Back

Replies (1)

More like this

Recommendations from Medial

Swapnil gupta

Founder startupsunio... • 8m

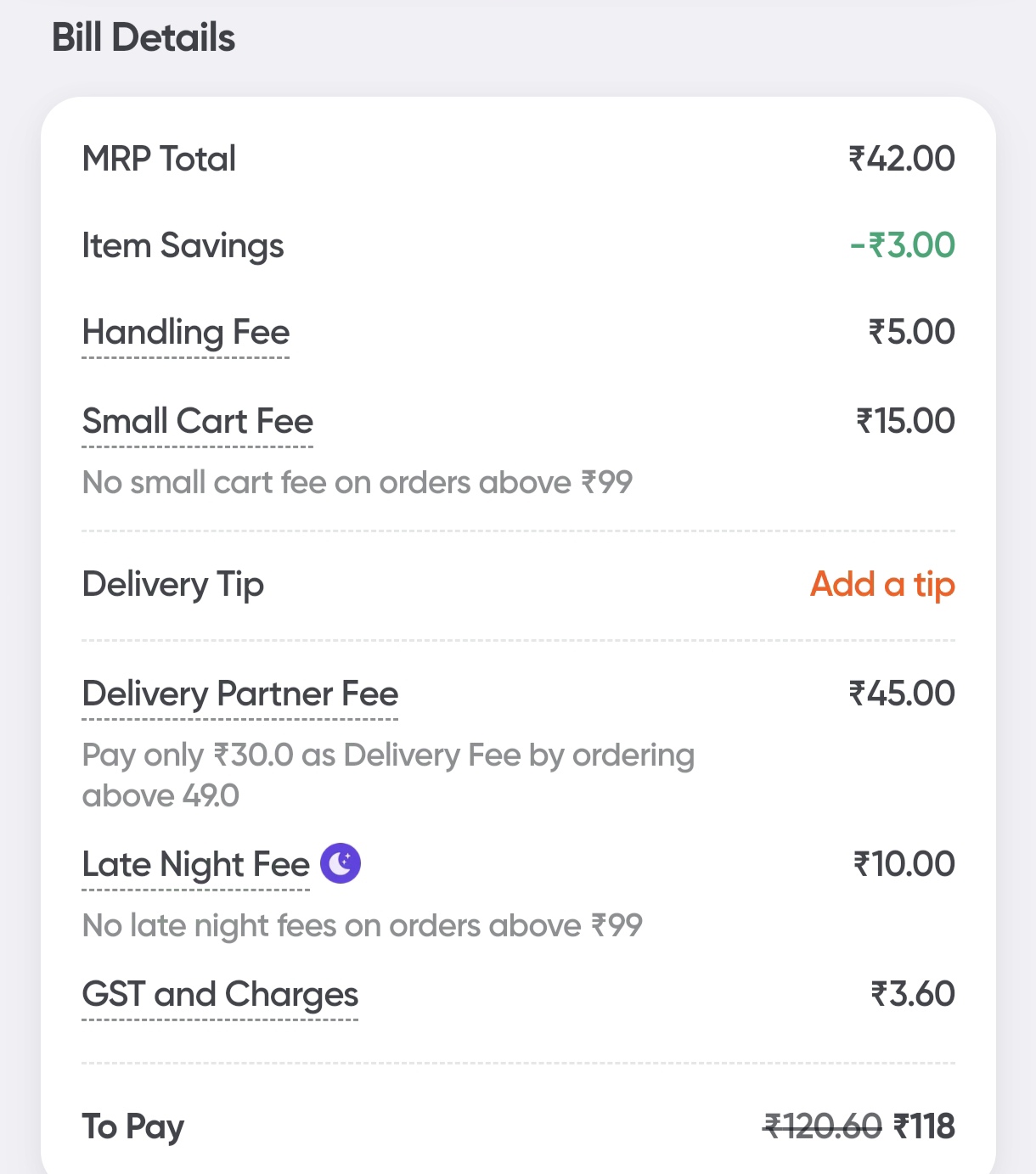

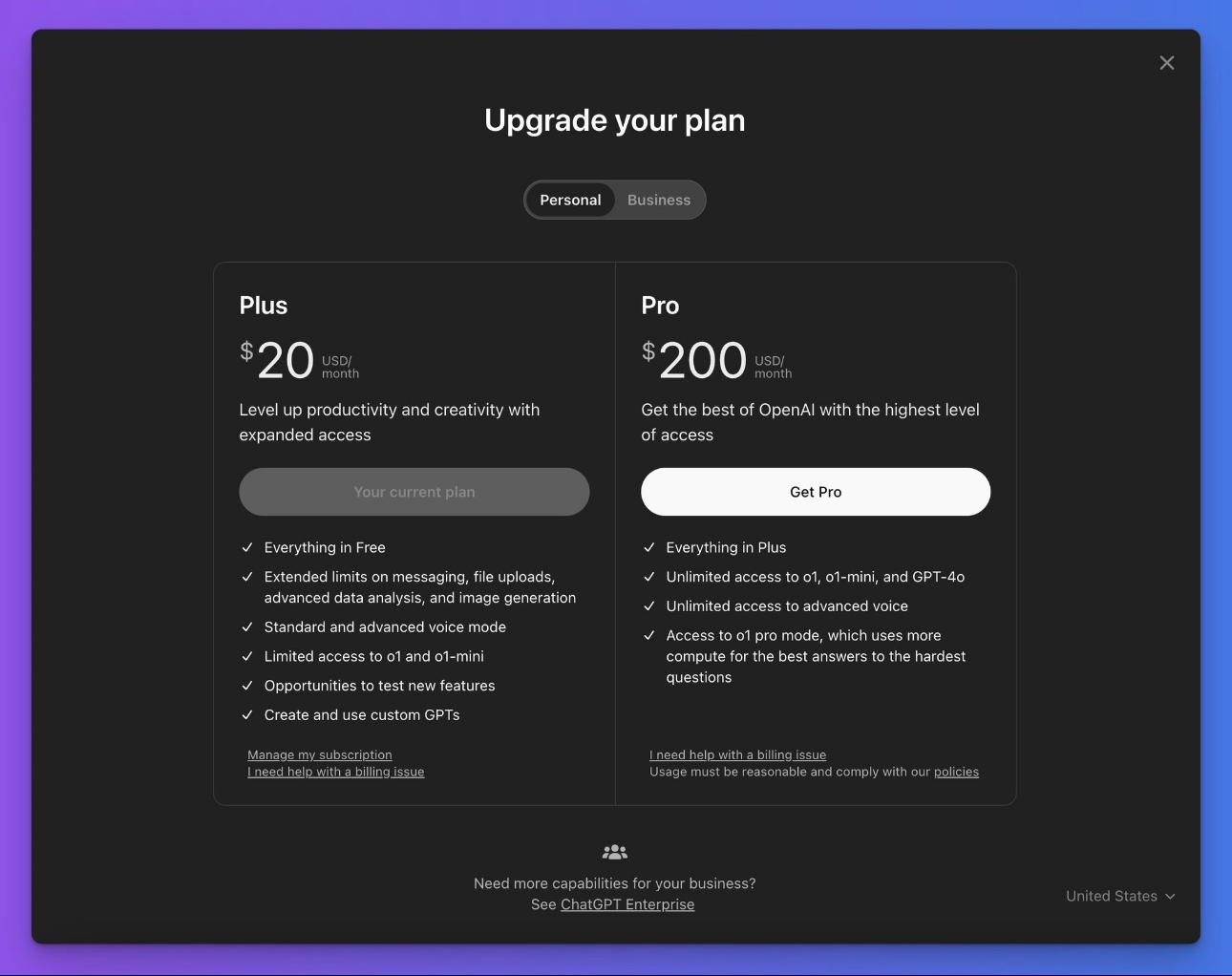

📌 Revenue Model of Groww 1. Subscription Charges: For premium services like advanced analytics. 2. Platform Fees: Charged for mutual fund investments. 3. Lending Services: Interest income from instant loans offered to select customers. A. Br

See More

3 Replies

3

13

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)