Back

Saathvi SN

Attended Mangalore U... • 1y

Hmm! Most probably credit co operative society, private investment banks and local capital venture! Fastercapital, townbank, investmentnetwork etc!

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

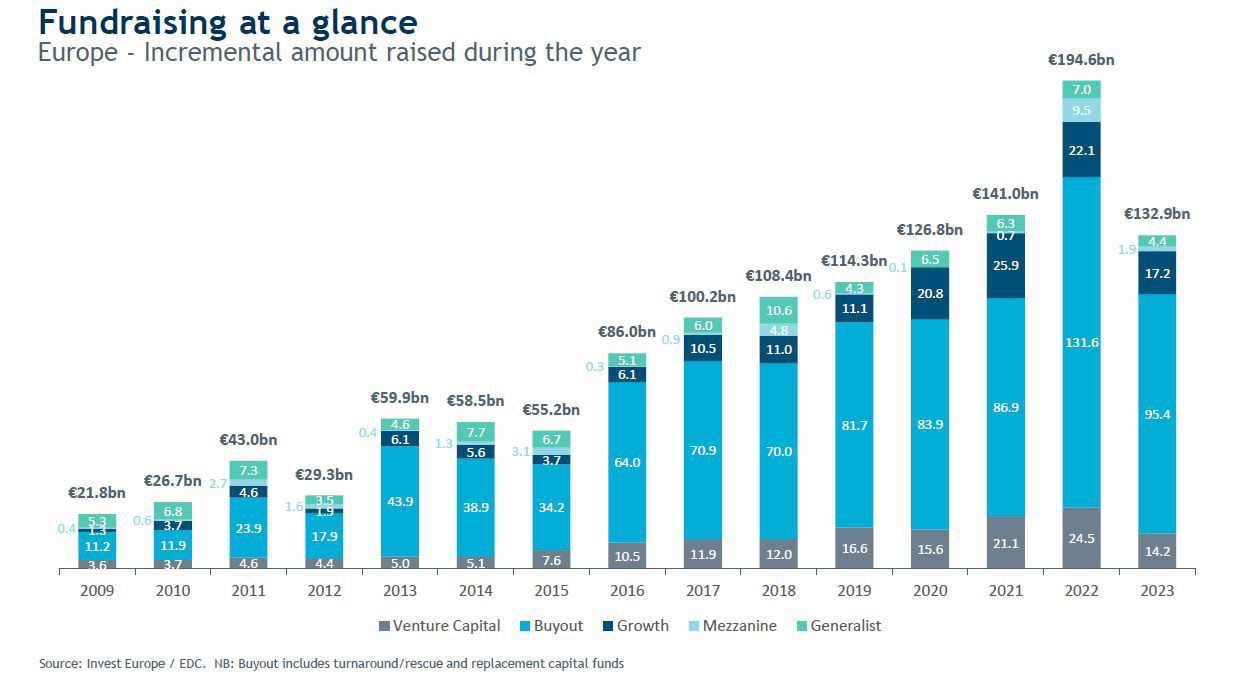

The global startup credit market is rapidly evolving beyond traditional VC. In Q4 2024, VC funding hit $120B (4,000 deals), with AI leading. Venture debt surged 46% to $83.4B, now 20–30% of total VC in US/Europe, offering non-dilutive capital for CAP

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Why Private Funding is a Tougher Nut to Crack Than a Bank Loan Often, private funding proves harder to get than a traditional bank loan. Banks are risk-averse and highly regulated, relying on excellent credit, established history, and collateral. Thi

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)