Back

Vishwa

Be Happy, be humble • 2m

Hi everyone, We’re an early-stage FinTech startup with live product, paying customers, and growing revenue. Currently raising capital to scale product development, partnerships, and customer acquisition. Highlights: Early revenue & strong user traction Clear problem–solution fit Scalable business model Looking to connect with angel investors, VCs, and strategic partners interested in FinTech innovation.

More like this

Recommendations from Medial

Amit Kumr Goel

Business Consultant ... • 11m

An accomplished Business Consultant & Strategic Advisor with nearly 30 years of experience in financial inclusion, e-commerce, payments, and FMCG sectors. Known for developing scalable B2B fintech platforms, driving merchant acquisition, and building

See MoreAanya Vashishtha

Drafting Airtight Ag... • 10m

Angel Investors vs. VCs: Who’s the Better Bet for Your Startup? Choosing between angel investors and VCs? Early branding gives founders a killer edge. Angels want passion and hustle—your authentic story online hooks them fast. VCs dig data and

See MoreMANAV VITHANI

ROBOTICS AND AUTOMAT... • 8m

At VendoChronic, we’ve built our first customized smart vending machine – VendoChronic 1.0. But here’s the truth👇 💡 Hardware needs capital first, traction comes later. 💸 VCs wait for traction. 🕒 Govt grants take 6+ months. 🔧 We’re building from

See Morebrijesh Patel

Founder | Venture Pa... • 3m

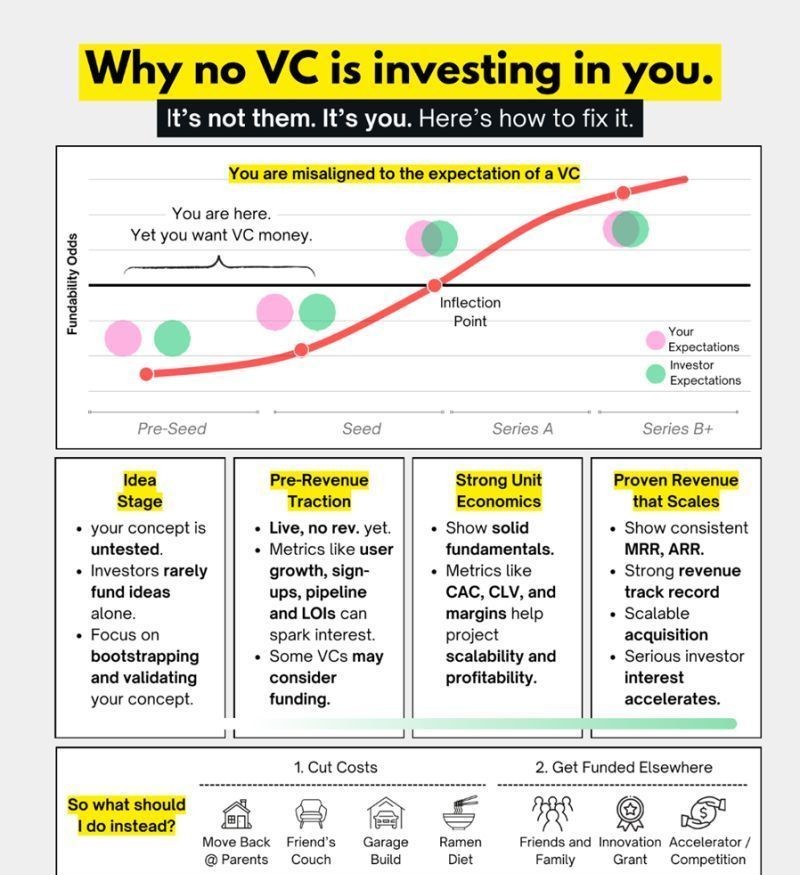

🚫 Why No VC Is Investing in You (Yet) Let’s be honest — it’s rarely the VC. It’s the mismatch between where your startup is and what VCs expect. This visual explains it perfectly 👇 Most founders think they’re “ready for funding.” But their expec

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Crucial KPIs for founders, from inception to exit: Pre-Seed: Validate your idea! Focus on Problem-Solution Fit (qualitative user interviews, early sign-ups). Seed: Prove initial traction. Track Customer Acquisition Cost (CAC), Conversion Rates, and

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)