Back

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 10m

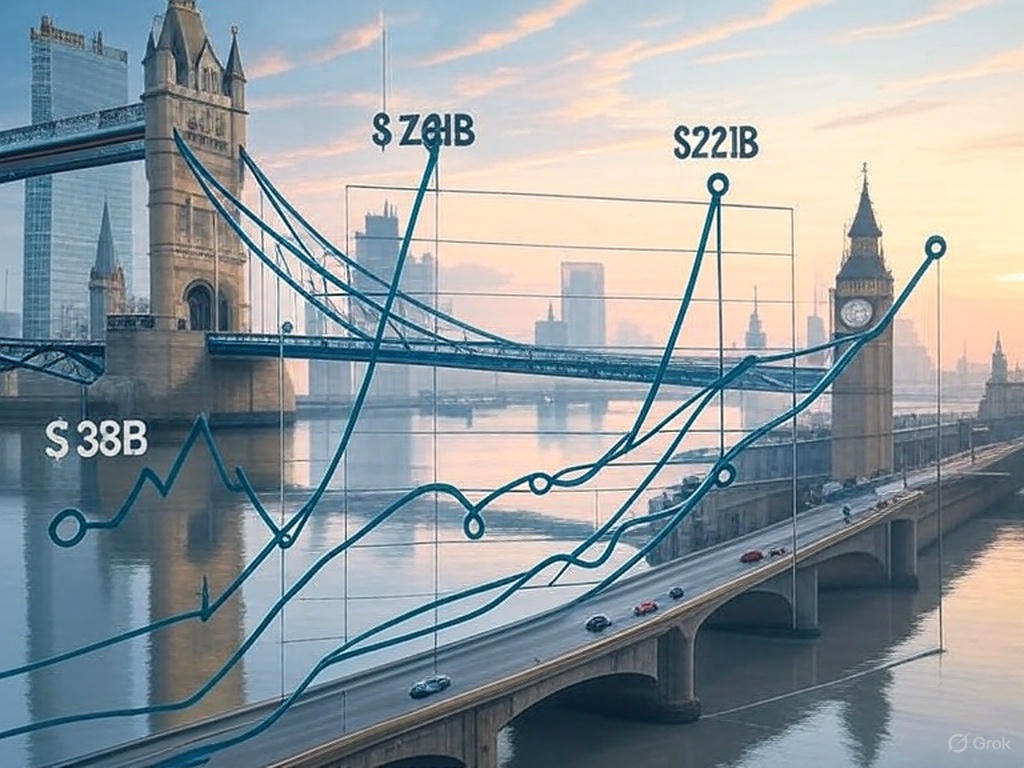

For early-stage startups, generating revenue and driving growth trump chasing venture capital (VC) funding. In 2023-2025, VC funding trends underscore this shift. Global VC investment plummeted from $381B in 2022 to $221B in 2023, with 2024 seeing on

See More

Mayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

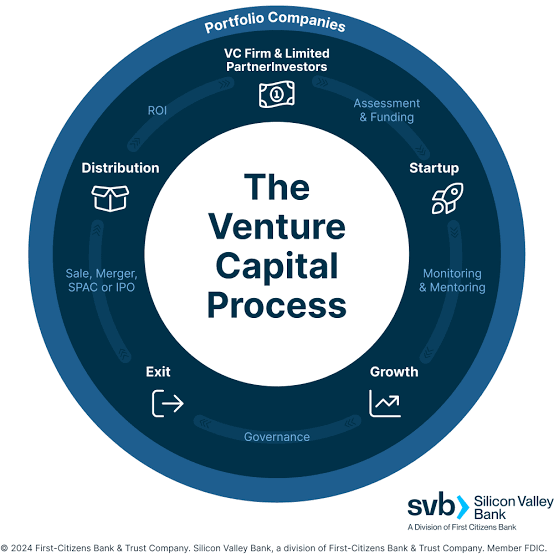

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new de

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

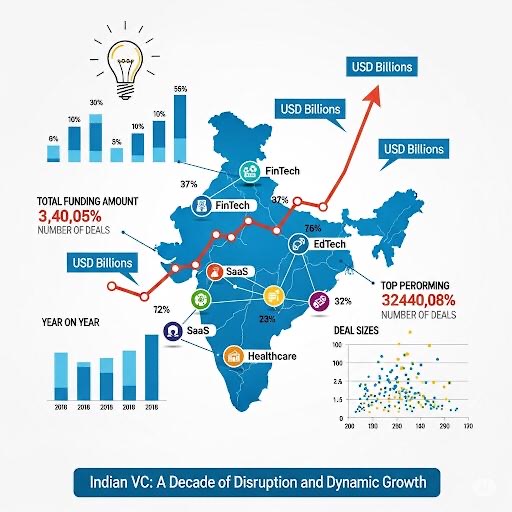

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)