Back

Replies (1)

More like this

Recommendations from Medial

Yash Barnwal

Gareeb Investor • 1y

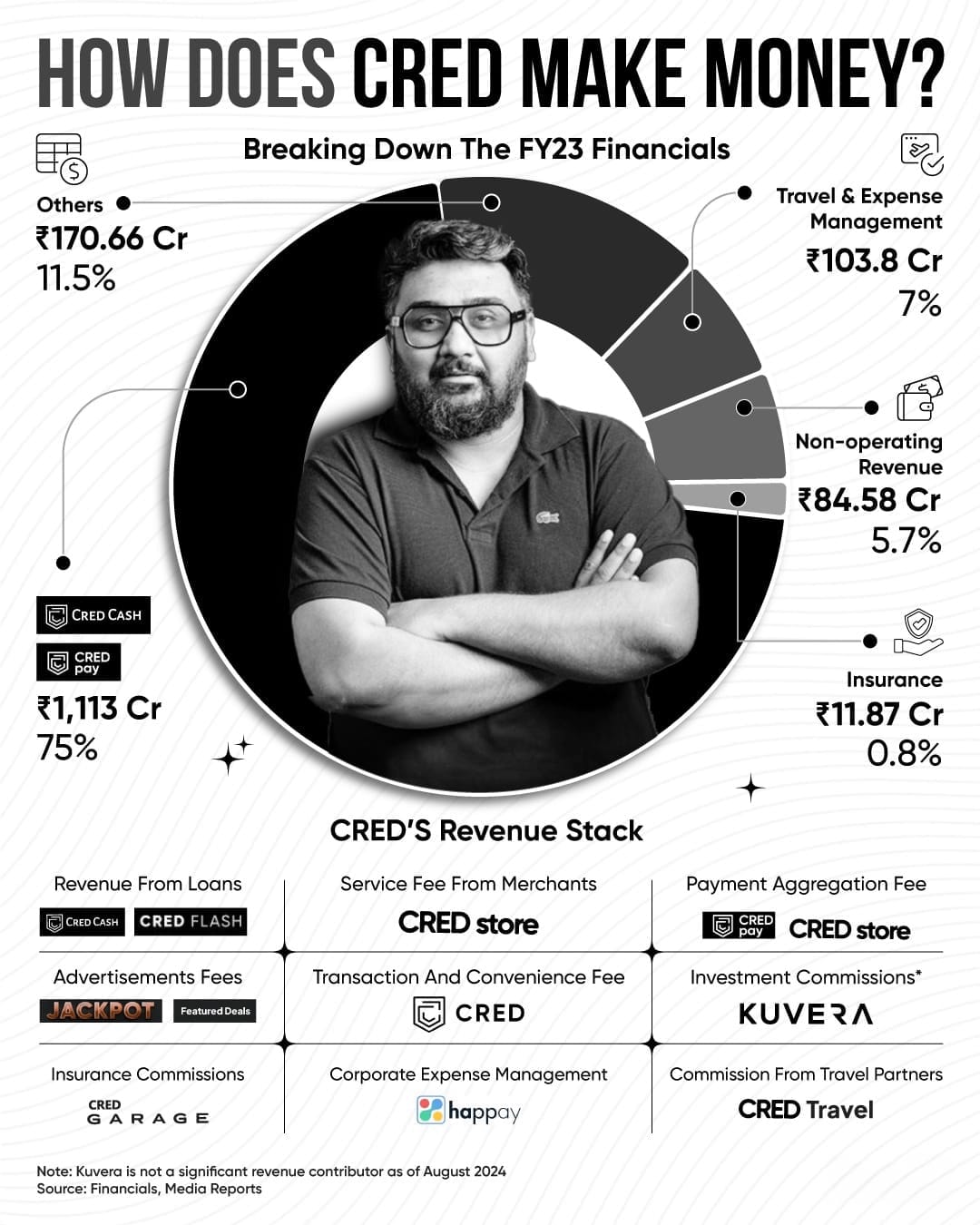

Here's a breakdown of how CRED makes money, based on their FY23 financials. With a significant chunk coming from loans, payments, and travel management, the platform diversifies through advertising fees, insurance, and corporate expense management. T

See More

Rohan Saha

Founder - Burn Inves... • 10m

The Indian government needs to learn something very important from the USA—how to deport illegal immigrants from the country. Nagpur is not a small town; if such incidents happen in places like this, it will definitely hurt the confidence of investor

See MoreAnonymous

Hey I am on Medial • 10m

Hii, this is my first post here on Medial. I'm about to complete BBA FT from a college in Indore and I have secured admission in DY PATIL Pune and Prestige Indore both. I want to know which is a better option given that I'll be taking a loan for any

See MoreSURAJ SHARMA

•

KFin Technologies • 7m

I’m from Sikar and have built my own startup and registered firm. I’ve partnered with multiple banks and NBFCs and secured official DSA codes. If anyone is interested in partnering with me, you’re most welcome! You’ll gain valuable field knowledge, a

See MoreDeepasnhu Chail

Mastering the Game o... • 1y

#9 Motivating examples of startups that displayed incredible hustle and grit to survive their early days DailyHunt (formerly Newshunt) Unable to raise funding for years, DailyHunt's founders operated in survival mode - paying salaries from their p

See More

Chirotpal Das

Building an AI eco-s... • 1y

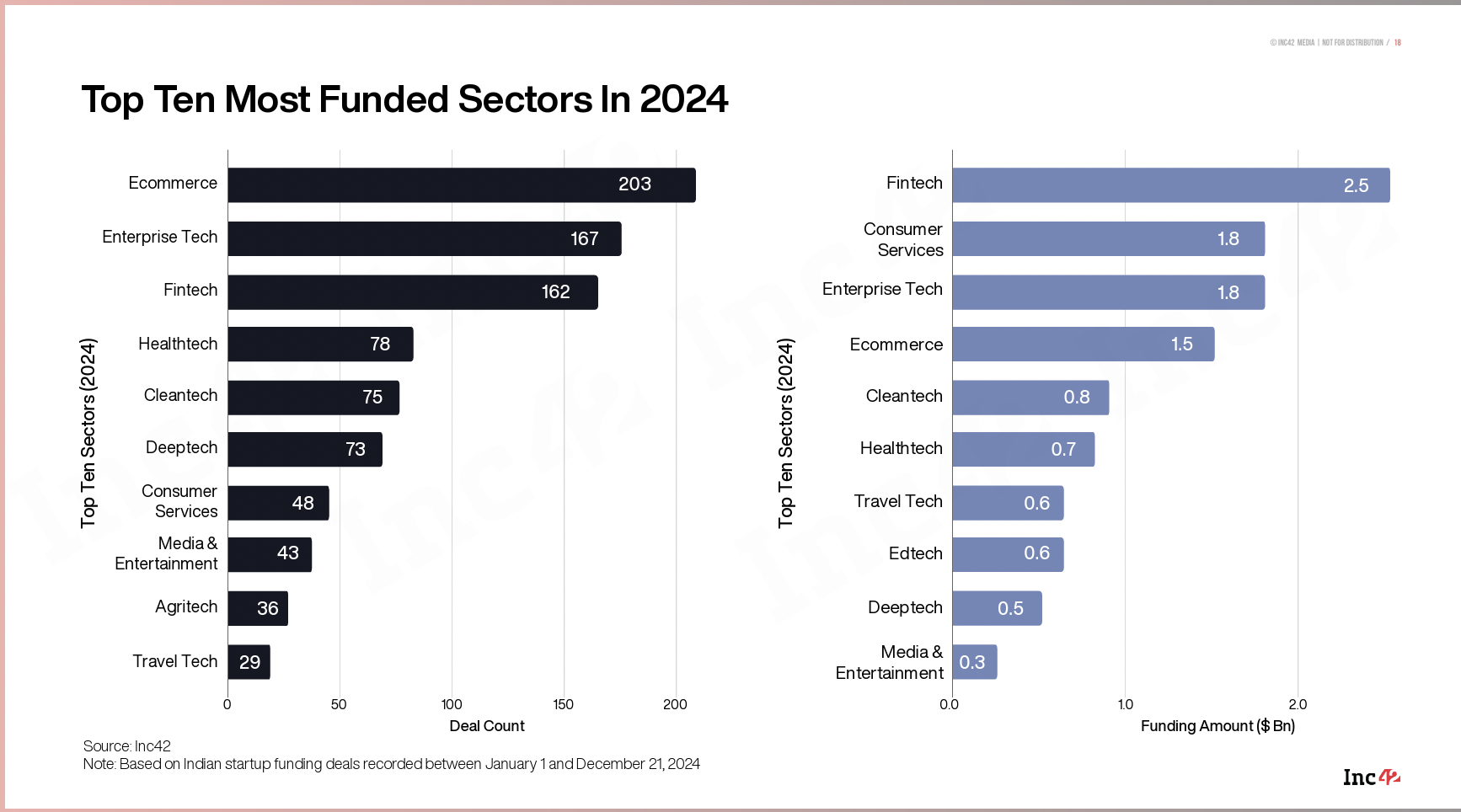

The state of DeepTech funding in India (2024) is miserable and then we ask why can't India build its own foundational model. - Out of all the deals only 7.99% accounts for DeepTech (at 6th position), whereas E-commerce (1st) is at 22%. Enterprise te

See More

Anonymous

Hey I am on Medial • 7m

How do you manage anxiety? When it comes to building a startup or a business especially if you’ve never done it before and come from a humble background where no one is into it, it becomes very difficult to start or even imagine taking a bold step.

See MoreRohan Saha

Founder - Burn Inves... • 8m

We used to think of Moneycontrol as just a regular news portal, but over time, it has transformed itself into a complete finance super app. From loans to stock trading, courses everything is now available in one place. The company is even planning it

See MoreDownload the medial app to read full posts, comements and news.