Back

Anonymous

Hey I am on Medial • 1y

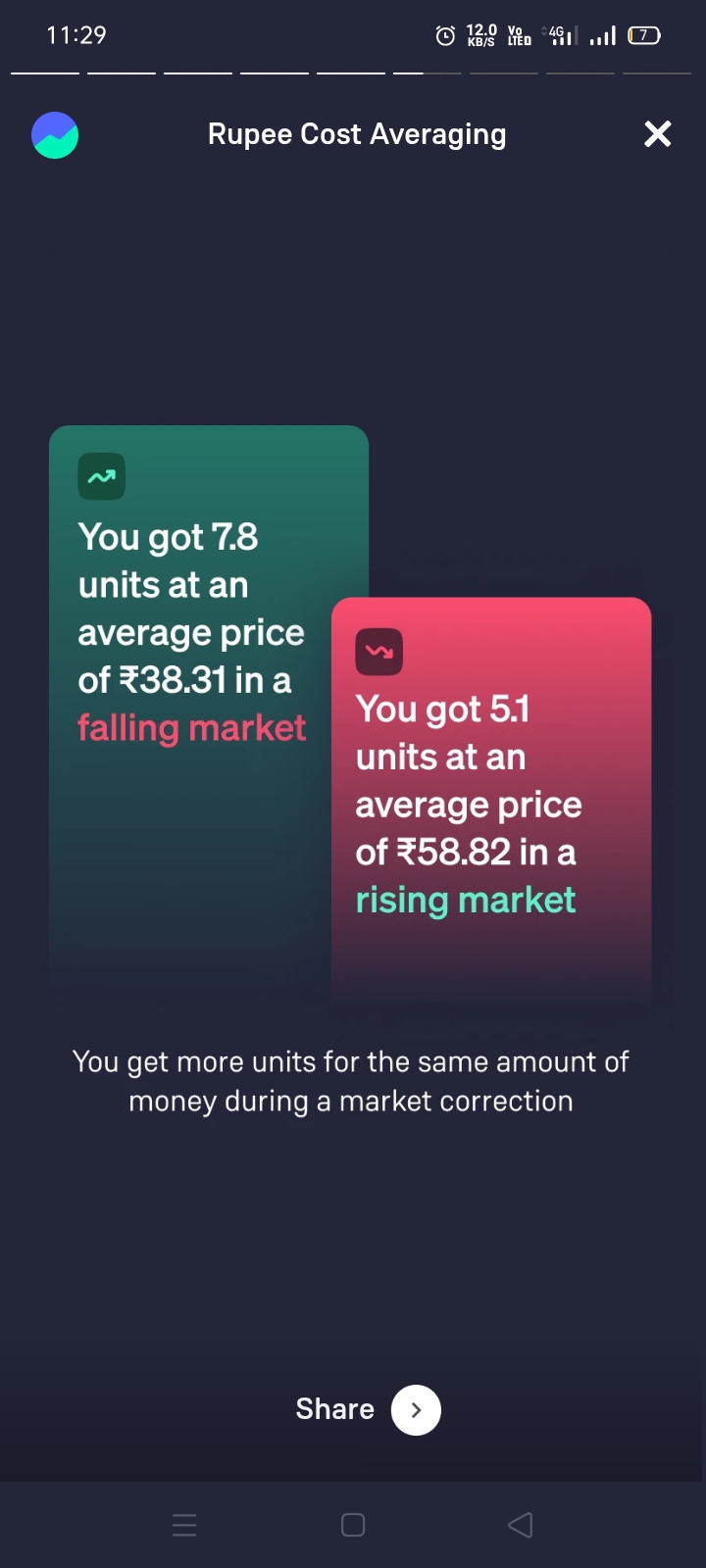

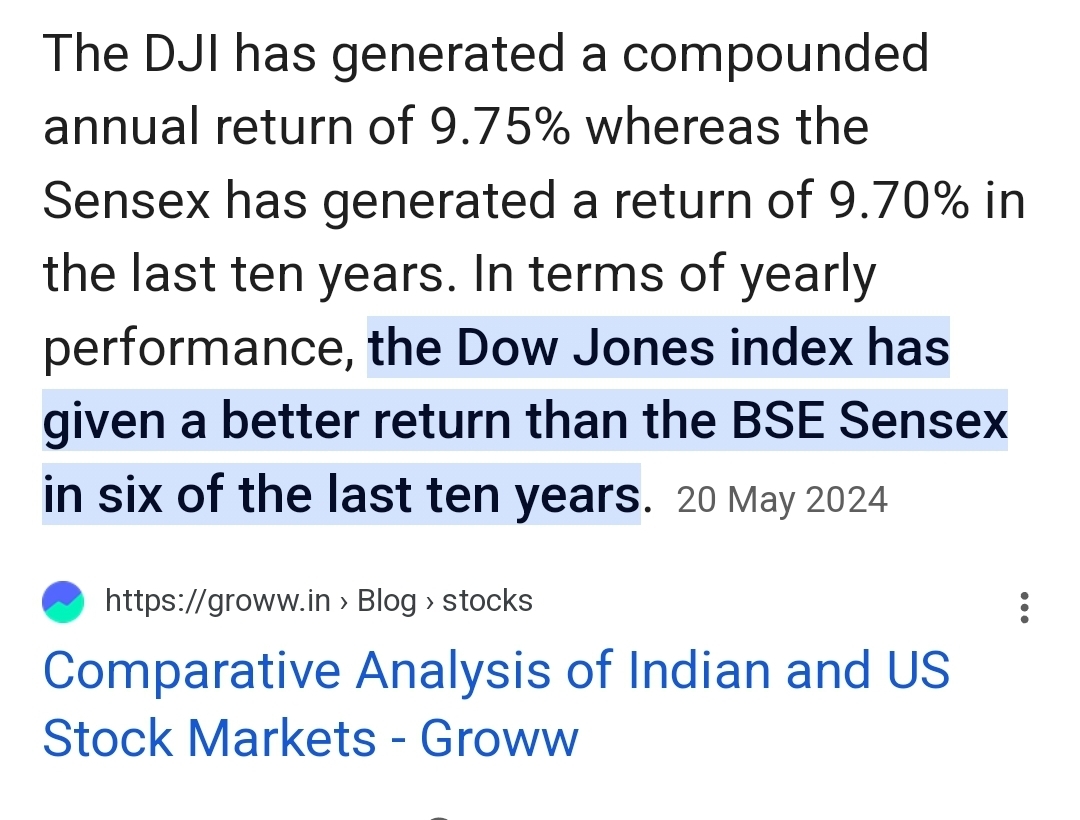

12. Efficient Portfolio Management: Modern portfolio theory (MPT) is explained, suggesting that investors should optimize portfolios based on risk and return. Malkiel emphasizes investing in a mix of asset classes to maximize returns for a given level of risk. 13. Dollar-Cost Averaging: Malkiel supports dollar-cost averaging—investing a fixed amount at regular intervals—because it minimizes the impact of market volatility and takes the emotion out of investing. 14. Avoiding Stock Picking: Individual stock picking is discouraged as most investors, even professionals, cannot consistently choose winning stocks. The better strategy is to invest in the overall market via index funds. 15. Inflation and Real Returns: The book explains how inflation erodes purchasing power over time and stresses the importance of investing in stocks and other assets that offer returns above inflation for long-term wealth building. 16. Bond Investing: Malkiel also discusses bonds, suggesting that they should be part of a balanced portfolio. He covers the basics of bond pricing, yields, and the relationship between interest rates and bond prices. 17. REITs and Real Estate: Real estate investment trusts (REITs) are recommended as a way to invest in real estate without directly owning property. They offer diversification and steady income through dividends. 18. International Diversification: Malkiel encourages investors to include international stocks in their portfolios to further diversify risk and tap into growth in global markets. 19. Avoiding Investment Scams: The book advises being skeptical of “get rich quick” schemes and promises of high returns with low risk. Malkiel warns against trusting salespeople or gurus who claim to have special insights into the market. 20. Taxes and Investing: Tax efficiency is another important consideration in investing. Malkiel suggests using tax-deferred accounts (like IRAs or 401(k)s) and minimizing trading to reduce taxable capital gains. 21. The Role of Bonds in a Portfolio: Bonds provide stability and income to a portfolio. Malkiel recommends adjusting the stock-bond mix based on age, risk tolerance, and market conditions, with more bonds as one nears retirement. 22. Stock Market Anomalies: The book acknowledges that market anomalies (like small-cap or value stock premiums) can exist but argues that these are not reliable or sustainable strategies over the long term. 23. Realistic Expectations: Malkiel encourages investors to have realistic expectations about returns. Historically, the stock market has returned around 6-7% annually after inflation, and expecting much higher returns can lead to risky behavior. 24. Retirement Planning: Planning for retirement is a major theme, and Malkiel emphasizes the importance of starting early, saving consistently, and investing in a diversified portfolio to build a secure financial future.

More like this

Recommendations from Medial

Tony Stark

Let's make this worl... • 11m

*Unlock the Power of Wealth Creation: Reasons to Invest in the Stock Market!* Benefits of Investing in the Stock Market 1. *Potential for High Returns*: 2. *Diversification*: Investing in stocks allows you to own a portion of various companies, sp

See More

Rohan Saha

Founder - Burn Inves... • 8m

These days, as more retail investors step into the bond market, high yield bonds are getting harder to find. I remember being able to buy AA rated bonds on the exchange with returns as high as 24% to 30%. Now, those same bonds hardly go beyond 12% or

See MoreSoumya Ranjan Dash

Hit & Trial • 1y

When I started investing in stock markets, I cared about: 100x returns Multibagger stocks Sharing profit screenshots What peers thought about me After getting grilled in the Market, I care about: Risk per investment Overall consistent annual retur

See MoreOMPRAKASH SINGH

Founder of Writo Edu... • 1y

Ways to Multiply Money 🤯 Investments: 1. Investing in the Stock Market: You can multiply your money by investing in the stock market, but it involves risks. 2. Mutual Funds: By investing in mutual funds, you can diversify your money into differen

See MoreVIJAY PANJWANI

Learning is a key to... • 2m

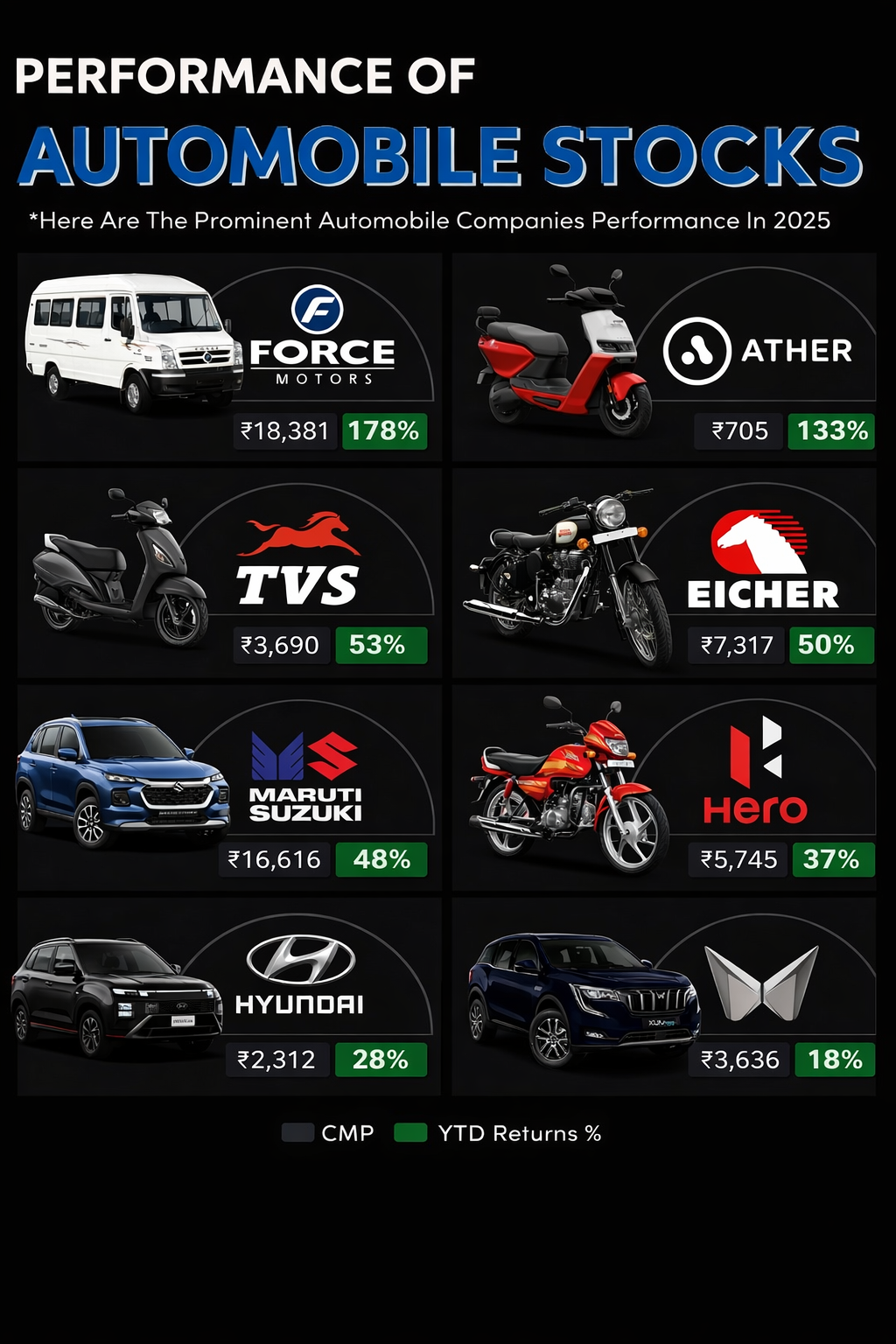

Automobile Stocks Performance in 2025! From Force Motors to Ather Energy, the automobile sector has delivered impressive returns this year 🔥 ✅ Top YTD Performers: 🚐 Force Motors – 178% 🛵 Ather Energy – 133% 🏍 TVS Motor – 53% 🏍 Eicher Motors –

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)