Back

Account Deleted

Hey I am on Medial • 1y

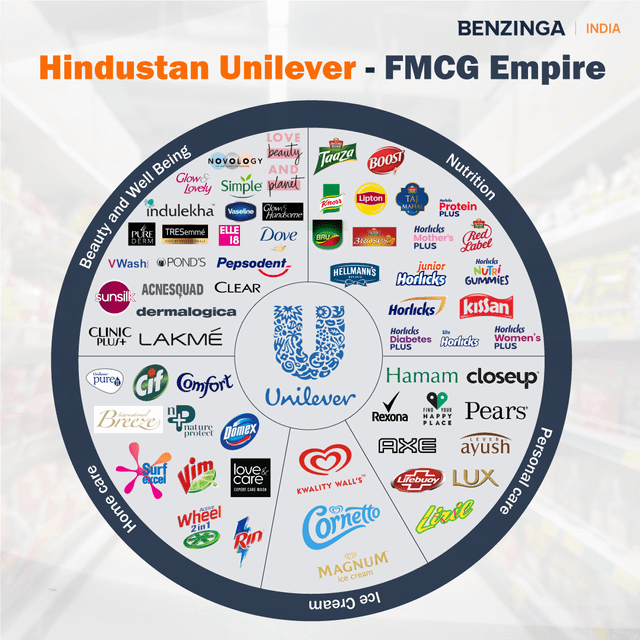

🌟 Exploring Hindustan Unilever Limited (HUL): A Giant in FMCG 🌟 Hindustan Unilever Limited (HUL) has been a cornerstone of India's fast-moving consumer goods (FMCG) sector since 1933. With a vast portfolio spanning foods, beverages, cleaning agents, personal care, and more, HUL has touched millions of lives across India and beyond. 📊 Key Highlights: Revenue: ₹62,707 crore (~US$7.5 billion) as of 2024 Employees: Over 27,764 (including 19,109 workers) Market Cap: ₹6,38,548.42 crore (December 2022) 🛍️ Product Portfolio: Foods & Refreshments Beauty & Personal Care Home Care HUL continues to redefine FMCG standards with its blend of legacy, innovation, and purpose-driven goals. Truly an inspiring story of impact and leadership! 🚀

Replies (9)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 10m

Hindustan Unilever Ltd (HUL), a leading player in the FMCG sector, has announced the completion of its acquisition of a 90.5% stake in Uprising Science Private Ltd, the parent company of D2C personal care brand Minimalist. According to a regulatory

See More

Sanskar

Keen Learner and Exp... • 1y

The insane $7 trillion empire of Unilever Ltd The story starts with "Lever brothers" in 1885, England In their initial days Lever brothers manufactured a Soap named "Sunlight" which quickly grew in popularity in England and it's neighbouring countr

See More

Sahil Bagwan

•

MDFC Financiers Private Limited • 8m

💰 How Does HUL Make Money? Hindustan Unilever (HUL) is one of India’s largest and most trusted FMCG companies. From soaps and shampoos to tea and detergents — it’s a brand you interact with every single day. But have you ever wondered how HUL a

See MoreAccount Deleted

Hey I am on Medial • 1y

Hindustan Unilever Limited is in talks to acquire Minimalist, a Jaipur skincare brand, for ₹3,000 crore. A deal could elevate Minimalist's valuation significantly, showcasing growth in the direct-to-consumer market as major FMCG companies pursue yo

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)