Back

Vikram Kumar

Founder at Stockware • 1y

🚀 Wow Momo's Ambitious Rs 650 Crore FY25 Revenue Target! 🚀 Guys, check this out! Wow Momo is aiming for a whopping Rs 650 crore in revenue for FY25. That's a 37% jump from last year! 📈 CEO Sagar Daryani's got some big plans: 1️⃣ Expanding their FMCG game with frozen foods 🍱 2️⃣ Launching new fast-food brands to mix things up 🍔 3️⃣ Rolling out the Wow Eats app for super easy ordering 📱 But here's where it gets really interesting for us at Stockware 😉 Our platform could be a game-changer for Wow Momo's growth! How? By streamlining their inventory management and optimizing logistics. As they scale up their FMCG biz, we could help them stay efficient and meet demand. 💪 Wow Momo's strategy + Stockware's tech = Fast-food domination! 🏆 What do you think? Could this be the next big partnership in the food industry? Drop your thoughts below! 👇 #WowMomo #Stockware #GrowthStrategy #FMCG #FoodTech #WarehouseInnovation

More like this

Recommendations from Medial

Amandeep Singh

Co-Founder @ The Waf... • 11m

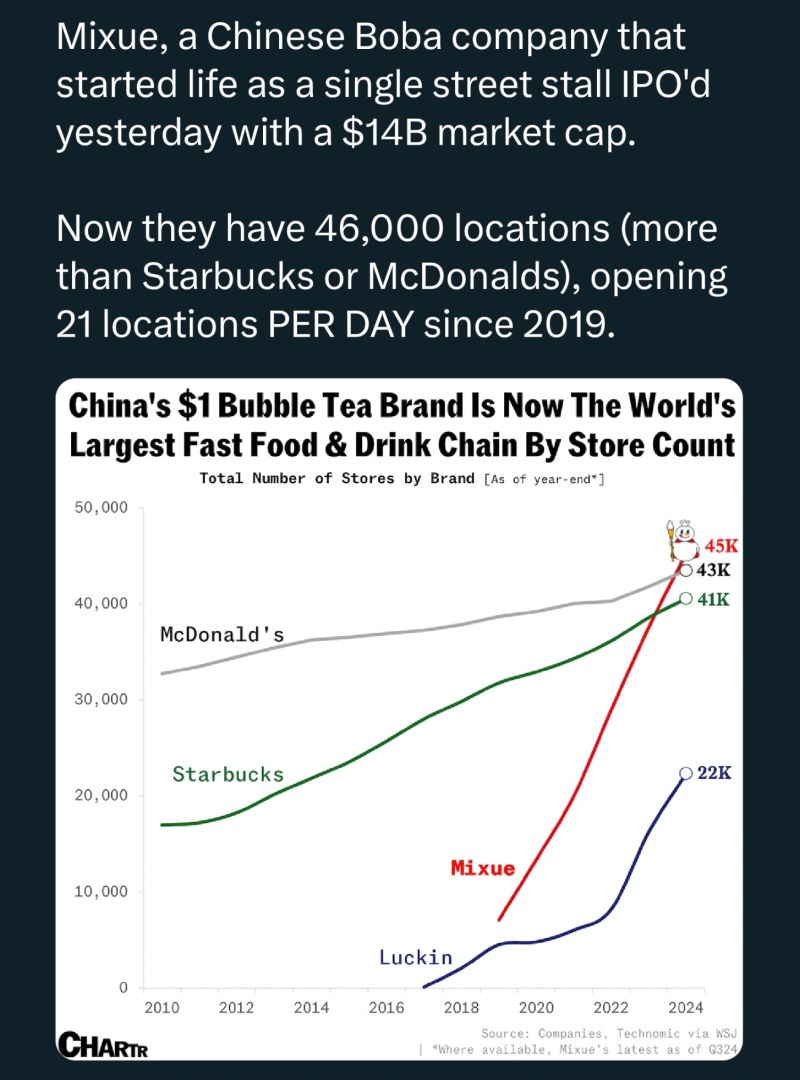

From a Street Stall to a $14B Giant – The Mixue Phenomenon Imagine starting as a small street-side stall and growing into the world's largest fast-food and beverage chain by store count! That’s the story of Mixue, a Chinese bubble tea brand that jus

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Mukesh Ambani’s FMCG business is highly underperforming 📛📛 Yet, what we see the media do is celebrate the sub-par execution by over-emphasising on the Rs 3k crore sales figure for FY24. It’s only on a deeper deepdive, that you see things as they

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)