Back

More like this

Recommendations from Medial

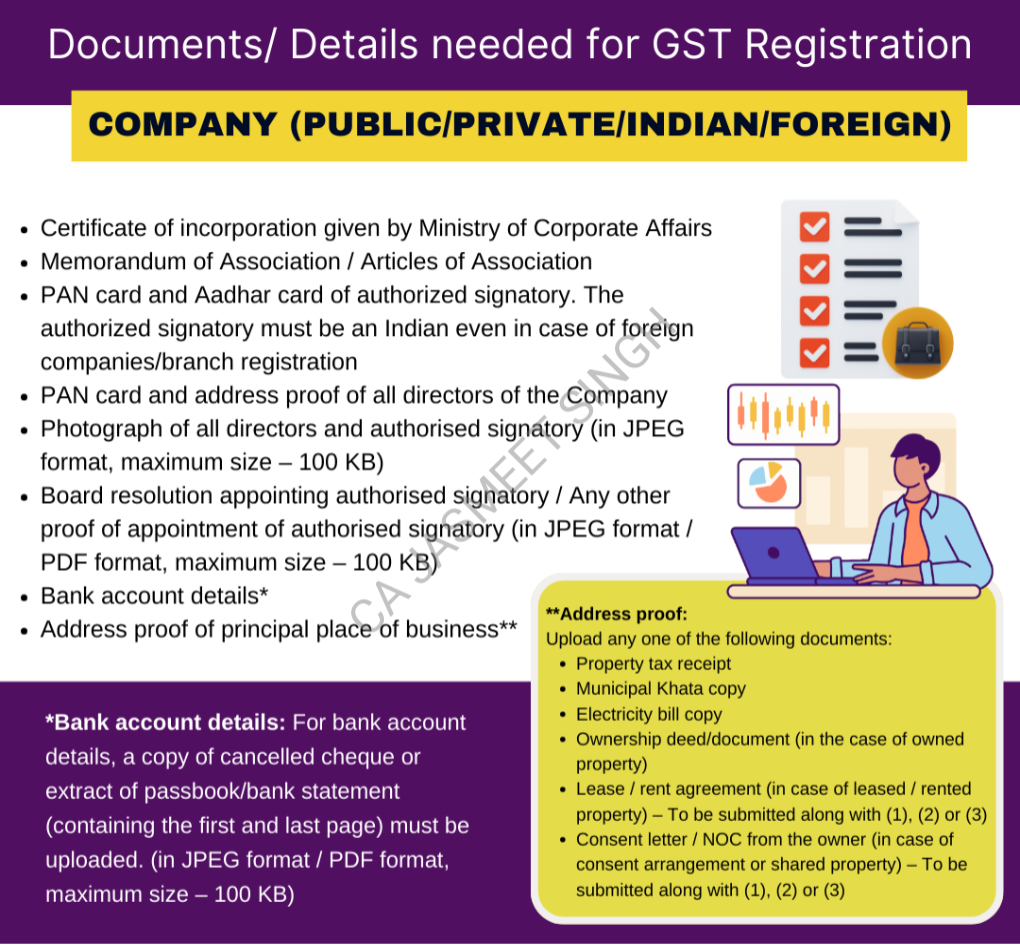

CA Jasmeet Singh

In God We Trust, The... • 11m

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

Shubham

Start small Dream Bi... • 2m

Need GST registration, company incorporation, or help in filing GST returns, corporate returns? Our team of chartered accountants & company secretaries handles it all—fast and hassle‑free. DM for more information. #GST #Incorporation #TaxReturns #S

See MoreMiten Solanki

Entrepreneur | Probl... • 5m

I am finally registering my startup as a company and wanted to know which kind of company registration should I do? so I have been building my AI product from last 3 months, solo. now the mvp is getting traction and we need a gst number to register

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)