Back

Chaman Kanth

Mechanical Engineer • 1y

This question is good you need to understand few things before going to any country debt to GDP ratio infrastructure future potential and good hold over geopolitics with stable politics and good export potential overall and your ethnic values Singapore

More like this

Recommendations from Medial

Shubham Khandelwal

Software Engineer • 1y

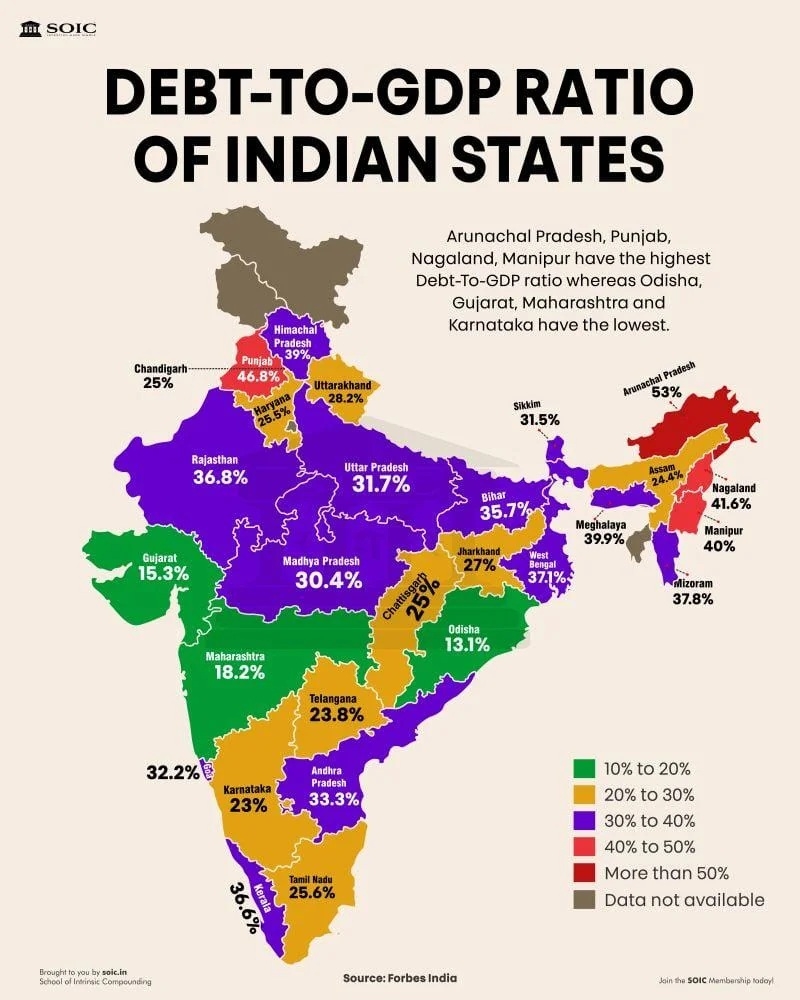

Debt to GDP Ratio of Indian States. Arunachal Pradesh, Punjab, Nagaland, Manipur have the Debt to GDP Ratio whereas Odisha, Gujarat, Maharashtra and Karnataka have the lowest Debt to GDP Ratio. Freebies in Poll Promises by Political Parties is the

See More

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreAkshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See Morefinancialnews

Founder And CEO Of F... • 1y

"Portfolio Manager Predicts Potential Market Correction Amid Growth Concerns" Brian Arcese, a portfolio manager at Singapore-based Foord Asset Management, highlighted the possibility of a market correction if U.S. GDP growth slows and inflation rise

See MoreRohan Saha

Founder - Burn Inves... • 7m

A lot of people tell me “You keep asking others to invest in debt but you yourself have never put even ₹1 into it or if you do you take it out quickly” so let me clear that up a bit. Personally I mostly invest in gold, silver, and stocks whatever is

See Morefinancialnews

Founder And CEO Of F... • 1y

Shares of the Bombay Stock Exchange (BSE), one of Asia’s oldest stock exchanges, witnessed a 7% drop in intraday trading on Wednesday, October 16, 2024, sliding to ₹4,419 per share. The decline followed a downgrade by global brokerage firm Jefferies,

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)