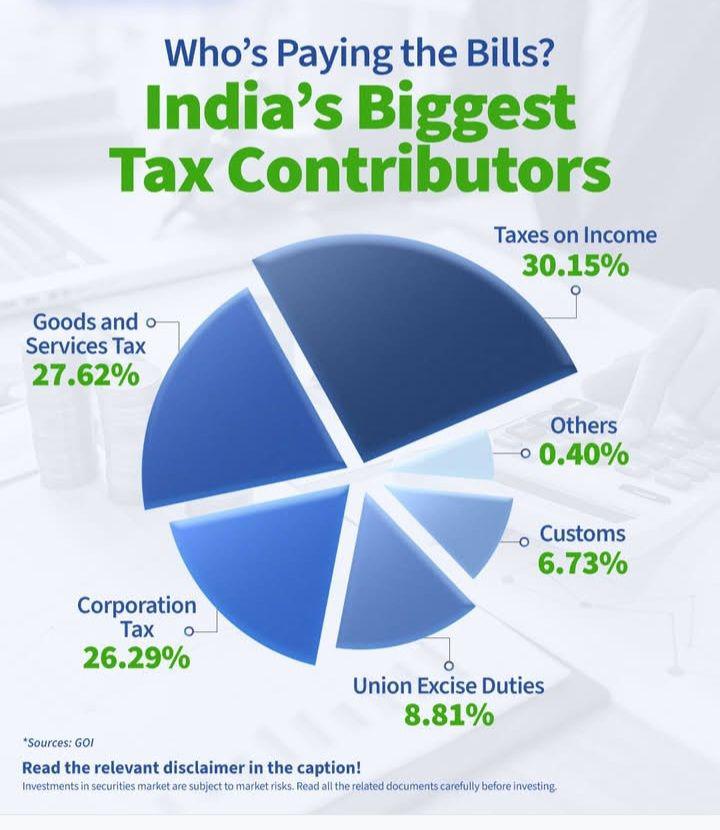

Meanwhile people still asking is Crypto legal in India (with 30% flat tax on profits)

3 Replies

12

1

Replies (3)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 10m

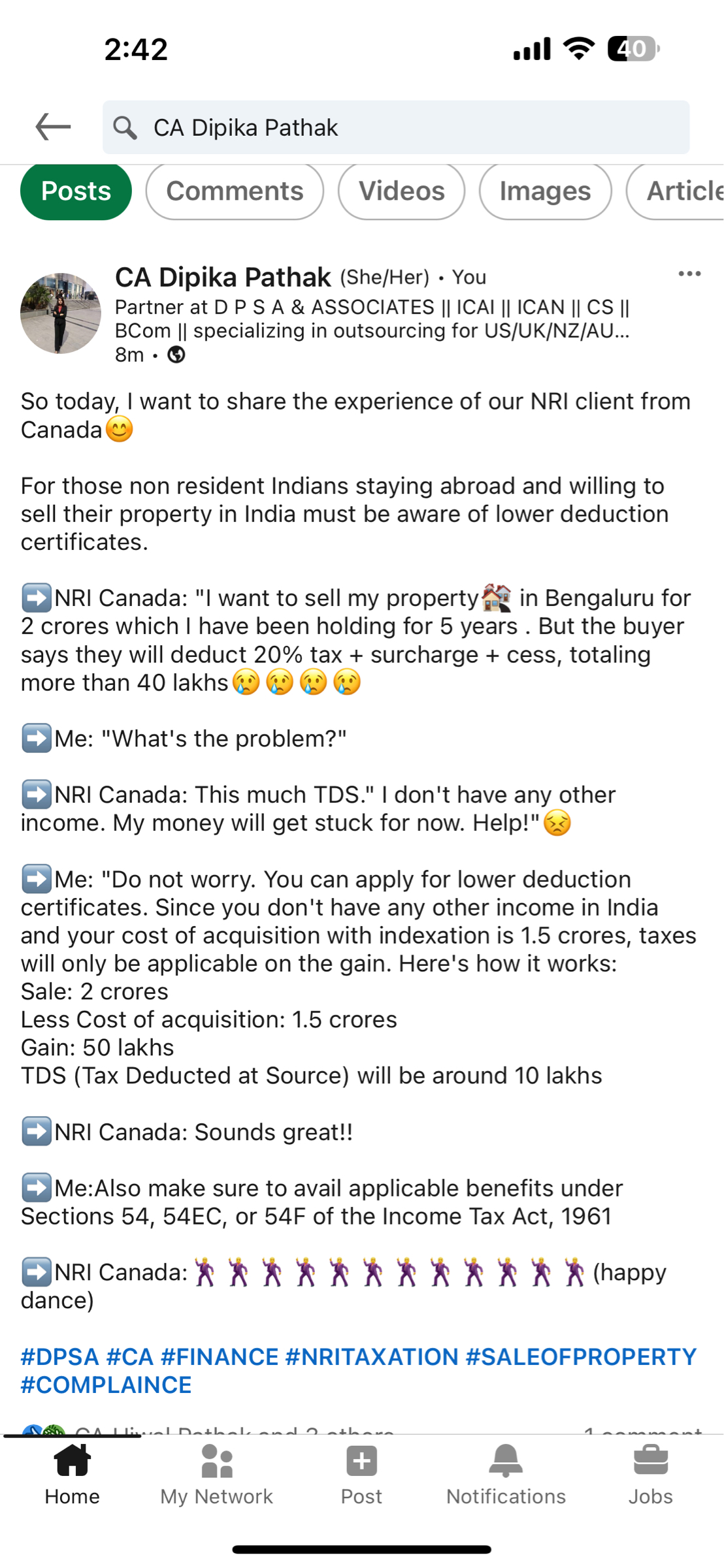

This morning, I shared a post about the 30% tax notice on crypto, highlighting that individuals are being asked to pay 30% tax on their total turnover. After discussing the issue with several people, I discovered that some Binance users have received

See More Reply

5

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)