Back

Applyly

Hey I am on Medial • 1y

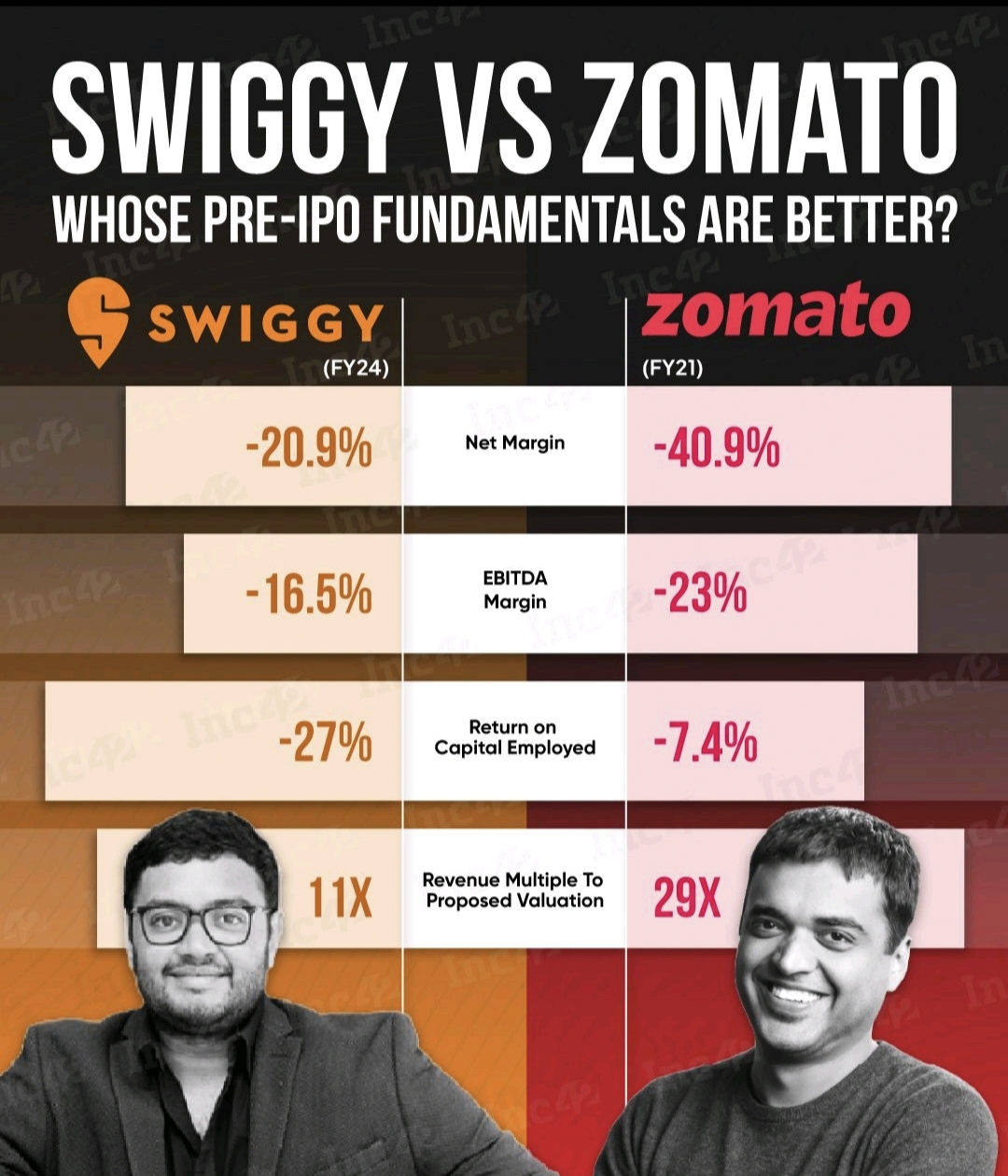

Zomato VS Swiggy: The tastier bet for investors The Indian food delivery sector has now become a field of high-risk investment. Two leading companies, Zomato and Swiggy, become the dominant players in this digital gourmet arena. Moreover, in recent financial quarters, both companies have shown strong growth and positive market reactions. Potential shareholders are closely watching the strategy and outcomes of their moves. These food tech titans have become significant growth patterns that have been received well by the stock markets. This led to the Zomato Market Cap rising to an astounding ₹ 2.9 lakh crore aided by the shares being at a 52-week high of ₹ 304.50. The newer player, Swiggy, has similarly impressed investors, with its market capitalisation reaching ₹1.23 lakh crore and shares soaring to ₹576.95. Financial Performance: Navigating Profitability Challenges Swiggy has made significant strides in its path to financial sustainability. The startup’s food delivery business turned profitable last year through strategic interventions. Their gross order value has grown by an impressive 41% while simultaneously reducing absolute costs by 22%. This demonstrates a remarkable ability to balance growth with operational efficiency. Zomato, not to be outdone, has consistently shown its potential to investors. Global brokerage CLSA has retained its ‘overweight’ on the stock and has an aggressive target of ₹370 per share. Its operation revenue was up by 30% from the year before to ₹3,601.4 crore in Q2 FY25, from ₹2,763.33 cr from the corresponding period last year. Growth Strategies: Beyond Food Delivery Each company is striving to diversify its range of services beyond the standard food delivery. One of them has been Instamart, the quick commerce arm launched by Swiggy. In total, the two have 609 dark stores across 44 cities and they are still planning for future expansion. The company aims to open twice as many stores by March 2025 and is also rolling out large-format stores that could accommodate up to 50,000 SKUs. This applies to Swiggy and, to a somewhat similar extent, to Zomato. However, Zomato’s diversification strategies are not as extensive as Swiggy’s..

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

• Zomato is planning to raise about ₹8,500 crore through a Qualified Institutional Placement (QIP) to grow its quick delivery service, Blinkit. This money will help the company open more dark stores and improve delivery services. • Zomato's quick d

See More

BigLoot IN

BigLoot.in - Where S... • 1y

Zomato Has 4 Major Apps Now • Zomato (Food Delivery) • Blinkit (Quick Commerce) • Hyperpure (Ingredients & Supplies) • District (Movies, Event, Going Out) While Swiggy Has One Application For Food Delivery, Quick Commerce and Dining BookMyShow is

See MoreAccount Deleted

Hey I am on Medial • 11m

Rapido is in discussions with restaurant owners to introduce food delivery services on its platform. This move signals its entry into a market dominated by Swiggy and Zomato. By adding food delivery, Rapido aims to leverage its existing bike taxi ne

See More

Nikhil Raj Singh

Entrepreneur | Build... • 1y

Milestone Alert! Celebrating as Swiggy joins Zomato on the stock market stage! 🚀🍔 It's incredible to see two giants in the food delivery world stand side by side, taking Indian foodtech to new heights. Proud moment for all foodies and the industr

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)