Back

Anonymous 2

Hey I am on Medial • 1y

Just because smallcaps have corrected doesn’t mean they’re bargains. Elevated valuations still signal caution, and chasing “opportunities” without due diligence is like jumping into a pool without checking its depth.

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

"Midcap and Smallcap Stocks Correct, but Valuations Stay Elevated: Chirag Setalvad" Midcap and Smallcap Valuations Ease, but Froth Remains: Insights from Chirag Setalvad Midcap and Smallcap Corrections: Froth Persists The midcap and smallcap indice

See MoreAccount Deleted

Hey I am on Medial • 12m

Welcome to Dark Pool Venture Capital-where ultra-wealthy individuals, family offices, and private funds invest off the record. Not all VC funding makes headlines. Some of it stays in the shadows. Why stay hidden? 1) No public signals, no inflated

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

From VC Intro to Term Sheet: 10 Surefire Steps! Master Your Story: Beyond numbers, paint a vivid vision. Know Their Lens: Research their fund's thesis, portfolio. Tailor your pitch for alignment. Prove Traction: Show compelling progress: revenue

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Excess Edge Experts Consulting highlights common pitfalls early-stage ventures face when seeking investment. Many founders delay addressing key issues, hoping to resolve them post-funding—often to their detriment. We frequently see: • Vague Vision:

See More

SamCtrlPlusAltMan

•

OpenAI • 6m

The Startup Fundraising Roadmap: A Complete Guide by Hissa Fundraising isn’t just about raising money, it’s about building momentum, choosing the right path, and navigating complexity without losing sight of what matters. Hissa’s guide breaks it dow

See MorePiyush Gupta

Digital Marketing Pr... • 6m

My First Medial Post: Honest SEO Advice from a SEO Guy Hey Medial community! 👋 Jumping in with my first post, so let me share one tip that’s working wonders for SEOs in 2025, Agentic AI. If you’re serious about SEO, trust me, start using Agentic

See MoreSrijan shahi

Connecting people in... • 2m

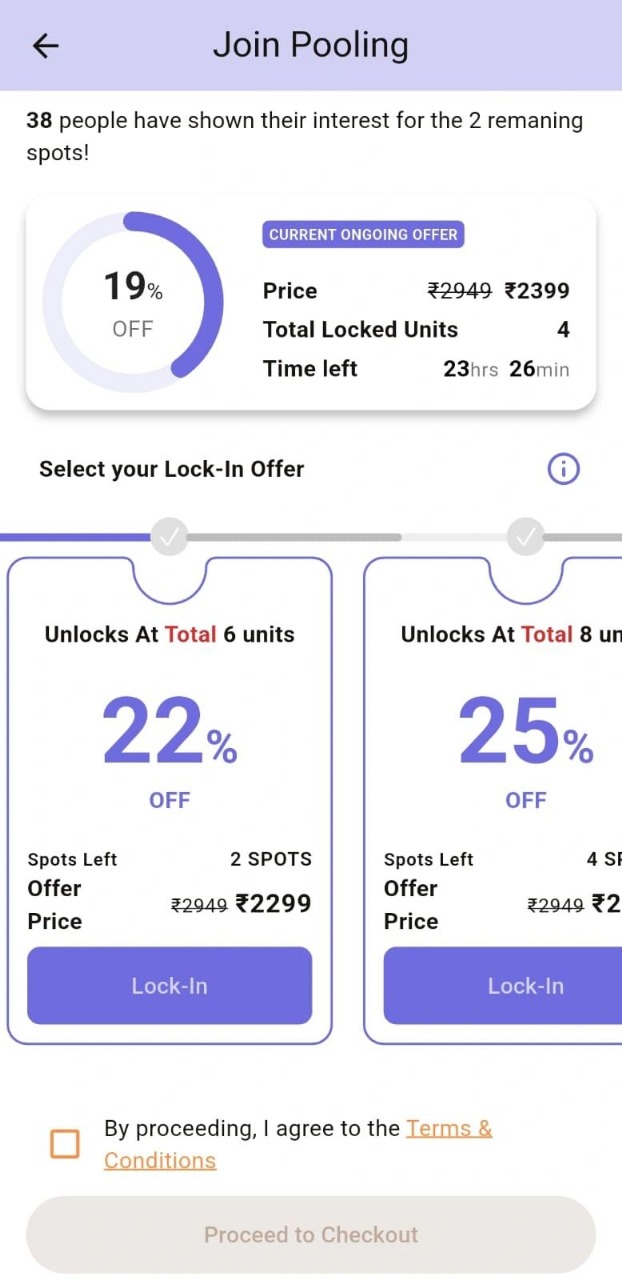

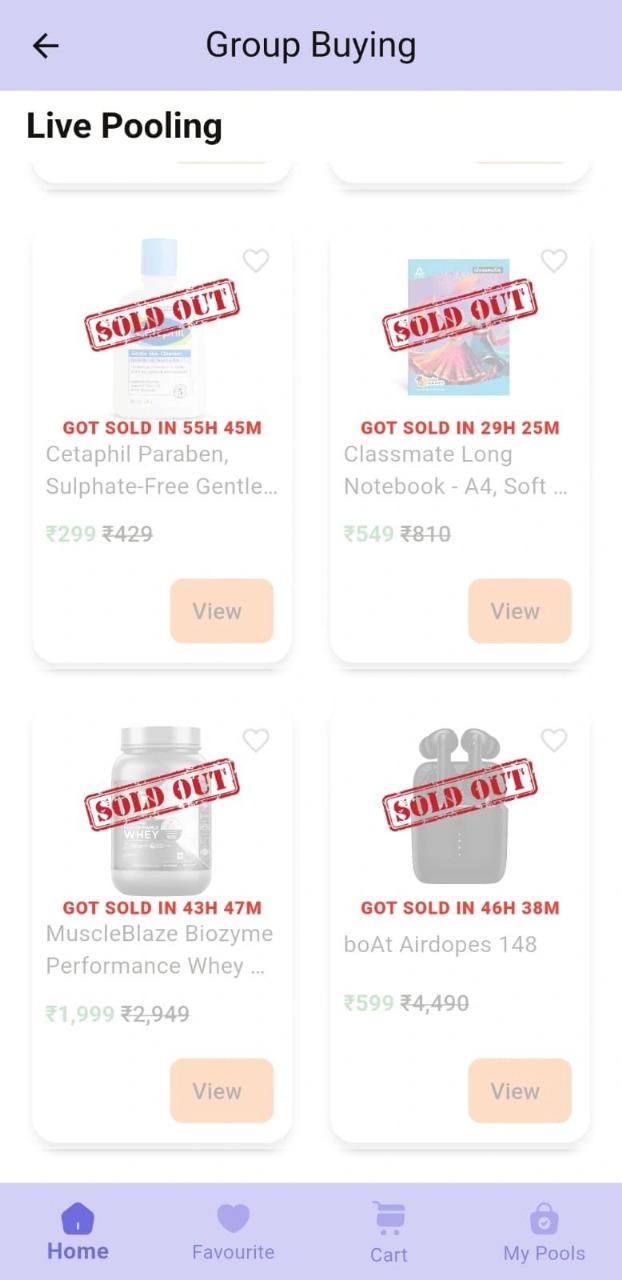

We launched Group Buying on Picapool on 11th October..... and the next few weeks turned into a crash course in user behaviour. For anyone new: Group Buy is simple. More people join from the same radius → volume goes up → price drops for everyone. Bu

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)