Back

Anonymous

Hey I am on Medial • 1y

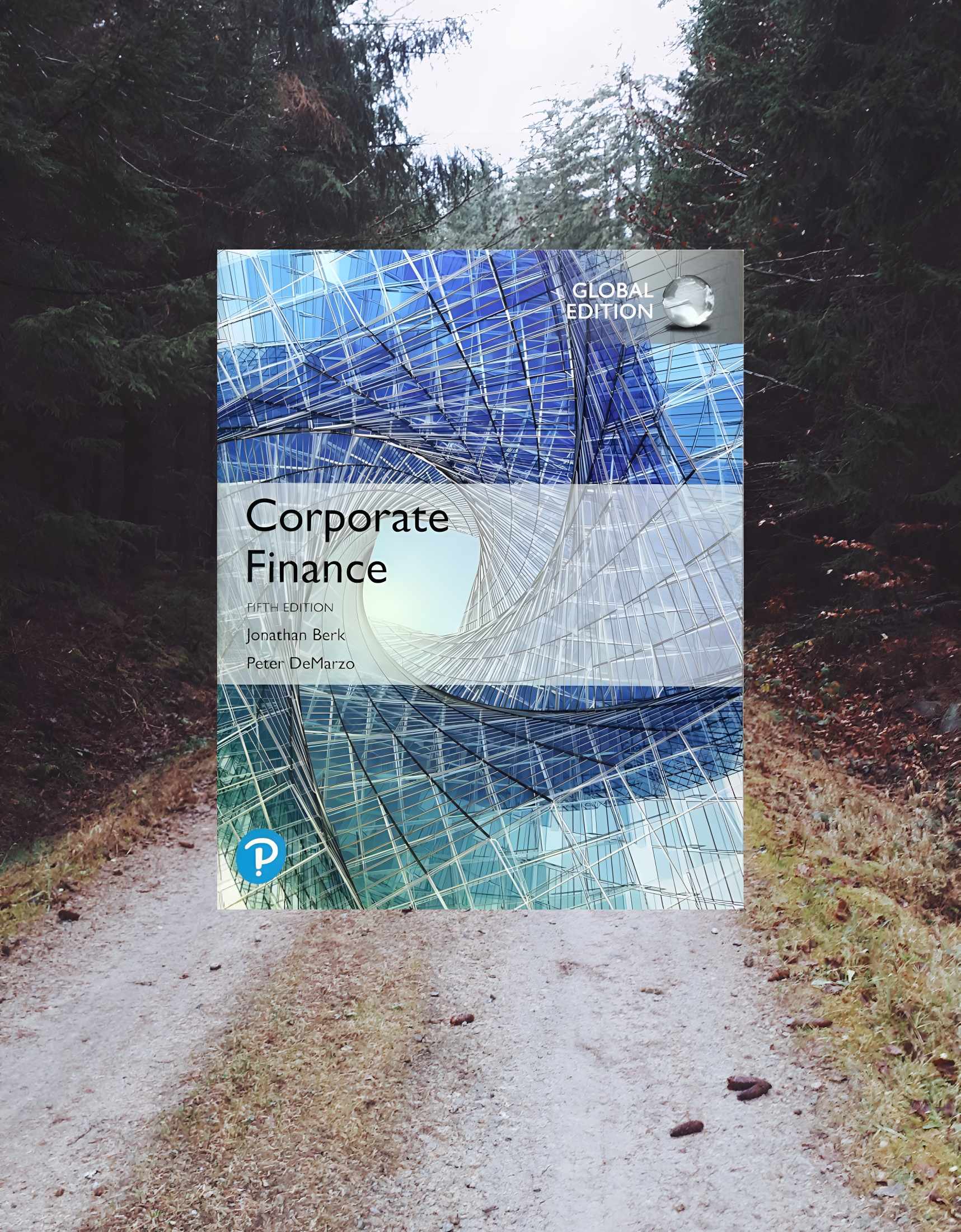

17. Alternative Financing Sources: Discusses financing options beyond traditional debt and equity, including venture capital, private equity, and initial public offerings (IPOs). 18. Capital Markets and Issuance: Covers how companies access capital markets, including the IPO process, seasoned equity offerings (SEOs), and bond issuance. 19. Agency Problems and Corporate Governance: Explores conflicts of interest between stakeholders (e.g., managers vs. shareholders) and the mechanisms, like boards of directors and executive compensation, that align interests. 20. The Modigliani-Miller Theorem: Presents the MM theory, which states that under certain conditions, a firm’s value is unaffected by its capital structure, providing a foundation for understanding leverage. 21. Debt Policy and Financial Distress: Analyzes the risks of debt, including the costs of financial distress and bankruptcy, and strategies to mitigate these risks. 22. Corporate Restructuring: Reviews restructuring options like spin-offs, divestitures, and leveraged buyouts (LBOs) to enhance value or refocus the company. 23. Tax Implications of Financing: Examines how different financing methods impact corporate taxes and the importance of tax considerations in decision-making. 24. Measuring and Creating Value: Focuses on tools for value creation, including Economic Value Added (EVA) and Market Value Added (MVA), to evaluate performance beyond traditional profit metrics. 25. Corporate Social Responsibility (CSR) and ESG Factors: Discusses the impact of CSR and Environmental, Social, and Governance (ESG) factors on a company’s reputation, valuation, and long-term sustainability. 26. Advanced Valuation Techniques: Introduces advanced valuation methods such as adjusted present value (APV) and multiples-based valuation for more complex assessments. 27. Leasing and Financing Alternatives: Covers leasing as a financing method, exploring types of leases and their impact on financial statements and tax liabilities.

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Omkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreTushar Aher Patil

Trying to do better • 1y

Day2 About Basic Finance Concepts Here's Some New Concepts 2. Corporate Finance Capital Budgeting: Deciding on long-term investments like new projects or equipment to enhance business profitability. Capital Structure: Determining the best mix of d

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Unlocking Potential: Innovative Financing for Turnaround Projects Turnarounds aren’t just about survival—they’re launchpads for reinvention. But even the best strategies stall without smart financing. Here’s how innovation is changing the game: 1. R

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

The global startup credit market is rapidly evolving beyond traditional VC. In Q4 2024, VC funding hit $120B (4,000 deals), with AI leading. Venture debt surged 46% to $83.4B, now 20–30% of total VC in US/Europe, offering non-dilutive capital for CAP

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)