Back

Anonymous 1

Hey I am on Medial • 1y

Bajaj Housing Finance’s valuation seems completely out of whack. ₹1,732 Cr net profit for a market cap of ₹1,33,534 Cr? Meanwhile, these other housing finance companies combined are worth just a bit more and earn way more profit together. Feels overpriced to me

Replies (1)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 9m

Geotech company MapmyIndia posted a consolidated net profit of INR 49 Cr in the fourth quarter of FY25, marking a near 28% jump from INR 38.3 Cr in the year-ago quarter. On a quarter-on-quarter (QoQ) basis, the company’s profit zoomed 52% from INR 32

See More

Poosarla Sai Karthik

Tech guy with a busi... • 7m

Paytm Q1FY26 results shows a massive growth in its earnings: • Revenue: ₹1,918 Cr -> up 28% YoY (₹1,501 Cr last year) • Net Profit: From ₹(840) Cr loss to ₹123 Cr profit [+963 Cr - a massive swing] • Total Expenses: ₹2,016 Cr ->18.6% down (₹2,476 Cr

See MoreAditya Arora

•

Faad Network • 1y

Left the Bajaj legacy, lost his co- founder and built a 34,000 CR company. 1. After completing his master's degree in Business Administration in the USA, Anurang Jain returned to India but got critical advice from his uncle, Rahul Bajaj, of the Baja

See More

VIJAY PANJWANI

Learning is a key to... • 1m

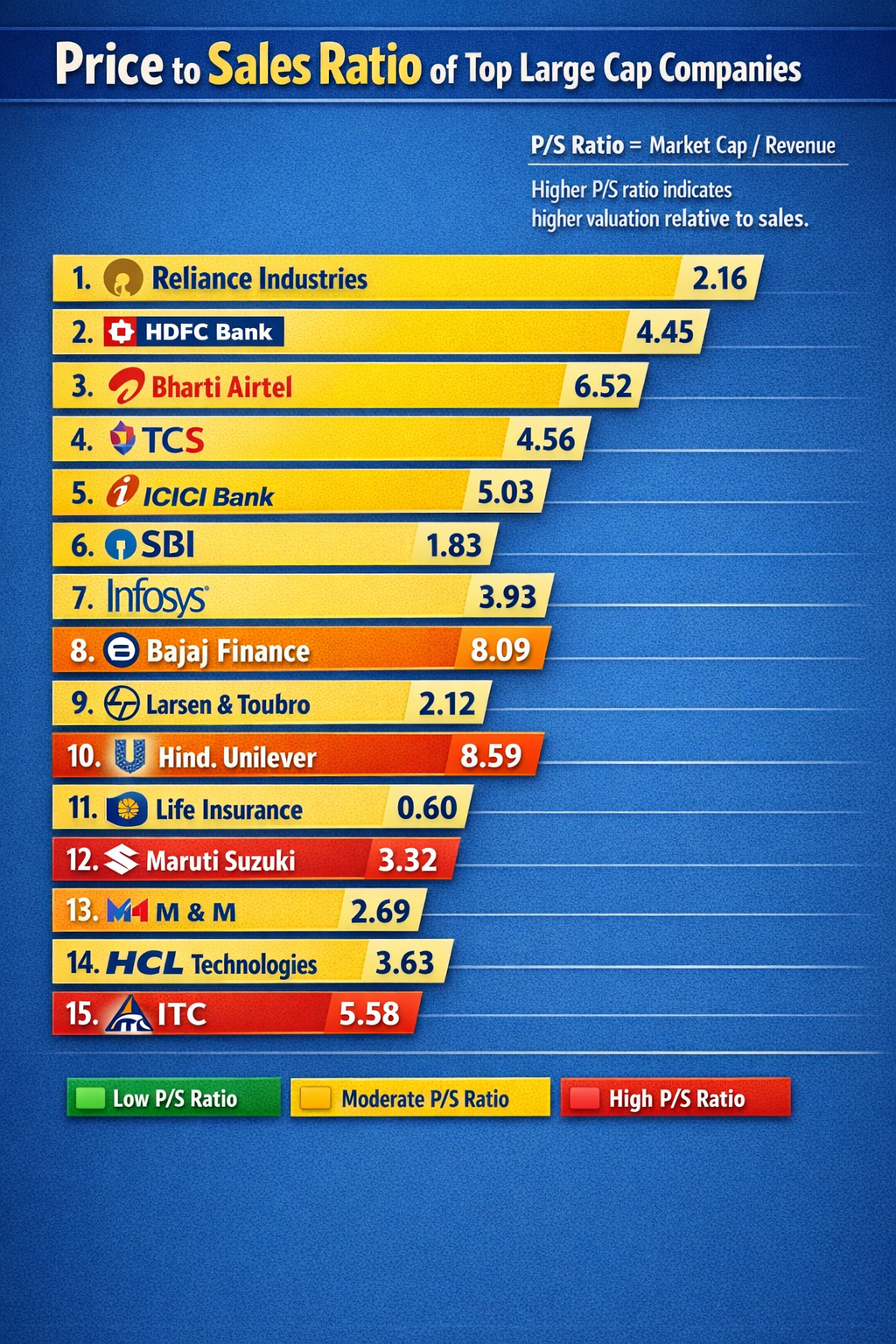

Price to Sales (P/S) Ratio of India’s Top Large-Cap Stocks 🇮🇳 Ever wondered which big companies are cheap vs expensive relative to their sales? That’s where P/S Ratio helps 👇 🔹 Low P/S → Potentially undervalued 🟡 Moderate P/S → Fairly valued �

See More

Aditya Arora

•

Faad Network • 1y

Meet the man who started at 22 and is worth 27,000 CR today. 1. At 24, Ajay Piramal had to take over his family's textile - Morarjee Textile Mills, in Bombay after his father passed away. To worsen things, his elder brother parted ways and took thei

See More

Nimesh Pinnamaneni

Making synthetic DNA... • 11m

🚨 The magic number: ₹800 Cr ⸻ VCs invest in businesses that can be big enough to return their entire fund. To get VCs interested, your startup must at least have the potential to reach ₹800 Cr+ in annual revenue or ₹8,000 Cr+ in market cap (assumi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)