Back

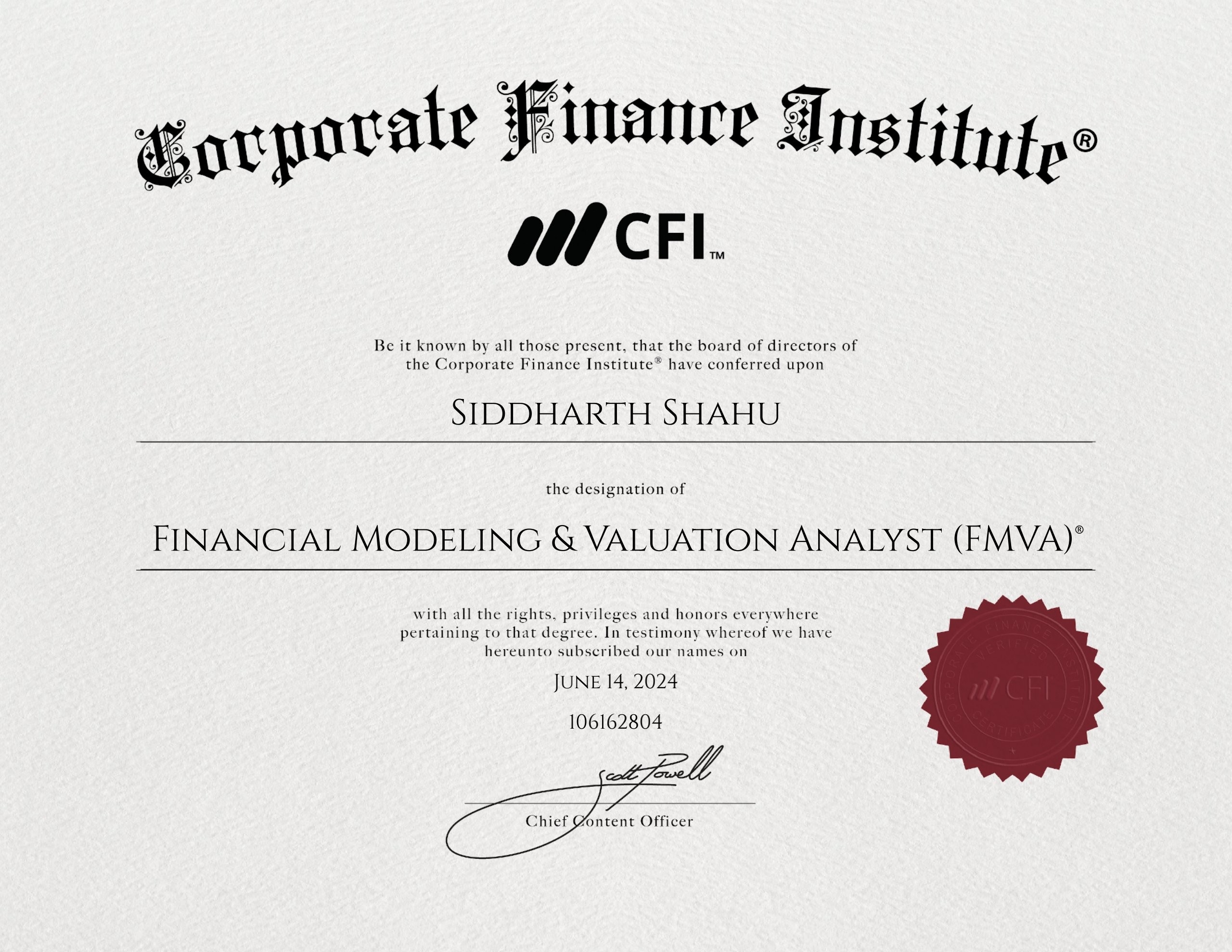

Siddharth Shahu

FMVA • 1y

This comprehensive investment banking program is specifically designed to enhance your expertise in financial analysis, financial modeling, private equity, and mergers and acquisitions. The curriculum is structured to provide a balanced and in-depth understanding of these dynamic fields. To be eligible, you must have a minimum 12th pass qualification and achieve a 70% score on the final exam to receive certification. Having completed this course, I can attest that it has significantly strengthened my analytical and valuation skills, particularly in the context of mergers and acquisitions. It will take approximately 6-8 months.

Replies (1)

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

Day 4 About Basic Finance Concepts Here's Some New Concepts Financial Markets and Institutions Stock Markets: Where shares of publicly traded companies are bought and sold (e.g., New York Stock Exchange) Bond Markets: Markets where debt securitie

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

HSBC Restructures Investment Banking Operations HSBC announced a significant reduction in its investment banking operations, particularly shutting down its Equity Capital Markets and Mergers & Acquisitions advisory businesses in the UK, Europe, and

See More

Abhishek raina

For betterment • 11m

Hello everyone, I am a final-year BBA Financial Investment Analysis student, set to graduate in two months. With experience in equity research, financial modeling, and data analysis, I have worked on investment research, financial modeling, and mark

See MoreSaketh Varma

Hey I am on Medial • 9m

ExcelR's Data Analyst Course provides a robust curriculum designed to equip you with the essential skills for a successful career in data analysis. Dive into key concepts such as data manipulation, statistical analysis, and visualization techniques u

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)