Back

SHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

📖 DAILY BOOK SUMMARIES 📖 🔗 DIRECT FREE E-BOOK DOWNLOAD LINK AVAILABLE — https://drive.google.com/file/d/1xY_NHVKRm4-qFTOVJVqnt9WQQMeB30BJ/view?usp=drivesdk 🔥 A Random Walk Down Wall Street 🔥 🚀 20 Lessons By 👉 ✨ Burton G. Malkiel ✨ 1. Efficient Market Hypothesis • The book argues that stock prices reflect all available information, meaning that it is impossible to consistently outperform the market by trying to predict price movements. Stock price movements are largely random and unpredictable 2. Random Walk Theory • Malkiel supports the idea that stock price changes are random, meaning that past price movements or trends cannot reliably predict future prices. Investors cannot "beat the market" by timing their trades based on past data 3. Index Funds vs. Active Management: • Malkiel advocates for investing in low-cost index funds rather than actively managed funds. Index funds, which track market indexes like the S&P 500, tend to outperform actively managed funds in the long run due to lower fees and better diversification 4. Risk and Return • Investors must understand the trade-off between risk and return. Higher returns typically come with higher risks. The book emphasizes the importance of managing risk through diversification and asset allocation 5. Diversification • Diversification reduces risk by spreading investments across different asset classes, industries, and geographies. A well-diversified portfolio is less affected by the poor performance of a single stock or sector 6. The Case Against Market Timing: • Malkiel discourages trying to time the market, as even professional investors struggle to predict market highs and lows. Instead, he suggests consistently investing over time, regardless of market conditions 7. Long-Term Investing • Malkiel emphasizes the importance of a long-term investment strategy. Stocks tend to outperform other asset classes over the long run, so staying invested through market volatility is key to building wealth 8. Asset Allocation • Proper asset allocation—dividing investments among stocks, bonds, and other asset classes based on your risk tolerance and time horizon—is crucial for managing risk and achieving financial goals 9. Behavioral Finance • The book highlights that many investors make poor decisions due to emotional biases, such as overconfidence, herd behavior, or panic selling during downturns. Rational decision-making is essential for successful investing 10. Speculative Bubbles • Malkiel warns against speculative bubbles, where asset prices become inflated due to irrational exuberance. He reviews historical bubbles like the dot-com bubble and housing bubble, cautioning against chasing hot stocks or trends 11. Stock Valuation: • While the book argues that stock prices are generally efficient, Malkiel discusses some valuation methods like the Dividend Discount Model and Price-to-Earnings Ratio to assess whether a stock is reasonably priced.

Replies (10)

More like this

Recommendations from Medial

Tony Stark

Let's make this worl... • 11m

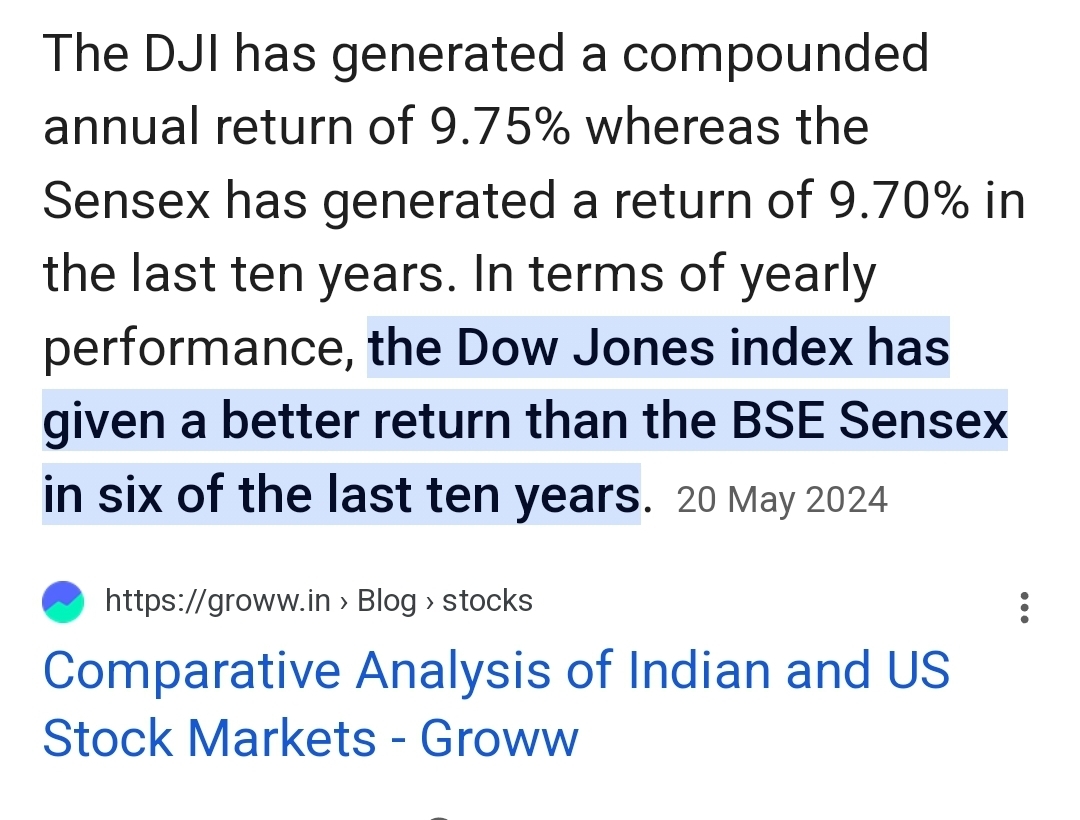

*Unlock the Power of Wealth Creation: Reasons to Invest in the Stock Market!* Benefits of Investing in the Stock Market 1. *Potential for High Returns*: 2. *Diversification*: Investing in stocks allows you to own a portion of various companies, sp

See More

Gangesh Rameshkumar

Figure it out • 8m

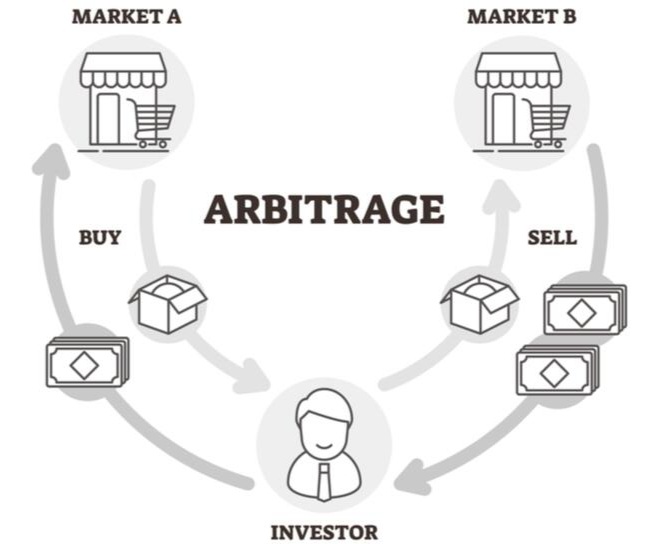

Term of the day: Arbitrage Arbitrage is the exploitation of market inefficiencies where the price of an asset is different in different markets For example, Company X's stock is listed at 20$ on the New York Stock Exchange(NYSE), but $20.05 on th

See More

Atharva Deshmukh

Daily Learnings... • 1y

Commonly used Jargons 1)Bull Market:-If you expect the stock prices to go up,you are bullish on the stock price. 2)Bear Market:-If you expect the stock prices to go down,you are bearish on the stock price. 3)Trend:-The term ‘trend’ usually refers

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)