Back

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

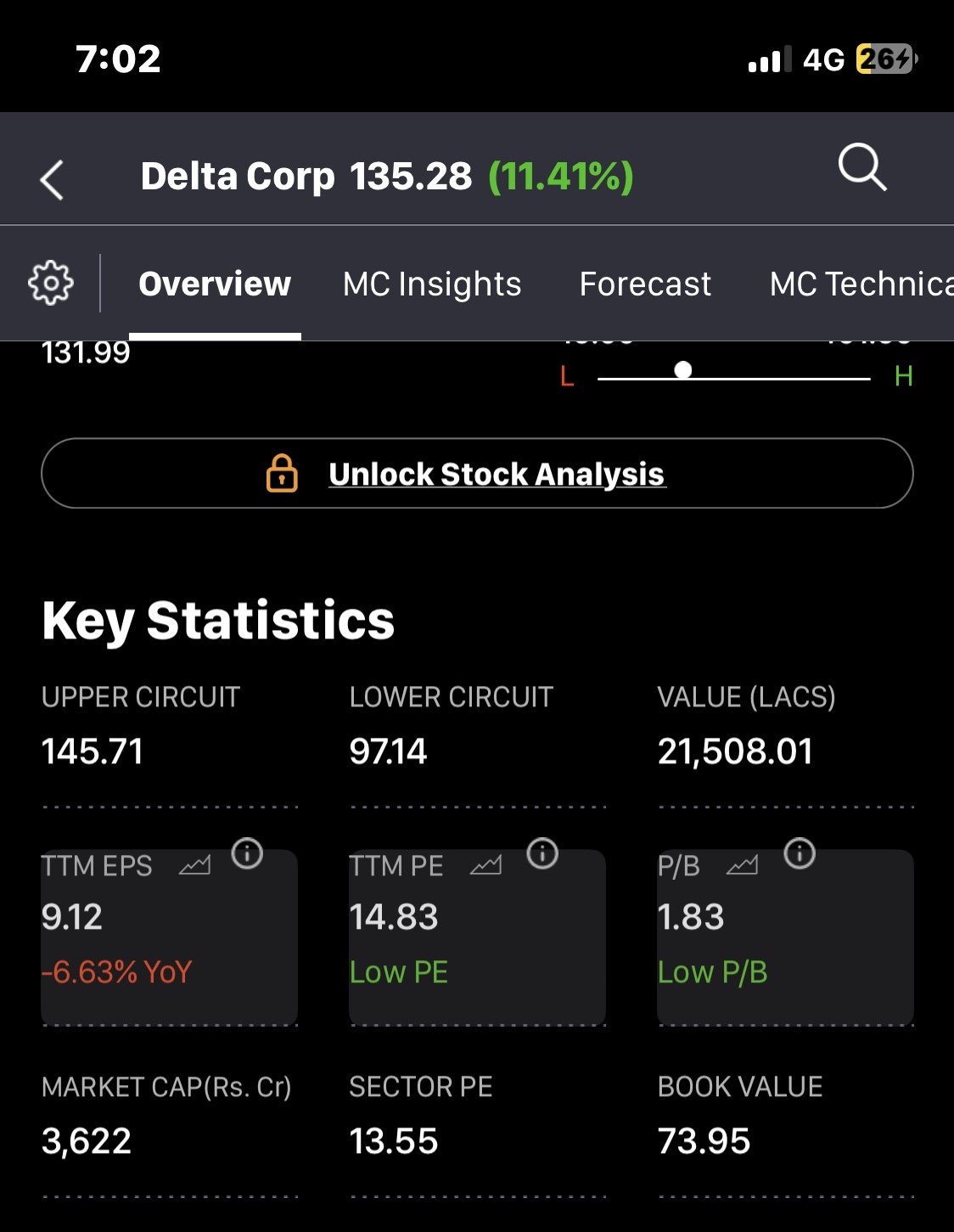

Delta corp is a Casino company their market cap is 3.6k crore but government is demanding 23k crore GST ??

Replies (13)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 10m

Jio Financial Services reported a net profit of ₹316 crore this time, and the company also announced a dividend of 0.5 paise per share. Along with that, the company’s market cap is ₹1,56,609 crore. Honestly, if it were any other company in its place,

See Moregray man

I'm just a normal gu... • 10m

The Finance Ministry has dismissed reports suggesting that the government is considering imposing Goods and Services Tax (GST) on UPI transactions exceeding INR 2,000. In an official statement, the ministry clarified, “The claims that the government

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)