Back

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

“How Zerodha disrupted stock broking industry ” Disruption Diaries #1 Zerodha was founded by two brothers Nithin and Nikhil Kamath in 2010.Nikhil began his career as a trader at a young age,he faced high brokerage fees,complex processes,outdated trading platform so he decided to start zerodha. Traditional brokers charged a percentage of the trade value as brokerage which made trading less profitable so Kamath implemented a flat fee of Rs 20 per trade for intraday,F&O and offered zero brokerage fees on equity delivery trades. Traditional brokers had hidden charges like maintance, transaction , and other fee which made trading costlier Zerodha maintained a transparent fee structure with no hidden charges, which built trust among customers. Zerodha significantly expanded the retail investor base so other brokers reduced fees and introduced flat fee structures. Zerodha not only disrupted the industry but also transformed how retail investors and traders participate in stock market.

Replies (18)

More like this

Recommendations from Medial

Deepasnhu Chail

Mastering the Game o... • 1y

#11 Zerodha Nithin Kamath launched Zerodha, a discount brokerage firm, in 2010 with just ₹3 lakhs. He and his team worked relentlessly, at times even taking calls at 3 AM to provide customer support. They also created educational content like trad

See More

Siddharth K Nair

Thatmoonemojiguy 🌝 • 8m

Zerodha, one of India’s most inspiring startup stories. Back in 2010, Nithin Kamath started Zerodha from his small room with a simple goal: make stock trading affordable and accessible to everyone. At a time when brokerage fees were high and platfor

See More

Ashish Singh

Finding my self 😶�... • 1y

🤯Founders with Highest salary in India. --⭐Supam Maheshwari (FirstCry) received an annual salary of ₹103.8 crore in FY24. This marks a significant decrease from his ₹200.7 crore salary in FY23. --⭐Nithin Kamath (Zerodha) Co-founder of the broker

See More

Akash Jain

Real Estate Solopren... • 1y

The Story of Zerodha: A Startup That Changed India's Stock Market In 2010, two brothers from Bangalore, Nithin and Nikhil Kamath, saw a major problem in India's stock trading industry. Brokerage firms were charging high fees, making stock trading ex

See MoreNandishwar

Founder @StudyFlames... • 1y

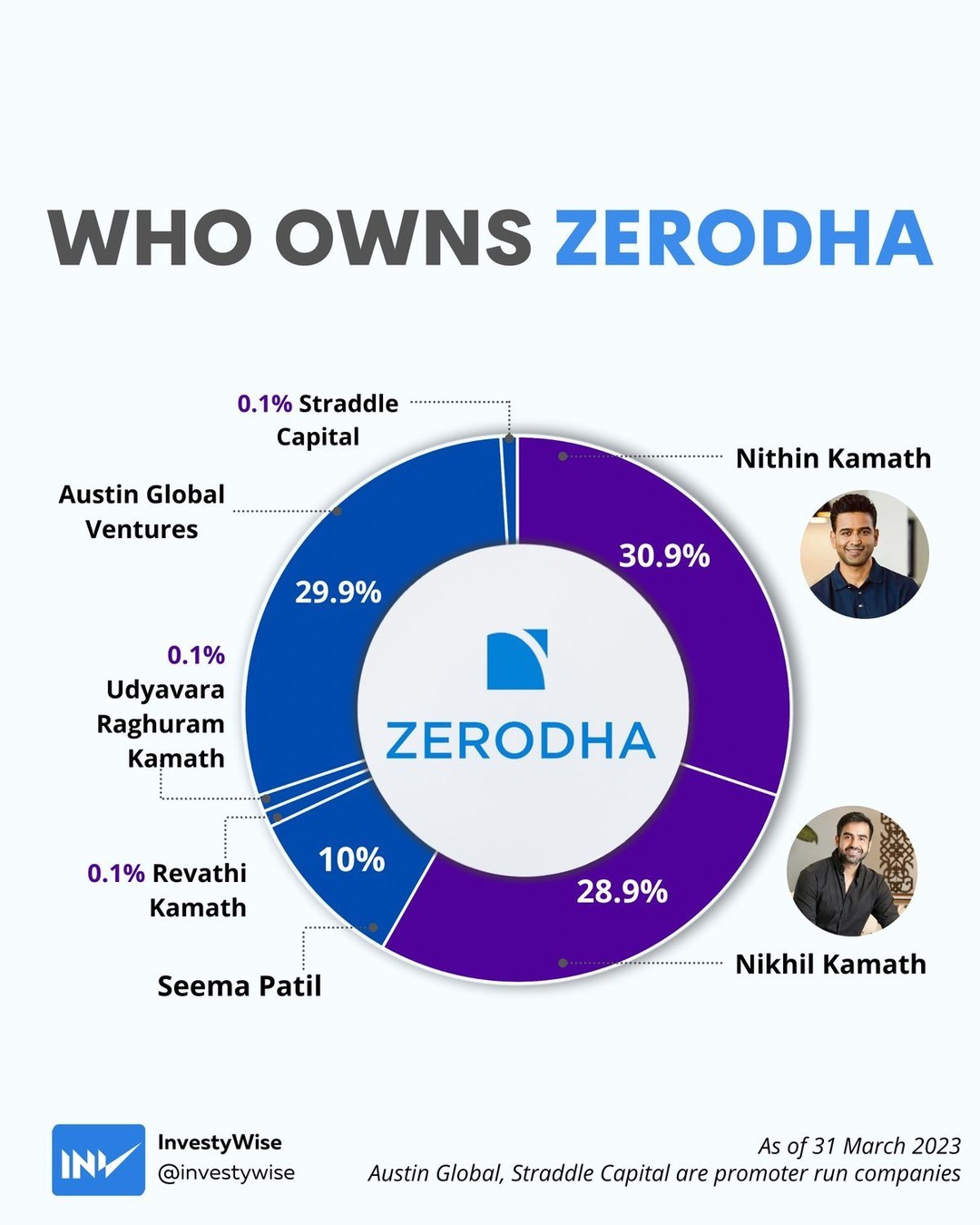

🚀 Who Really Owns Zerodha? The Inside Story! 📊 Zerodha, India's biggest stock brokerage, is 100% owned by its founders & close associates. No VC money, no outside investors—just pure bootstrapped success! 💪 Here's the breakdown of ownership: 🔹

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)