Back

Replies (1)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

People should seriously consider investing in unlisted companies because the potential for massive returns is undeniable. When a private company eventually goes public and performs well, the wealth creation can be staggering. The power of compounding

See MoreAccount Deleted

Hey I am on Medial • 10m

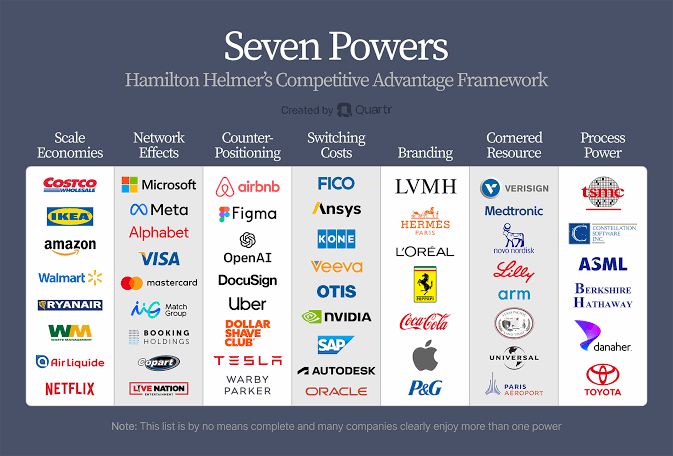

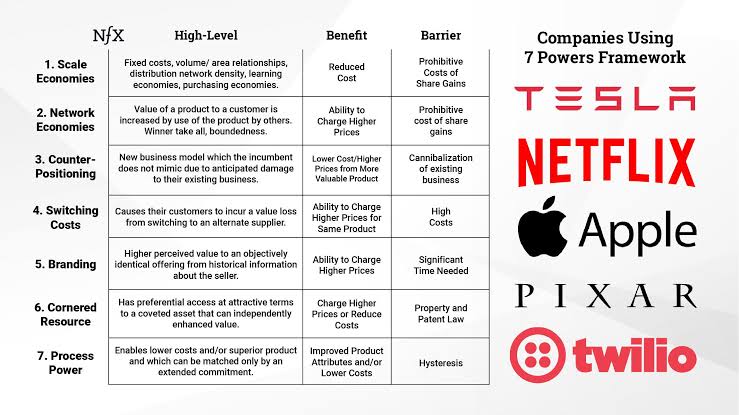

A quick short read one should must explore. Purpose: To build enduring, compounding business value ("Power" = sustainable differential advantage). Few build Power while other chase growth. #Hamilton Helmer breaks it down into 7 defensible advanta

See More

Account Deleted

Hey I am on Medial • 1y

Life really comes into perspective when your friend, who works at a major power transmission company says:- it's easier to sell to VCs, not so much to companies. His boss btw is 65 y/o. Age Anxiety only exists in fast moving industries. Most respe

See MoreNARESH Rathore

Hey I am on Medial • 11m

💡 What if I tell you that you can master financial literacy & wealth building in a gamified way? 🚀 Introducing Financity – India's first AI-powered financial education & money management platform! ✅ All income sources + step-by-step implementatio

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)