Back

Rohan Saha

Founder - Burn Inves... • 7m

A lot of people tell me “You keep asking others to invest in debt but you yourself have never put even ₹1 into it or if you do you take it out quickly” so let me clear that up a bit. Personally I mostly invest in gold, silver, and stocks whatever is left I keep in fixed deposits I don’t put much into debt funds and I have a few reasons for that. First I often need quick access to my money with debt funds withdrawing takes some time and I can’t always wait. Second while debt funds give better returns than FDs they still don’t beat gold or equity so I don’t find it that attractive. And most importantly I am a full time trader I even invest in global markets. I suggest debt funds to others because not everyone is able to track the market all the time and some people get uncomfortable with market ups and downs for them having some money in debt is a good way to keep their portfolio stable after all not everyone does trading full time and that’s totally okay.

Replies (1)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

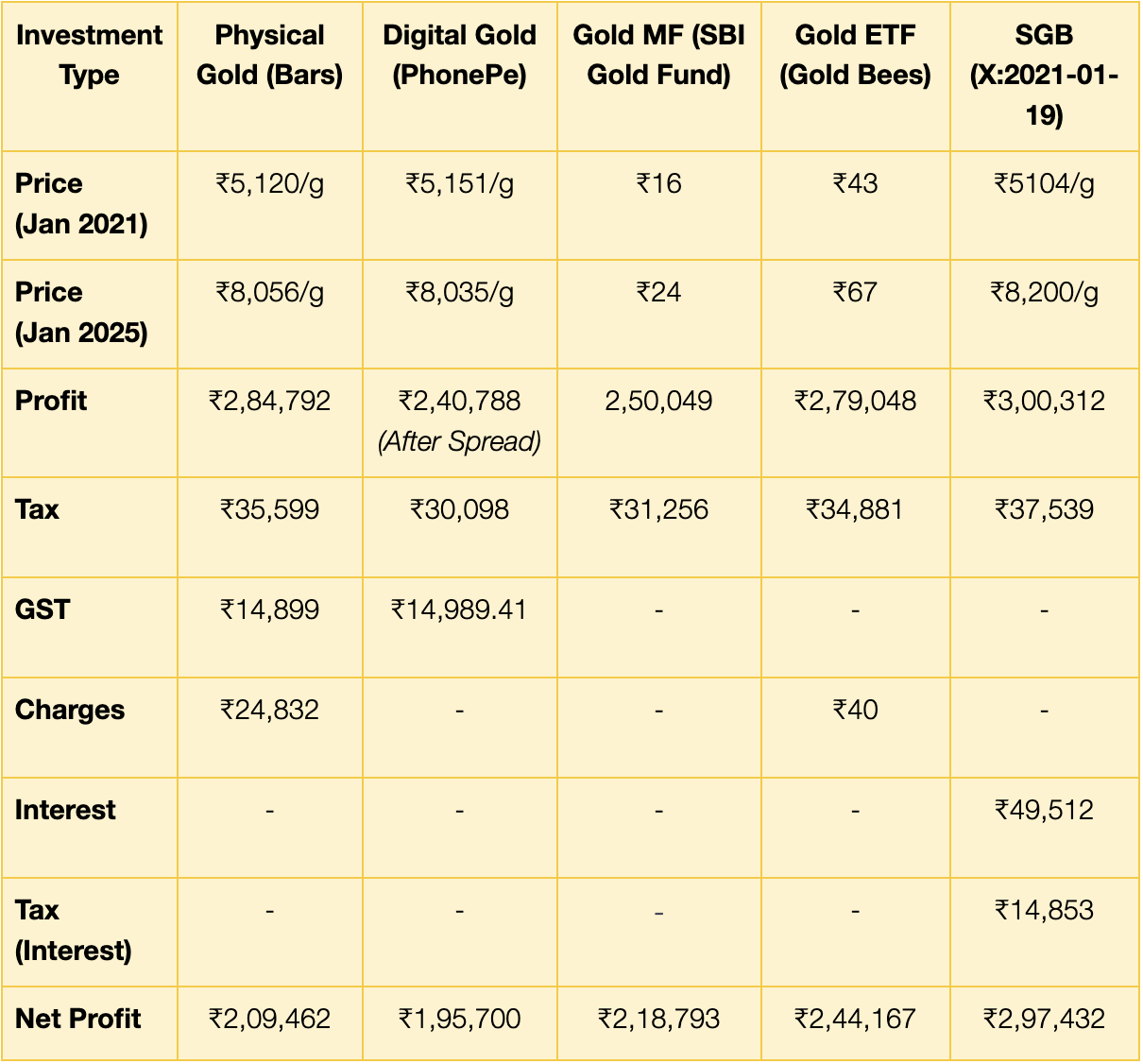

Different Ways to Invest in Gold 🪙 If you invest ₹5 Lakhs for a period of 5 years, what could your ROI look like across different gold investment options? There are commonly 5ways to invest in gold. 🪙 Physical Gold (Jewelry, Coins, Bars) 🪙 Digi

See More

Cards Wala

One stop shop for ev... • 4m

#CRED is offering 1% discount on buying #Gold through them. Everyone wants to offer a way to invest in gold now 😅 Good if you already invest in gold in this way on some other app. Can think of switching. But beware, this is one of the worst possi

See More

Shubham Jain

Partner @ Finshark A... • 1y

Financial Planning for One Client Age :- 34 Salary In Hand :- 1.8L Expenses :- 85-95K ( Including EMI ) Advised him to invest in 60K in Mutual Funds and 20K in Gold Funds . Going to increase SIP by 10% Every Year Amount after 15 Year in MF :-

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)