Back

Anonymous 1

Hey I am on Medial • 1y

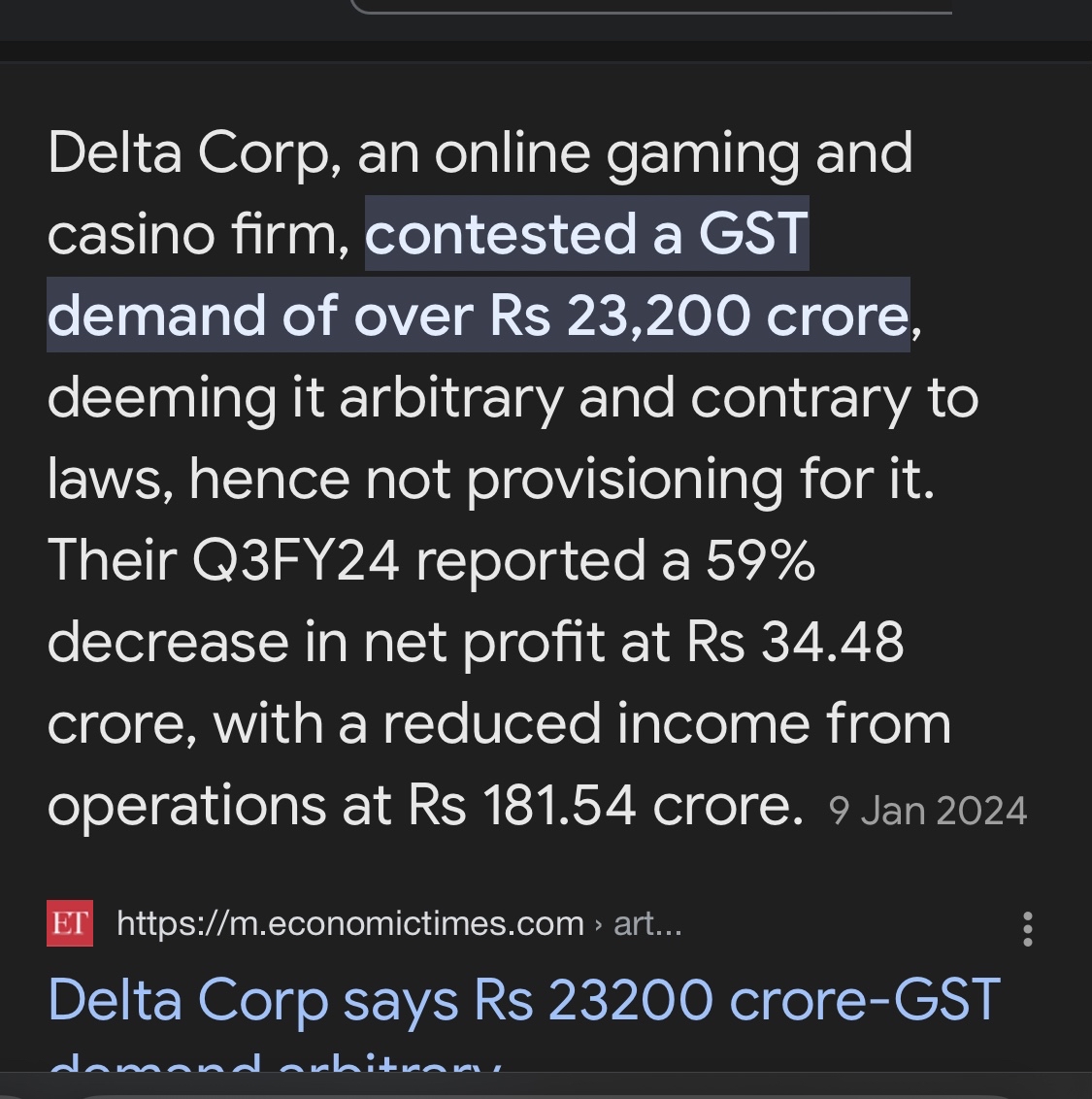

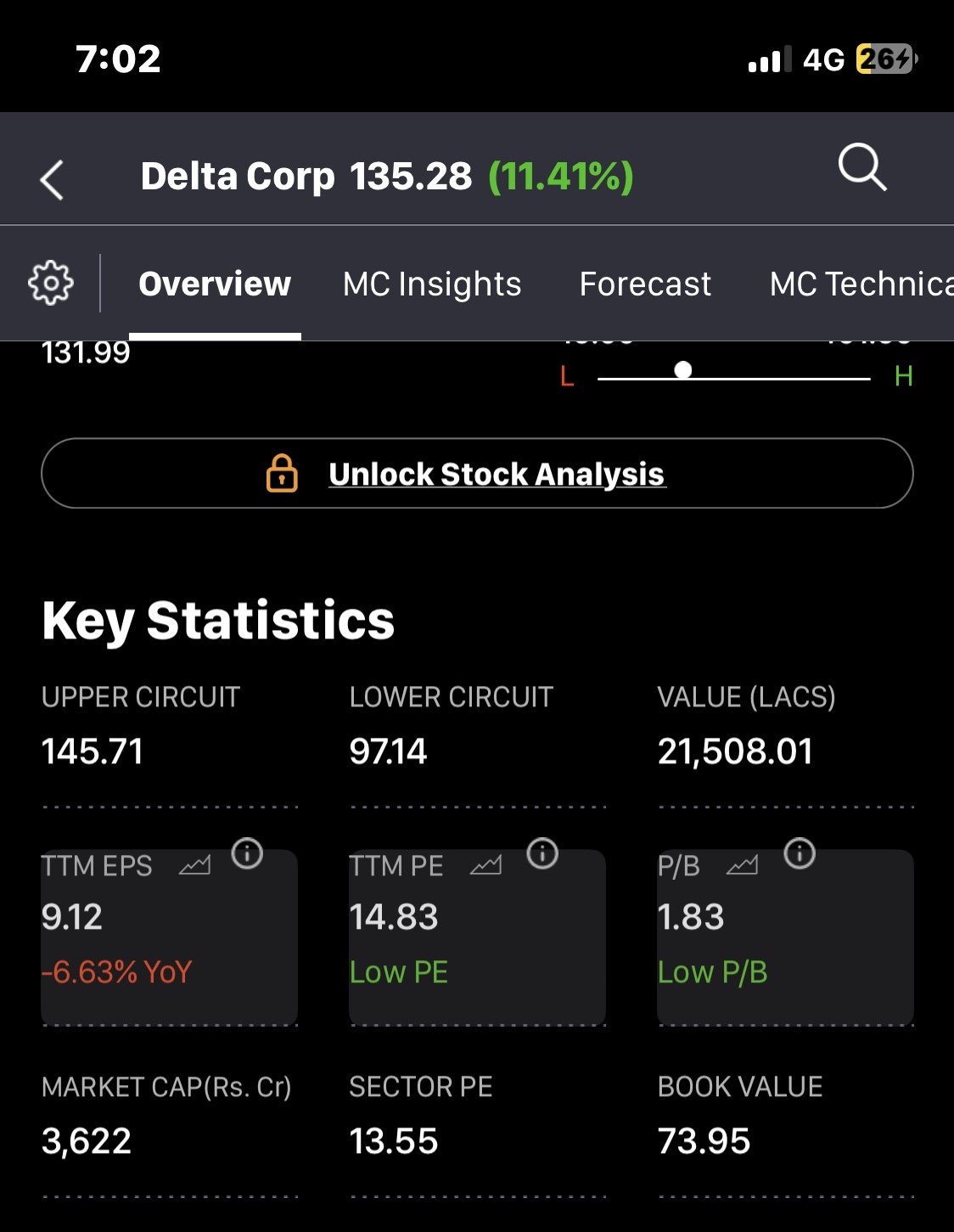

Rs 23,200 crore GST demand on a company with market cap of just Rs 3,600 crore? That seems completely absurd and unfair by the tax authorities. And it's weirdly funny too..dont you think?

1 Reply

1

Replies (1)

More like this

Recommendations from Medial

Shreyas Ramdasi

Mechanical Engineer • 1y

Billionaire businessman Gautam Adani has increased his stake by 1.32% in Adani Enterprises from the open market in April to June quarter, a statement to stock exchanges stated on June 14.Adani Enterprises had reported a consolidated net profit of Rs

See More

Reply

6

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)