Back

Aditya Arora

•

Faad Network • 1y

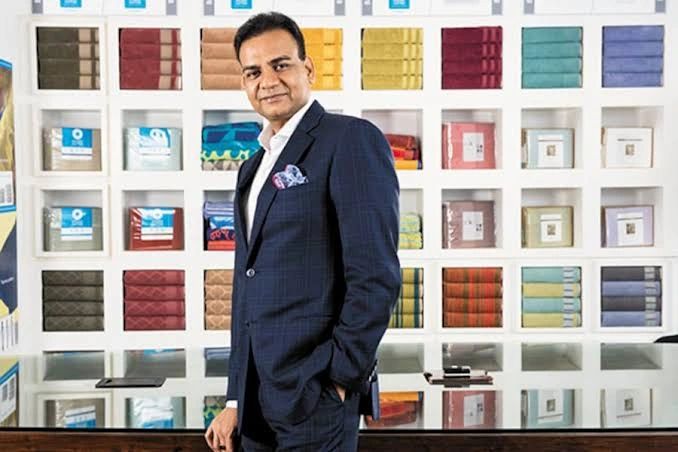

Meet the man who started at 22 and is worth 27,000 CR today. 1. At 24, Ajay Piramal had to take over his family's textile - Morarjee Textile Mills, in Bombay after his father passed away. To worsen things, his elder brother parted ways and took their best business - luggage maker VIP Industries. As he was lost, another tragedy struck him. 👇 2. His older brother passed away five years later of cancer, leaving him the breadwinner of his brother's three children, too. He realised the textile business was not his interest, and it was time to focus on new sectors and run as separate businesses. In 1984, Piramal Group was born. 🚀 3. The idea was simple ⏩ Acquire companies and scale them to great heights. Ajay started by acquiring Gujarat Glass Limited, manufacturing glass packaging for pharmaceutical and cosmetic products. He scaled it to 5 CR turnover by 1985, but his big break came three years later. 👇 4. In 1988, Nicholas Laboratories, an Australian Pharmaceutical MNC, was exiting India and was looking for buyers. Despite 100s of bids from large players, Ajay's vision to make it the top five pharma companies came through. He bought Nicholas for 16.5 CR. 💰 5. In 1991, he set up a formulation plant at Pithampur in Madhya Pradesh and changed the name to "Piramal Healthcare". He built marketing in Myanmar and focused on bulk drugs. As a result, it scaled from 19 CR revenue in 1988 to 441.8 CR in just ten years. 📉 6. Ajay did not stop the growth and made global acquisitions - Boehringer Mannheim (1996) and ICI (2002). As it became the top five pharma companies, NYSE-listed Abbott Labs acquired Piramal Healthcare for 17,100 CR in 2010, making the combined entity the biggest Indian pharma company with a 7% market share. 💪 7. Ajay had done the biggest deal of his life, but he was still not done. In 2012 - He started a privately owned real estate entity under the Piramal Group. In the same year, he acquired HUL's sea-facing property in Worli, Mumbai, for 452 CR. But Piramal Realty's life-defining year came three years later. 👇 8. In 2015 - Piramal Realty raised 2700 CR from private equity legends like Goldman Sachs and Warburg Pincus, making it one of the biggest investments in the real estate space. As it entered housing and capital finance, another PE legend, Blackstone, acquired his glass business for 7500 CR in 2012. 💵 9. Today, Piramal Group clocks revenue of 14,710 CR at a profit of 1,923.11 CR across all its companies in the real estate, finance and pharmaceutical sectors. Meanwhile, Ajay Gopikisan Piramal is India's 56th richest man worth 26,560 CR. 💪 ➡️ But his Piramal Foundation still impacts the lives of 11.3 CR people across 27 Indian states in health, education and waste management. 🙏

Replies (12)

More like this

Recommendations from Medial

Aditya Arora

•

Faad Network • 1y

Meet the man from Goa who built a 40,000 CR company. 1.Born in the Saligao village of Goa, Gracias Saldanha had made everyone proud. He became one of the first graduates of Saligao to earn a master's degree in science from Bombay University. After c

See More

CEO Dr Abhishek Bhatt

World wide daily new... • 1y

Once upon a time, in the bustling city of Delhi, there was a man named Dr. Abhishek Bhatt. Not only was he a CEO of a successful company, but he was also a PhD history gold medalist from Delhi University. His intellect and wit were unmatched, making

See MoreSanskar

Keen Learner and Exp... • 1y

Arul Sujanesh was born in madhurai in a 28 member joint family who had many successful businesses but however when he was pursuing his dream of becoming a civil engineer he gets a call from his father which changed everything. His father told him th

See MoreAditya Arora

•

Faad Network • 1y

Meet the man who started at 19 and built a 17,000 CR business empire. 1. Born into a Marwari family in Hisar (Haryana), Balkrishan Goenka (BKG) was born to a father who traded and exported food grains. But he wanted to do something of his own. At 16

See More

Yash Tandekar

Aspiring Entrepreneu... • 11m

Last night, at 2:25 AM, my dad and I had a life-changing conversation. Months after leaving his job due to a conflict with his boss, he decided to take the biggest risk of his life—starting his own C&F Agency in the pharmaceutical sector. With 25 ye

See MoreAditya Arora

•

Faad Network • 1y

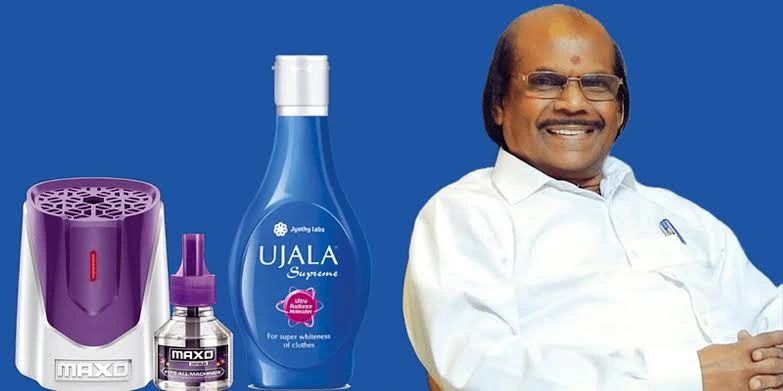

Took Rs 5000 loan from his brother and built a 16,000 CR FMCG empire. 1. Born in the cultural city of Thrissur in Kerala, Moothedath Panjan (MP) Ramachandran faced failures early on. While working as an accountant, he experimented with his whitener

See More

Aditya Arora

•

Faad Network • 1y

Meet the doctor from Punjab who built a 30,000 CR company. 1. Born in the ancient city of Batala in Punjab to a gynaecologist mom and ENT specialist father, Naresh Trehan always wanted to be a doctor. His dream came true when he completed his MBBS

See More

Anonymous

Hey I am on Medial • 7m

Gautam Adani is sold as a college dropout who built an empire—but he didn’t rise from rags, he rose from reach. Born into a well-off Jain family in Gujarat, his father was a textile merchant—he didn’t grow up poor, just outside the spotlight. He dr

See More

Aditya Arora

•

Faad Network • 1y

Left the Bajaj legacy, lost his co- founder and built a 34,000 CR company. 1. After completing his master's degree in Business Administration in the USA, Anurang Jain returned to India but got critical advice from his uncle, Rahul Bajaj, of the Baja

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)