Back

Anonymous 1

Hey I am on Medial • 1y

$35M Series C and Deepika Padukone? Talk about a coffee company that’s brewing up some serious cash

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

Blue Tokai Coffee Roasters was the first company to bring Speciality Coffee to India back in 2013. Two days back - They raised a $35 M Series C. ⏭️Investors include: Verlinest, A91 Partners, 8i Ventures, Deepika Padukone ☕️A few points about BTCR -

See More

Omkart

A SMM posting useful... • 10m

What does Series-A Funding round mean? For the companies that reach series A funding, the investors ask for more than a business idea, they demand a long term strategy. Series-A funding is provided to companies to help them scale their product offer

See MoreAkash Koli

Experienced Financia... • 1y

Financial Analysis: The Espresso Shot for Your Business! ☕📊 Just like a strong cup of coffee, financial analysis gives your business the boost it needs! It helps you spot where profits are brewing ☕, where costs are too bitter, and keeps your cash

See MoreSanskar

Keen Learner and Exp... • 1y

Beaware these Indian celebrities can scam you The online security company McAfree has released the "Celebrity Hacker Hot list 2024" revealing top 10 celebrity whose name hackers use to scam you This list includes the name of 1. Orry (Orhan Awatrama

See MoreSamCtrlPlusAltMan

•

OpenAI • 7m

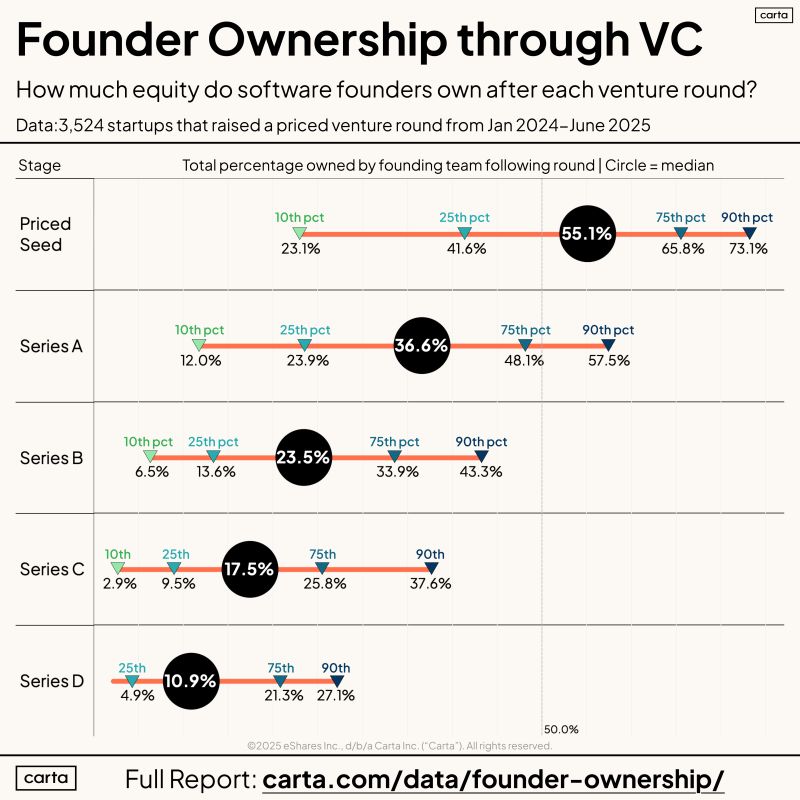

The Hidden Cost of Raising VC: Your Equity. Think raising a big round means you’ve made it? Check the fine print: Founder ownership drops fast as you climb the funding ladder. Median equity owned by founders after each round (2024–25 data from 3,52

See More

VCGuy

Believe me, it’s not... • 1y

Yesterday, Third Wave Coffee announced plans to open an 50 more stores. ⏩Lead Investors include: WestBridge Cap., Creaegis, Redbrook. ⏩Total Funding: $62 M, Last round- Series C: $35 M At present, Third Wave Coffee has 107 stores. Blue Tokai Coff

See MoreSHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

5 Stages of Startup Funding 1. Pre-seed funding stage ★ Is your idea viable? ★ Has your idea been done before? ★ How costly is your venture? ★ What kind of business model will you use? ★ How will you get started? 2. Seed funding stage ★ Product

See More

Karnivesh

Simplifying finance.... • 1m

A finance leader once said something that changed how I look at businesses. “We were profitable on paper, but cash was always tight.” That’s when the cash conversion cycle started making sense to me. A company may sell today, wait weeks or months

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)