Back

Anonymous 1

Hey I am on Medial • 1y

there's no one-size-fits-all answer. The amount can vary widely depending on factors like your industry, traction, and location. Generally, for 10% equity, you might be looking at anywhere from $100K to $1M. Have you done any market research specific to your sector?

More like this

Recommendations from Medial

derek almeida

Founder ,Ceo , Entre... • 4m

📣 Looking for Companies Raising $1M+ (₹8Cr+) I’m currently working with a Private Equity fund and syndicate network actively looking to deploy $1 million to $100 million into high-growth companies. We’re sector-agnostic, focusing primarily on: Compa

See MoreVedant SD

Finance Geek | Conte... • 1y

Day 14: Cost of Living in Bangalore for Entrepreneurs: A Breakdown Balancing affordability with a comfortable lifestyle is crucial for entrepreneurs. Here's a breakdown of the cost of living in Bangalore: * Accommodation: Renting a 1 BHK apartment

See MorePradeep K Chaudhay

Co-Founder & CPO Gro... • 1y

In India, Product Managers earn an average of ₹13.4-₹25.8L annually, starting at ₹4.8L and reaching ₹40L for experienced professionals, significantly higher than the national average of ₹3.8L. Globally, salaries vary: US ($116,963 + $5K bonus), UK (£

See MoreBlack ocean Cosmetic

Hey I am on Medial • 1y

In India's cosmetics industry, profit margins vary based on brand positioning and product type. For standard cosmetic products, companies typically achieve profit margins between 10% and 15%. In contrast, luxury cosmetic brands often realize signific

See MoreAccount Deleted

Hey I am on Medial • 11m

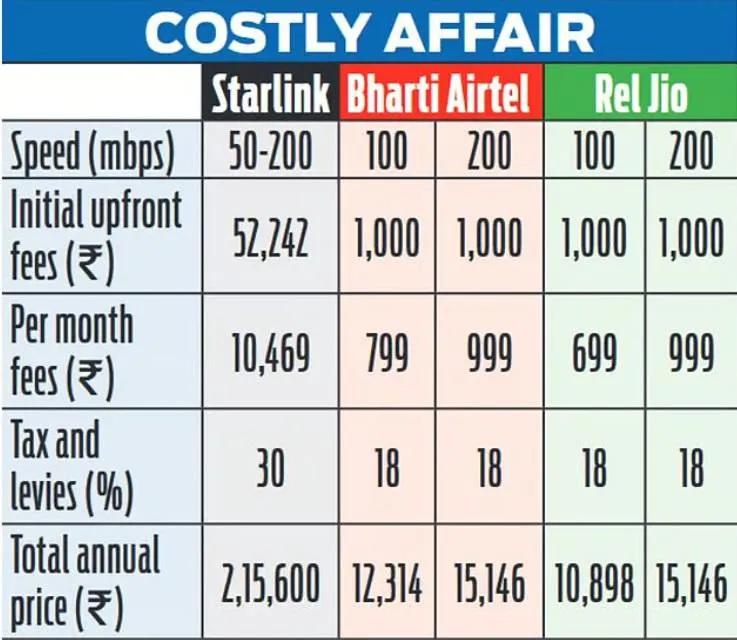

Jio and Airtel offer affordable internet with similar pricing and an 18% tax, making them budget-friendly options. Airtel is slightly more premium, while Jio remains widely available across India. Starlink, on the other hand, provides high-speed in

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Ever wondered what happens before a startup secures funding? Let's deconstruct it Valuation is key in funding rounds – is it art or science? For early-stage startups, it's a mix. Common Valuation Methods: DCF: Future cash flows discounted to present

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)