Back

Account Deleted

Hey I am on Medial • 1y

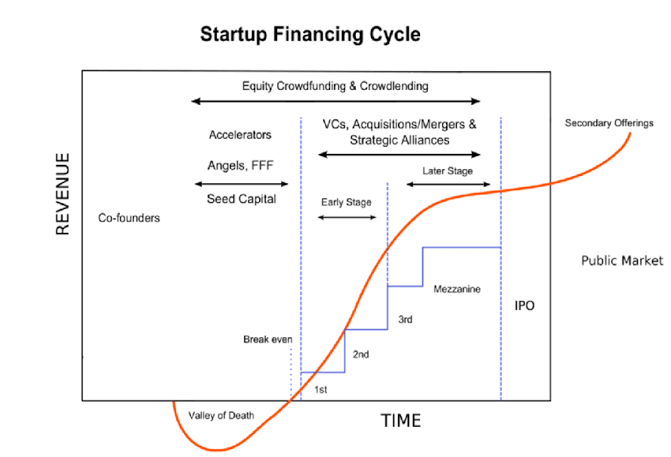

Mezzanine financing bridges the gap between debt and equity, a strategic move for growth without dilution

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Omkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreVivek Joshi

Director & CEO @ Exc... • 2m

Before You Raise Money, Decide What Kind of Company You Want to Build Founders often chase capital without asking the real question: What type of funding actually matches your strategy? Because equity, debt, and hybrid instruments don’t just finance

See More

Account Deleted

Hey I am on Medial • 4m

Grow Your Startup Without Giving Away Equity Every founder's dilemma: How to fuel growth without diluting ownership too early? While seed funding is crucial, it's not the only path. At Opslify, we help you explore strategic, non-dilutive funding ro

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-4 Types of AIF’S Suitable for Startups? What is Mezzanine Capital? 🎯Types of AIF’S: These are divided based on Investment Strategies & AUM(Asset Under Management).VC's are defined as investments in Unlisted securities such as S

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)