Back

Arijit Ray

•

Twilio • 1y

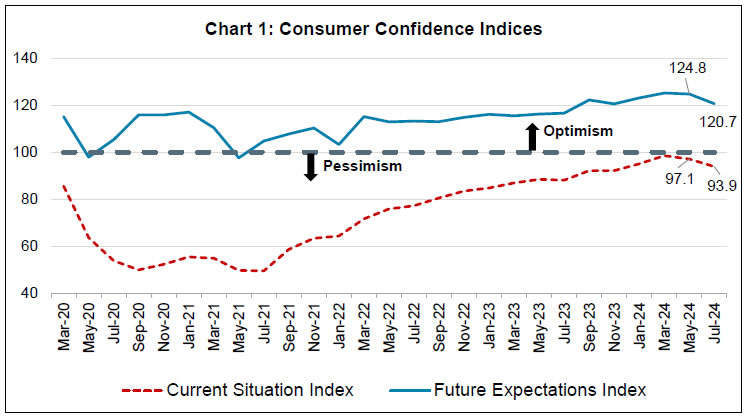

The confidence of Indian consumers are declining regarding their financial situation and the broader economy. Despite somewhat positive inflation stats posted by the RBI this month, Indian consumers are becoming a bit pessimistic about their spendings and the economy, according to a recent consumer survey report by the RBI. Concerns about layoffs, rising among unemployment and—most importantly— the controversial rising food price inflation seem to be the primary factor behind dampening the mood of the average consumer. Now why is this important? Well, a negative sentiment definitely act as catalyst for the consumers wanting to spend less, which can have a ripple effect through the entire economy. This is why the RBI conducts this bi-monthly consumer confidence survey on their inflation expectations across 19 major cities. As per the latest report released this month, the expectations fell down harder than the last report that was released on May this year. What are your thoughts on the same? Let me know in the comments. Here is the latest report: https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=22465 Special Thanks to The Daily Brief by Zerodha for bring this into my notice and creating an insightful news byte. PS: This article is part of a insights oriented newsletter "Buzzing Trendz" where every Friday, I handpick and share 3 insightful articles or stories covering the latest in Business, Tech and Trends. My goal is to cut through the noise to bring valuable and engaging content directly to you. If you like what you just saw, definitely give a thumbs up as that would encourage me to find more stories like this. Link to the Newsletter: https://curiousaboutmoney.substack.com/p/buzzing-trendz-2

Replies (4)

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See Morefinancialnews

Founder And CEO Of F... • 1y

"RBI Expected to Cut Repo Rate by 25 Basis Points to 6.25% in December Amid Concerns Over Volatile Food Prices" "RBI Likely to Cut Key Policy Rate by 25 Basis Points to 6.25% in December as Inflation Expected to Ease, Aiming to Boost Economic Growth

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See Morefinancialnews

Founder And CEO Of F... • 1y

Wall Street Update: US Stock Indices Trade Mixed Amid Fresh PCE Inflation Data Wall Street Update: Dow Rises, S&P 500 and Nasdaq Slip Amid PCE Inflation Data **US Stocks Mixed as Investors Digest PCE Inflation Data** US stock indices were mixed on

See MoreSHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

Some Important Full Forms For Startups 1 =} B2C ( Business to customer ) ★ All products that you buy from an online / offline marketplace as a consumer is known as B2C. Ex- Flipkart , amzony 2=} B2B ( Business to business ) ★ B2B business mode

See MoreAkshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreRohan Saha

Founder - Burn Inves... • 1y

The RBI has made a 25 basis points rate cut. However, there is still some tension in the market regarding what the RBI will do about banking liquidity and how it will manage future inflation. Due to these concerns, the market is somewhat sideways and

See MoreTushar Aher Patil

Trying to do better • 8m

📢 **RBI MPC Delivers "Hat-trick" Rate Cut; Shifts Stance to 'Neutral'** The Reserve Bank of India (RBI) today announced its bi-monthly monetary policy outcome, with significant decisions impacting the Indian economy. **Key Announcements & Insights

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)