Back

Harshit tiwari

Be optimistic • 1y

Is it mandatory to take GST in sole proprietorship & What compliance maintain in sole proprietorship

1 Reply

1

Replies (1)

More like this

Recommendations from Medial

Aanya Vashishtha

Drafting Airtight Ag... • 11m

"Sole Proprietorship vs. Private Limited— Imagine this: You’re launching your dream business. You’ve got the idea, the drive, and maybe even your first few clients. But then, the big question hits you— "Should I register as a Sole Proprietor or a

See More

8 Replies

18

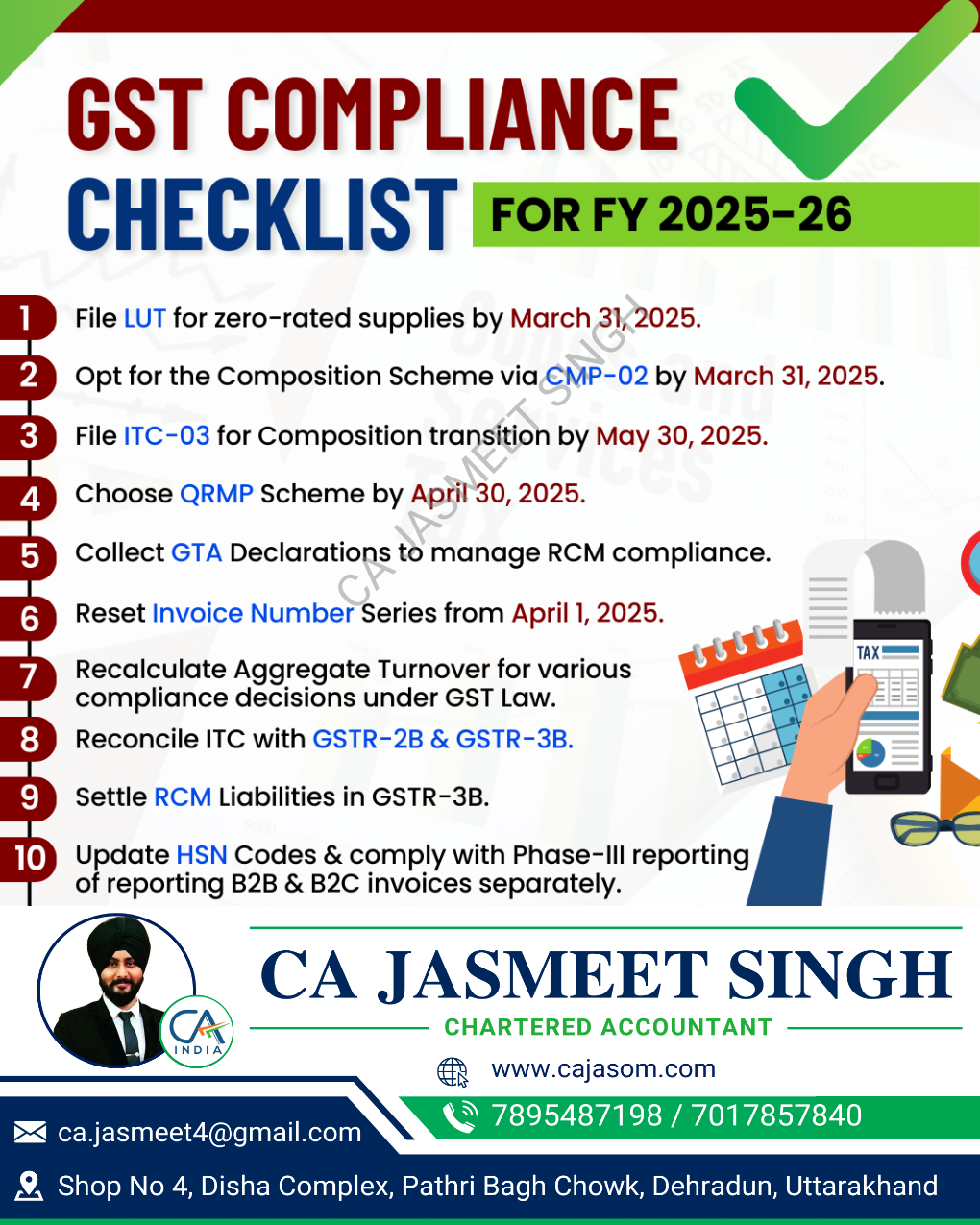

CA Jasmeet Singh

In God We Trust, The... • 11m

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

Reply

1

20

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)