Back

More like this

Recommendations from Medial

Miten Solanki

Entrepreneur | Probl... • 5m

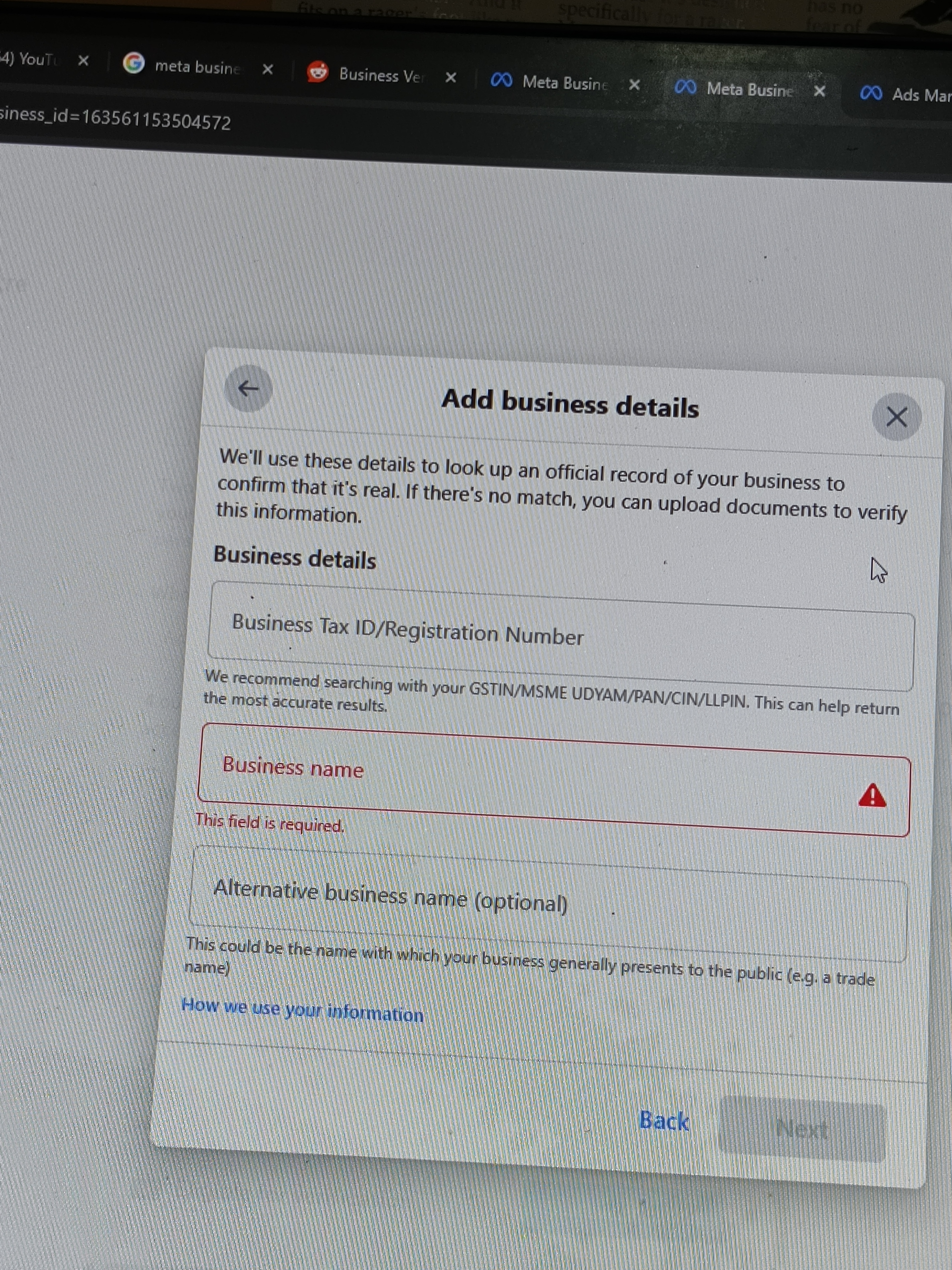

I am finally registering my startup as a company and wanted to know which kind of company registration should I do? so I have been building my AI product from last 3 months, solo. now the mvp is getting traction and we need a gst number to register

See MoreKrupali TRaders import and export

Import and export y • 1y

Exporting coconut and coconut oil can be a lucrative business due to their high demand globally. Here are the details you need to know about the process: 1. Market Research Identify Target Markets: Research countries with high demand for coconuts an

See More

Sk Ayes

Always Exited to Lea... • 11m

I hope everyone is doing well! I’m launching PearlMakhana, a premium makhana (fox nut) brand for health-conscious consumers, gym enthusiasts, and young adults. My goal is to create a high-quality, well-packaged product for both Indian and internatio

See MoreStudio Artwise Business Solutions Pvt. Ltd.

Hey I am on Medial • 1y

hello community, plz share your valuable views - how about a platform for a MOBILE WEBSITE BUILDER platform. pre-build ready to use dynamic templates, which is industry oriented. like a sharable digital profile for common population. target aud

See MoreAASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)