Back

Replies (1)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

I am 28 years old and have 32L in savings. 1L monthly expenses 3.2L monthly income through jobs other passive income sources. If I start saving 2L per month in the next 12 years 2.88 Cr. Let’s consider with job switches and increments this amount re

See MoreSuman solopreneur

Exploring peace of m... • 1y

is Emergency Fund are important? Rajesh, who works as a software engineer, suddenly faces a medical emergency in his family. He doesn’t have savings, so he ends up borrowing money at high interest, adding financial stress to an already tough time. M

See MorePoosarla Sai Karthik

Tech guy with a busi... • 3m

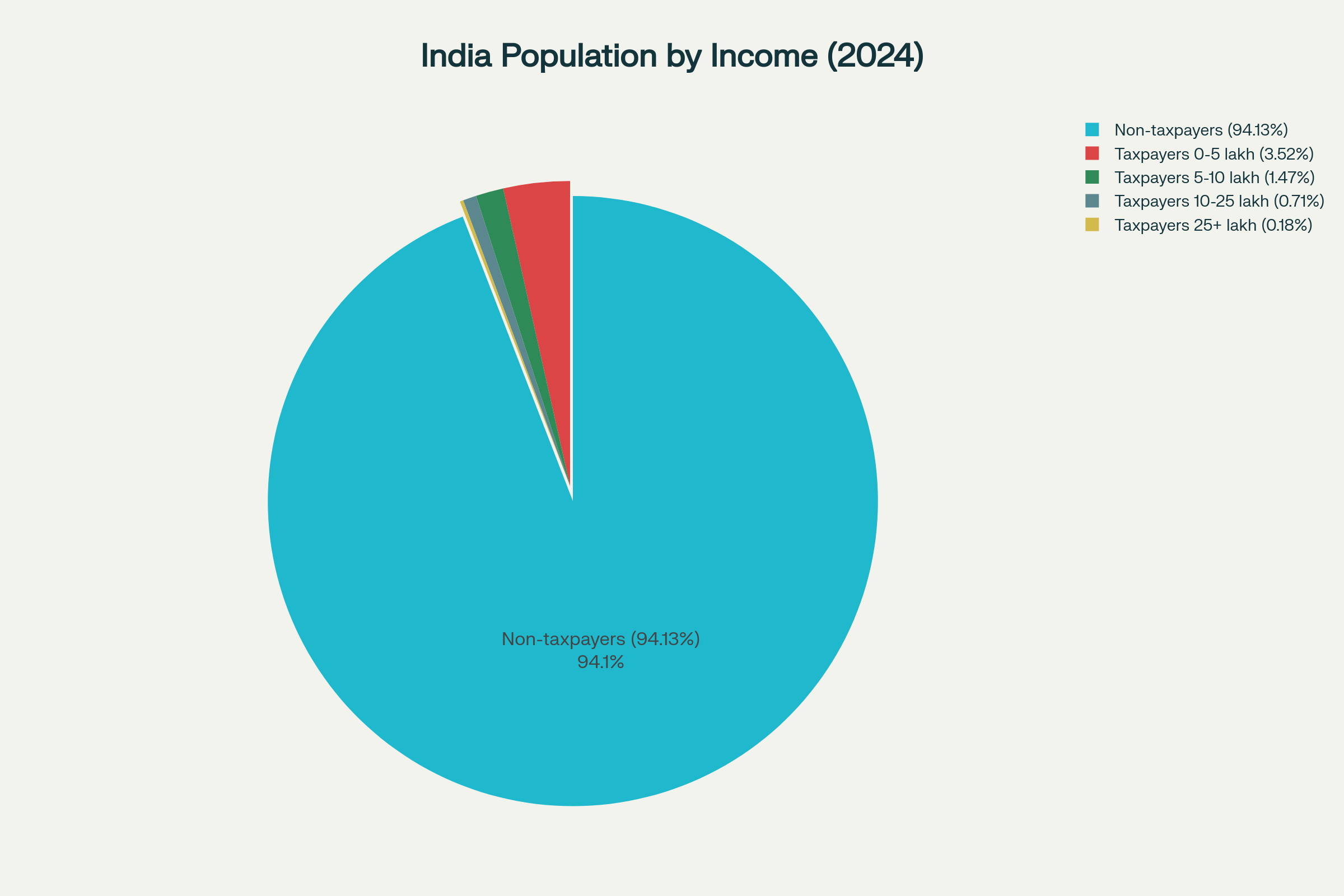

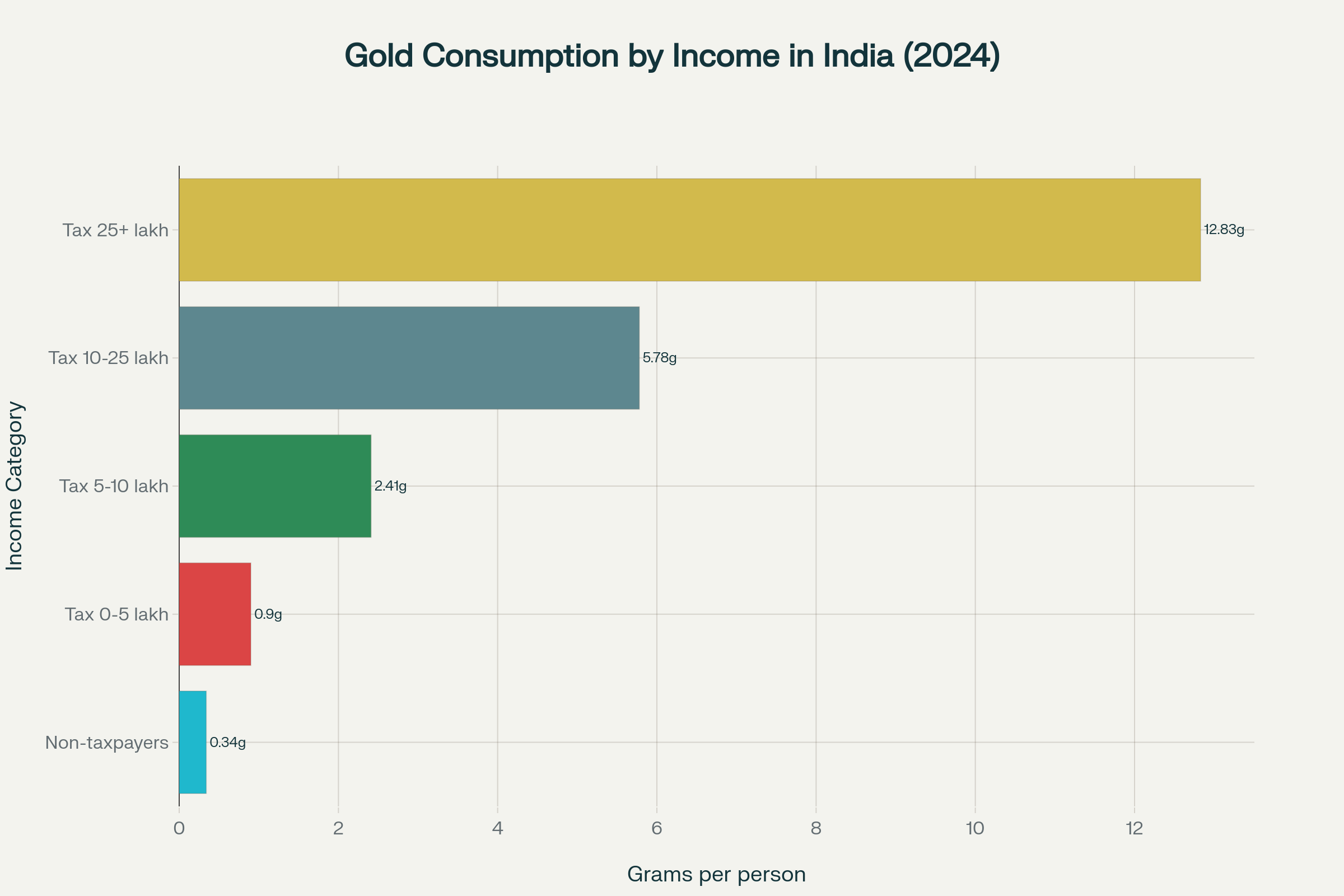

Why India’s Tax Stats and Gold Love Tell a Unique Investment Story Did you know only 5.9 percent of India’s vast population pays income tax, but nearly every household treasures gold not only as jewellery but as a trusted financial foundation? Here

See More

Suprodip Bhattacharya

Entrepreneur || Star... • 1y

I need technical co founder The idea is : Imagine a world where teenagers ate saving money for their future and low Income families Can build a safety net instead of living with big debts Tired of Vague Financial Dreams? Wealthyse helps you set clea

See MoreTushar Aher Patil

Trying to do better • 1y

Hey medial family. I am starting a new series of basic finance concepts. For the first time in my life I have to explain a lot. If I do something wrong, then correct me as a little brother. 1. Personal Finance Budgeting: Planning how to allocate i

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)