Back

More like this

Recommendations from Medial

Aatif dehalvi

Hey I am on Medial • 11m

Business Idea: Enabling Credit Card Discounts and Cashback for Non-Credit Card Users In today’s digital shopping era, e-commerce platforms like Flipkart, Amazon, and others frequently offer discounts and cashback deals, especially for customers using

See MorePVSN RAJU

Start Small Dream Bi... • 1y

We are a fintech startup based out of Bangalore. Our idea is to give a genuine income earning opportunity to people. We will give our Website and CRM free of cost to interested persons to process loans,sell credit cards,insurance etc on a commission

See MoreBharat Yadav

Betterment, Harmony ... • 1y

Key Financial Considerations for Medical Professionals 1 . Debt Management: Strategize student loan repayment, credit cards, and personal loans. 2. Retirement Planning: Maximize tax-advantaged accounts (401(k), IRA). 3. Investments: Diversify portfol

See MoreRohan Saha

Founder - Burn Inves... • 10m

Flipkart's Super Money app introduced the Super Card a few months back. It's a pretty handy option basically, you can get a credit card by just creating a fixed deposit (FD), no need for a strong credit history. So if you're looking to build your cre

See MoreYash Barnwal

Gareeb Investor • 1y

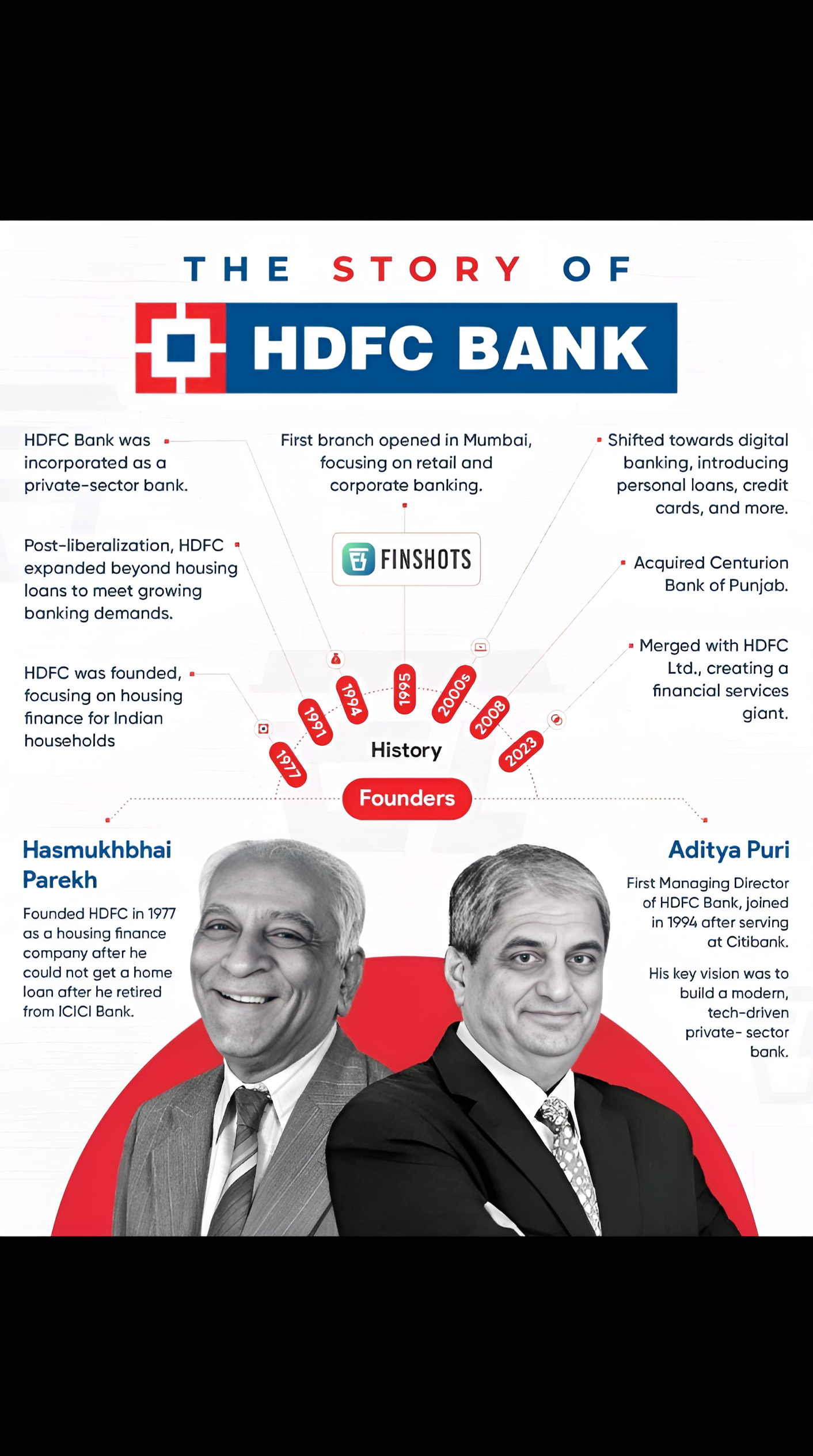

🏦 The Story of HDFC Bank 📈 Founded by Hasmukhbhai Parekh in 1977, HDFC Bank started as a housing finance company and grew into a leading private-sector bank. Under the leadership of Aditya Puri, who joined in 1994, the bank expanded into retail and

See More

Account Deleted

Hey I am on Medial • 1y

Introducing Sahith Fintech SFI Pvt: Revolutionizing Merchant Finance Why We Started The Unorganized Sector In India, many merchants struggle with: Access to Credit: Traditional banking systems often have stringent requirements, making it difficult

See More

Bhavya luthra

obsessed with why an... • 1y

Budget 2025 – A Win for the Middle Class, But What About Businesses? 🤔 Here's what caught my eye: ✅ More spending power for consumers – Zero tax up to ₹12 lakh means a cash boost for the middle class. Great for businesses targeting this segment! �

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)