Back

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

UPI based payment gateway for developers. I want to enable UPI payments on my website. Which solution can I use? Paytm, Razorpay, Phonepe required documents proving you are a registered business. But I'm a dev, don't have any registered business. Loo

See More18 Replies

1

11

Jayant Mundhra

•

Dexter Capital Advisors • 1y

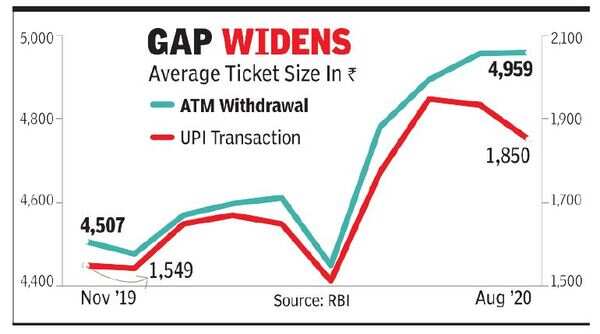

Paytm shareholders are ignoring this? 📛📛 The fintech giant was the only UPI app to be making money on UPI. And now that’s no more possible. Here's all you should know! .. The thing is, NPCI (via Govt grants) compensates the banks to up keep the

See More1 Reply

1

24

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)