Back

Sagar Anantwar

•

SimpliFin • 1y

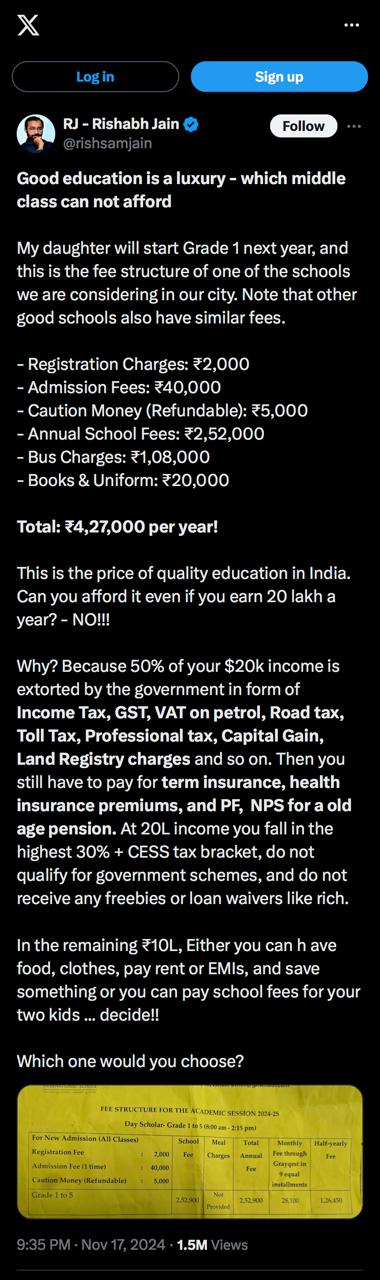

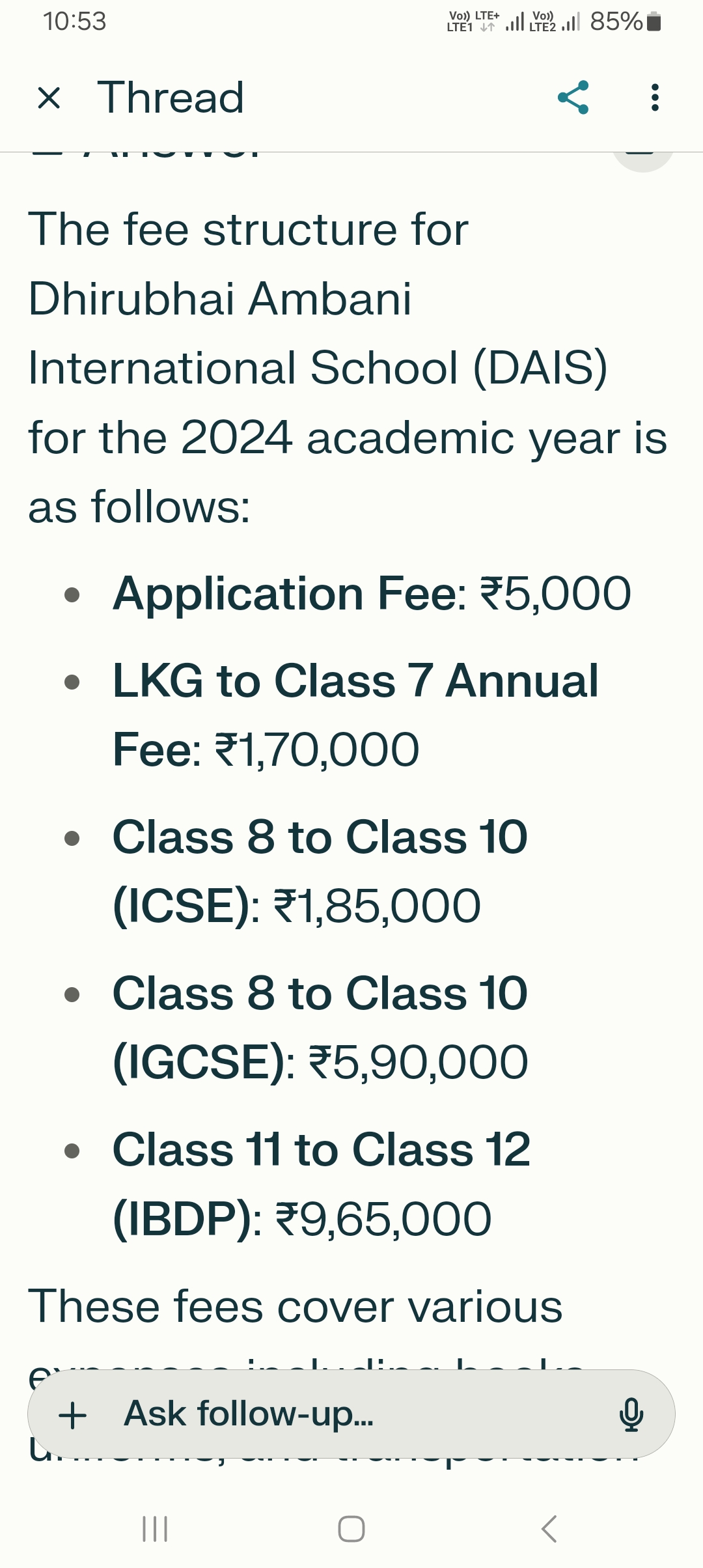

Your child may not get the quality education you think, and it's not their fault ... Education costs are skyrocketing, and it’s becoming a growing concern for parents. Recently, an influencer highlighted that the annual fees for Grade 1 in a good school in an urban city is ₹4.27L per year! What’s more alarming? Education costs are inflating at nearly 12-15% per year, while income levels are barely keeping up. If this trend continues, many families may struggle to provide their children with quality education a few years down the line. Here’s why it’s critical to act now: 🔹 The Education-Inflation Gap: At 12% annual inflation, the cost of ₹4.27L today could become ₹7.5L in just 5 years and over ₹13.5L in 10 years. Without proper planning, this could lead to financial strain for families. 🔹 Why Investing is Key: Saving alone won’t bridge the gap between rising costs and income levels. You need to invest in high-growth instruments like mutual funds or equity that can outpace inflation over the long term. 🔹 Start Early, Stay Consistent: The earlier you start investing for your child’s education, the easier it becomes to handle rising costs. Even small, regular investments through SIPs can grow significantly over time thanks to the power of compounding. 🔹 Plan Separately for Education: Education is a non-negotiable financial goal. Set it apart from your other savings and investments to ensure you’re fully prepared to give your child the best opportunities. At Simplifin, our Goals Feature helps you create a tailored plan for education costs and ensures you stay on track to achieve it. Don’t let rising education costs compromise your child’s future—start planning today. How are you preparing for your child’s education? #EducationCosts #Investing #FinancialPlanning #ChildEducation #Simplifin #WealthBuilding #Inflation

Replies (6)

More like this

Recommendations from Medial

Abhijeet Sarkar

Hey I am on Medial • 8m

https://www.amazon.in/The-Unstuck-Brain/dp/B0FFHC9Q6M Are you ready to unlock the full potential of your child—and become the fiercest advocate they’ve ever had? 💪📚 Meet The Unstuck Brain by Abhijeet Sarkar—a must-have guide for every parent navi

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)