Back

Aditya Arora

•

Faad Network • 1y

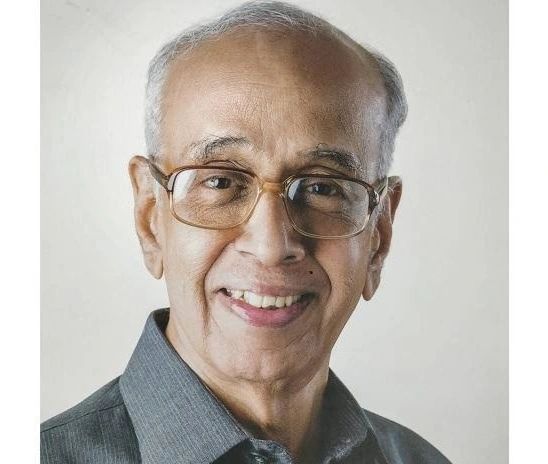

Meet the man who donated 6120 CR worth of his shares to employees. 1. Born in a middle-class Brahmin family in Chennai, R Thyagarajan wanted to be financially independent. As he was looking for money, he saw an advertisement. 🤔 2. In 1961, New India Assurance, a general insurance company, offered a training stipend of Rs 500 when companies did not pay beyond Rs 300. He got selected amongst only 12 people for the job and worked in commercial financing for the next decade. But another piece of news came. 👇 3. On 20th September 1972, Indira Gandhi led government nationalised the general insurance business of 55 Indian companies. 37-year-old Thyagrajan realised it was time to move on and build something of his own. He wanted to finance people without a credit history, and an idea struck him. 💡 4. The idea was simple ⏩ A chit-fund, where the collected money pot is doled out to one investor monthly until everyone has received a share. He would utilise that money to buy trucks and finance at 37% interest when the market charged 80%. On 5th April 1974, Shriram Chits started. 🚀 5. Thyagarajan's idea took off and got a new name with Shriram Transport Finance Company (STFC) in 1979. It scaled to deposits worth Rs 800 CR from 2 lakh depositors and was listed on the stock market in 1984. Seeing the growth, Tata Motors and Ashok Leyland took a 15% stake in STFC in 1990. 💰 6. But then RBI came knocking in 1998. It cautioned depositors of STFC that their money was not safe as it lent to purchase 5-10-year-old pre-owned trucks. Thyagarajan spoke to every depositor for the next three months and assured them of his model. And magic happened! 🪄 7. With an unbelievable 98% collection rate, it showed everyone that truck financing could be risk-free at lower interest rates. As it crossed 3000 CR in managed assets at a profit of 100 CR in 2006, it raised 700 CR from TPG and Chrys Capital and became a 1000 CR company. 📉 8. By 2009, it had purchased hypothecation loans from commercial vehicle maker - General Electric and ventured into construction equipment financing. As it securitised 8757 CR worth of loans and raised 584 CR, it crossed 50,000 CR in managed assets by 2013. 💵 9. With ratings upgraded to AA+, STFC raised 25,100 CR by issuing India's first Masala Bonds - Senior Secured Rupee Denominated bonds on the Singapore stock exchange. Thyagarajan had scripted history as Shriram crossed the trillion-dollar mark by achieving managed assets worth 100,000 CR in 2019. 🙌 10. Today, the Shriram group deals with housing, insurance, transport, wealth management, and real estate. However, its star entity - Shriram Finance (name changed from STFC in November 2022), manages assets worth 233,443 CR, while the group is worth 70,400 CR with over 23 million customers. 💪 ➡️ But the best part is that R Thyagarajan still does not own a mobile phone, drives a Rs 4 lakh car and donated 6120 CR worth of his shares to his employees. 🙏

Replies (7)

More like this

Recommendations from Medial

Aditya Arora

•

Faad Network • 1y

Meet the man who started at 22 and is worth 27,000 CR today. 1. At 24, Ajay Piramal had to take over his family's textile - Morarjee Textile Mills, in Bombay after his father passed away. To worsen things, his elder brother parted ways and took thei

See More

Aditya Arora

•

Faad Network • 1y

Meet the man who was the son of a farmer but started a 9000 CR company. 1. Born to a Jain family in the small village of Padru in Rajasthan, Motilal Oswal's father had a fledgling grains trading business. But he wanted to leave the family trade and

See More

Aditya Arora

•

Faad Network • 1y

Meet the man who was the son of a farmer but started a 9000 CR company. 1. Born to a Jain family in the small village of Padru in Rajasthan, Motilal Oswal's father had a fledgling grains trading business. But he wanted to leave the family trade and

See More

gray man

I'm just a normal gu... • 10m

B2B ecommerce company IndiaMART InterMESH Limited has completed the buyout of SaaS startup Livekeeping Technologies through a secondary deal worth INR 26.78 Cr ($3.1 Mn). It must be noted that IndiaMART initially acquired a majority 51.09% stake in

See More

Aditya Arora

•

Faad Network • 1y

Meet the man who started a 12,000 CR company at 69. 1. Ashok Soota was famously known as the magic man of the IT industry. In 1978, he took over as CEO of Shriram Refrigeration, which posted losses for four consecutive years and turned it around to

See More

Aditya Arora

•

Faad Network • 1y

Meet the doctor from Punjab who built a 30,000 CR company. 1. Born in the ancient city of Batala in Punjab to a gynaecologist mom and ENT specialist father, Naresh Trehan always wanted to be a doctor. His dream came true when he completed his MBBS

See More

Aditya Arora

•

Faad Network • 1y

Meet the man from Chennai who built a 5000 CR company after his father died. 1. Born in the coastal town of Cuddalore, Tamil Nadu, Chinni Krishnan Ranganathan was deeply inspired by his father, who pioneered selling shampoo in sachets. At the time,

See More

Deepasnhu Chail

Mastering the Game o... • 1y

How is Jeff Bezos So Rich with Only 9% of Amazon? Jeff Bezos's net worth is substantial even though he owns only about 9% of Amazon because of several key reasons: 1. Amazon's Market Capitalization: For instance, if Amazon's market cap is $1.5 tril

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)