Back

Ronak Patel

Here you go! • 1y

Another important but ignored question they ask is :- what are your competitors financial, profits, cash flow? Their market cap?

Replies (1)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 16d

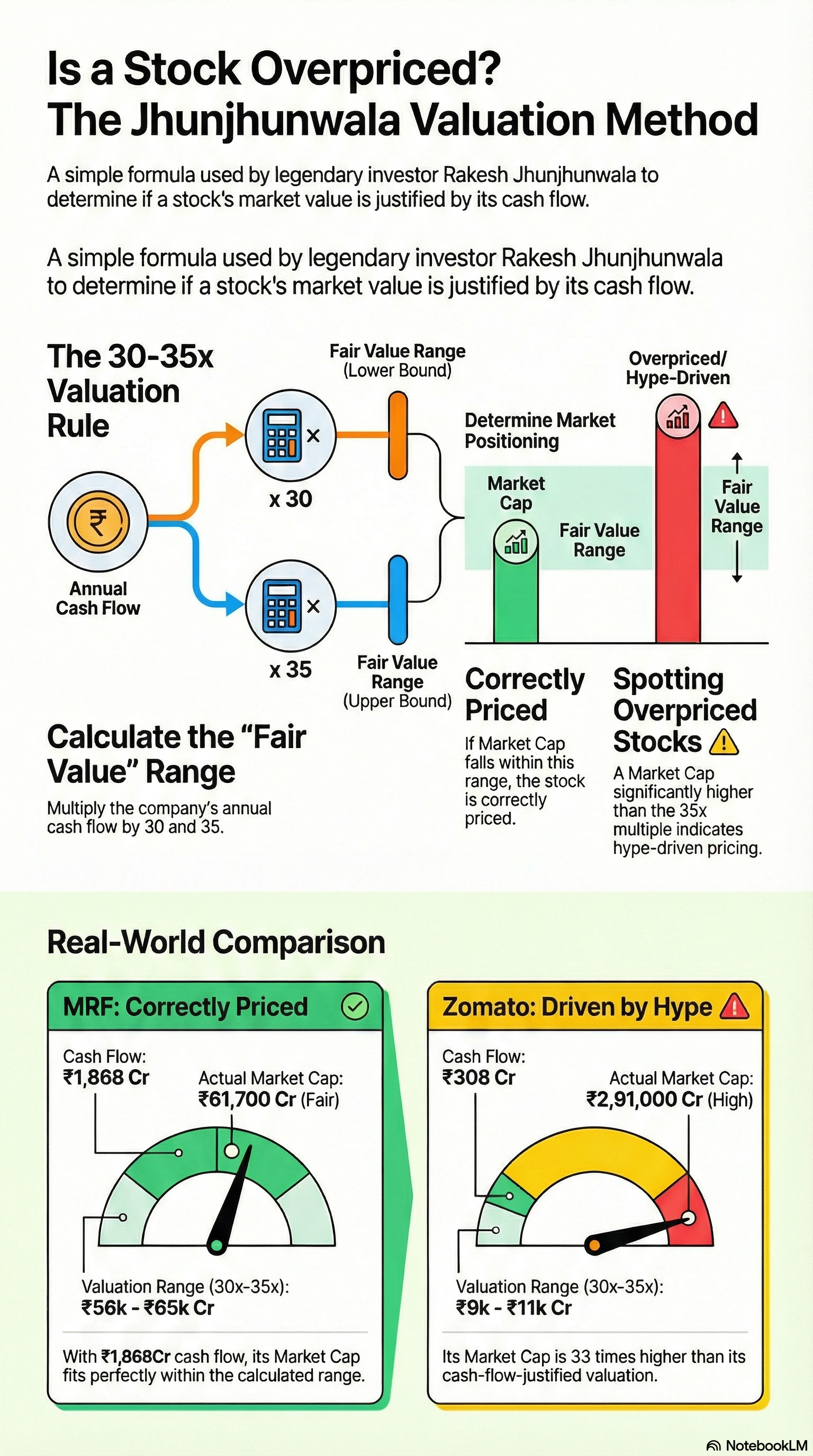

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

Vikas Acharya

Building Reviv | Ent... • 11m

The A-Z Survival Guide to Entrepreneurship! C – Cash Flow Profitability sounds great, but if you run out of cash, your business dies—no matter how good your idea is. I learned the hard way that revenue doesn’t equal survival. Managing cash flow is

See MoreCA Rajat Agrawal

EaseValue Advisors • 9m

One of my startup clients recently struggled with severe cash flow issues — something I see quite often, especially in AI-driven or tech-based startups. Despite having a great product and market fit, they were stuck because of delayed receivables an

See MoreSandip Kaur

Hey I am on Medial • 1y

Mastering Cash Flow: Simple Strategies for Indian Startups Cash flow can either make or break your startup, and managing it well is critical. Here are some practical tips to help your startup thrive financially: 1.Separate Business and Personal Fina

See MoreKarnivesh

Simplifying finance.... • 1m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See MoreKarnivesh

Simplifying finance.... • 27d

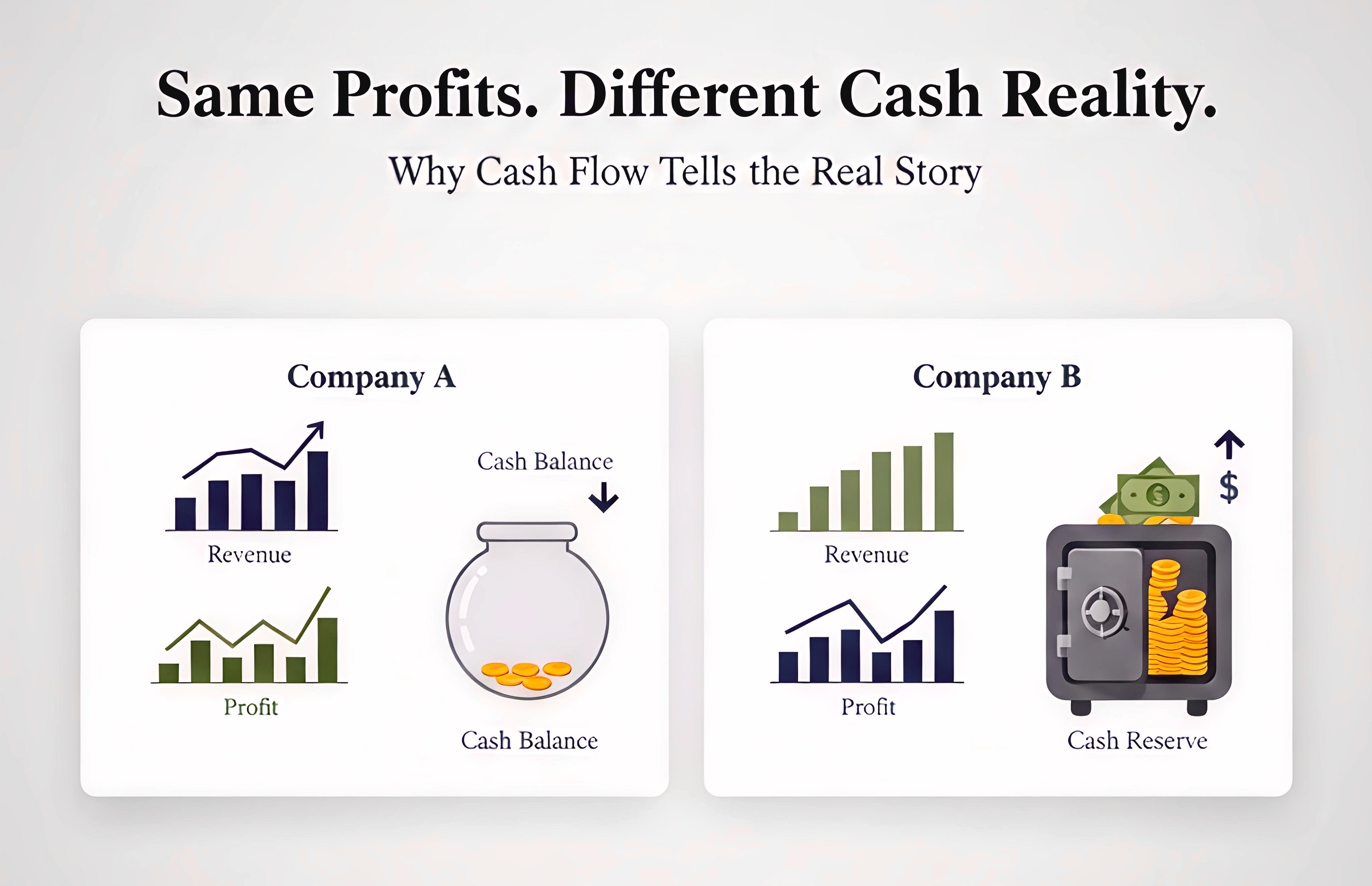

Two companies can report the same profit. Yet one constantly struggles with cash, while the other quietly builds a buffer. This used to confuse me until I started paying attention to how cash actually moves. Some businesses collect money quickly an

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)