Back

AjayEdupuganti

I like software and ... • 1y

Not exactly, even if u register on say icici, all the proceedings are done by sales guys only. And i dont think, cred and slice doesnt exactly offer new bank credit cards and personal loans from the actual banks. These companies partner with nbfcs and offer at higher interest rates

More like this

Recommendations from Medial

Yash Barnwal

Gareeb Investor • 1y

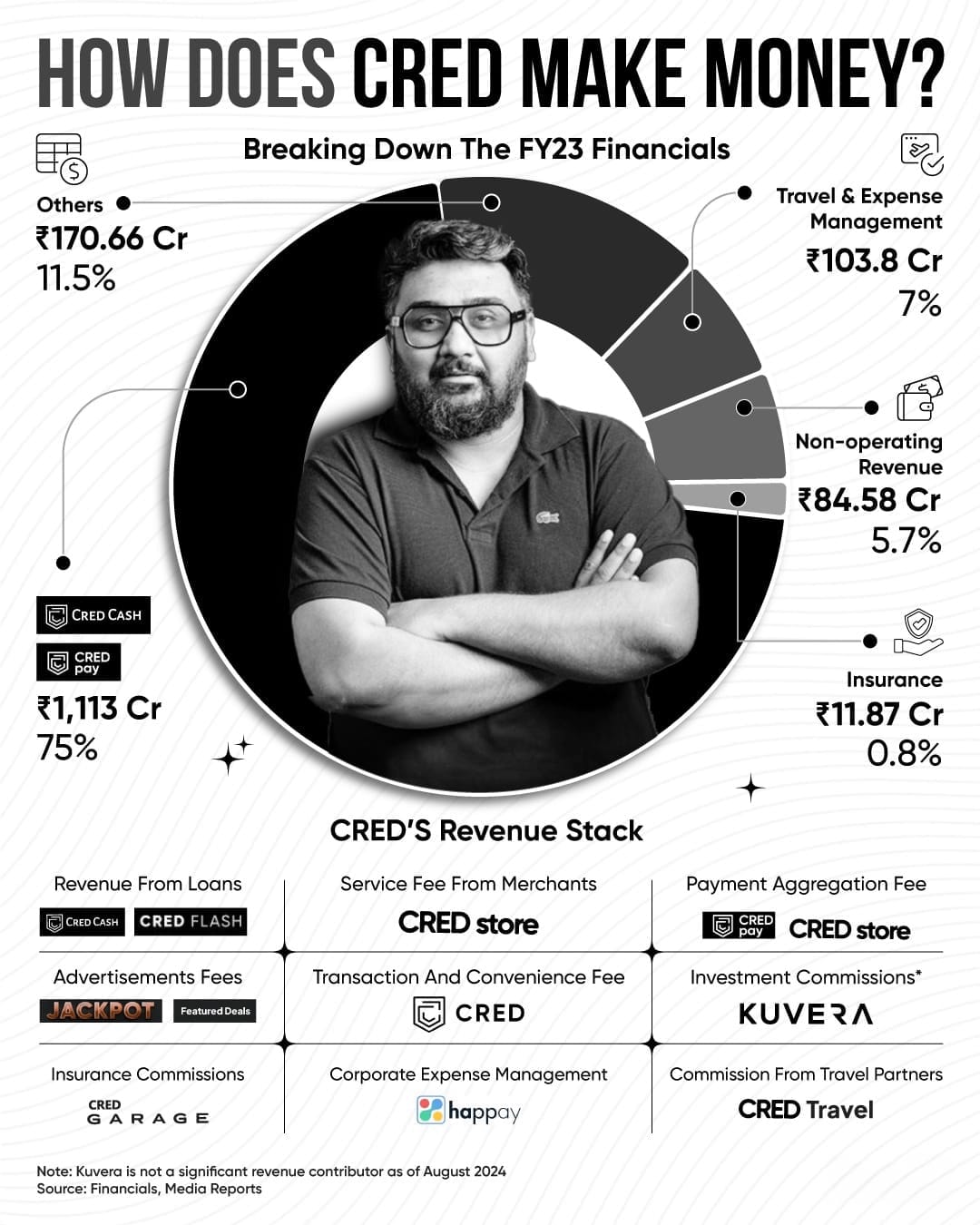

Here's a breakdown of how CRED makes money, based on their FY23 financials. With a significant chunk coming from loans, payments, and travel management, the platform diversifies through advertising fees, insurance, and corporate expense management. T

See More

SARASHI ASSOCIATION

Hey I am on Medial • 11m

Sarashi Association Need help for startup and grow.....My aim is to provide loans to common poor business people at very low interest rates, and much lower than normal banks and finance company like half interest loans, small medical expenses loans

See MoreDownload the medial app to read full posts, comements and news.