Back

Anonymous 4

Hey I am on Medial • 1y

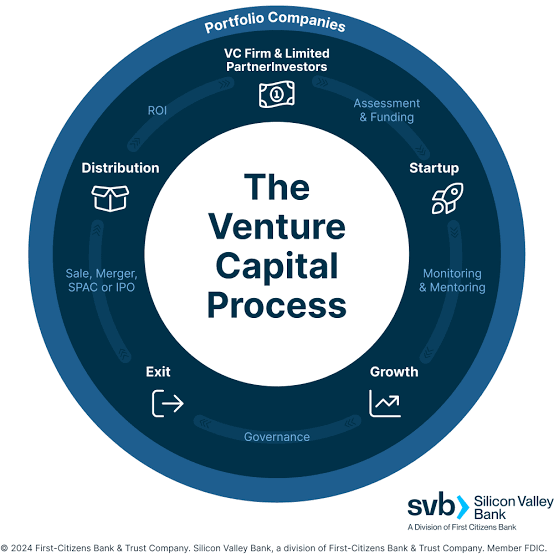

Get ready to answer tough questions about your financials. Investors want to see that you’ve thought about revenue streams, customer acquisition costs, and long-term profitability. And I’ve spoken to a few VCs they don’t feel so safe nowadays without a revenue model.

More like this

Recommendations from Medial

Yash Barnwal

Gareeb Investor • 1y

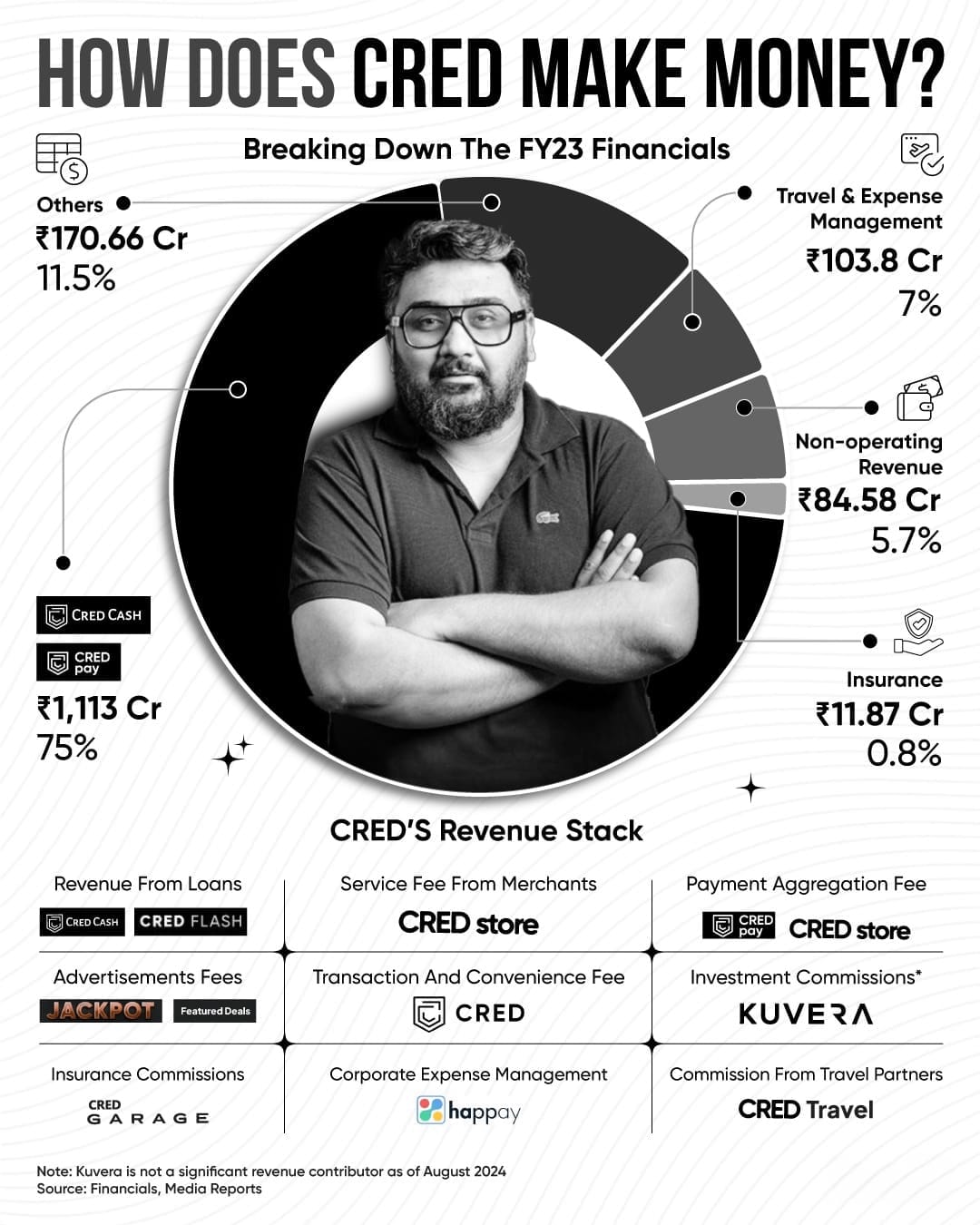

Here's a breakdown of how CRED makes money, based on their FY23 financials. With a significant chunk coming from loans, payments, and travel management, the platform diversifies through advertising fees, insurance, and corporate expense management. T

See More

Rutrank Tandon

Hey I am on Medial • 1y

Can somebody please help me find a company with these specifics : Business : 1. B2B 2. Domiciled in India Or Domiciled in US with ties to India 3. Bootstrapped Financials : 1.Revenue - $10-$30 million 2.Profitability for 3+ years 3. 15%+ growt

See MoreNitin Pratap Singh

Campayn • 5m

Spotify is fascinating. • $13B annual revenue • 574M active users • 226M premium subscribers But here’s the twist: Even with millions of paying users, 57% of Spotify’s revenue comes from subscriptions, while only 13% comes from ads. So, how does a

See More

Akshat kumar Jain

Front end developmen... • 1y

Wow Momo has doubled its revenue every year Founded in 2008, Wow! Momo has become a national phenomenon with over 500 outlets across 25 Indian cities. Let's dive deeper into their impressive FY23 financials Revenue Soars: Total revenue, including

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

For early-stage startups, generating revenue and driving growth trump chasing venture capital (VC) funding. In 2023-2025, VC funding trends underscore this shift. Global VC investment plummeted from $381B in 2022 to $221B in 2023, with 2024 seeing on

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Got a great product, team, and traction but VCs are still passing?here are 6 common reasons: * Market Size Too Small: Your concept's proven, but is the total addressable market large enough for VC-level returns (10x+)? VCs seek massive scale, not ju

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)