Back

Anonymous 4

Hey I am on Medial • 1y

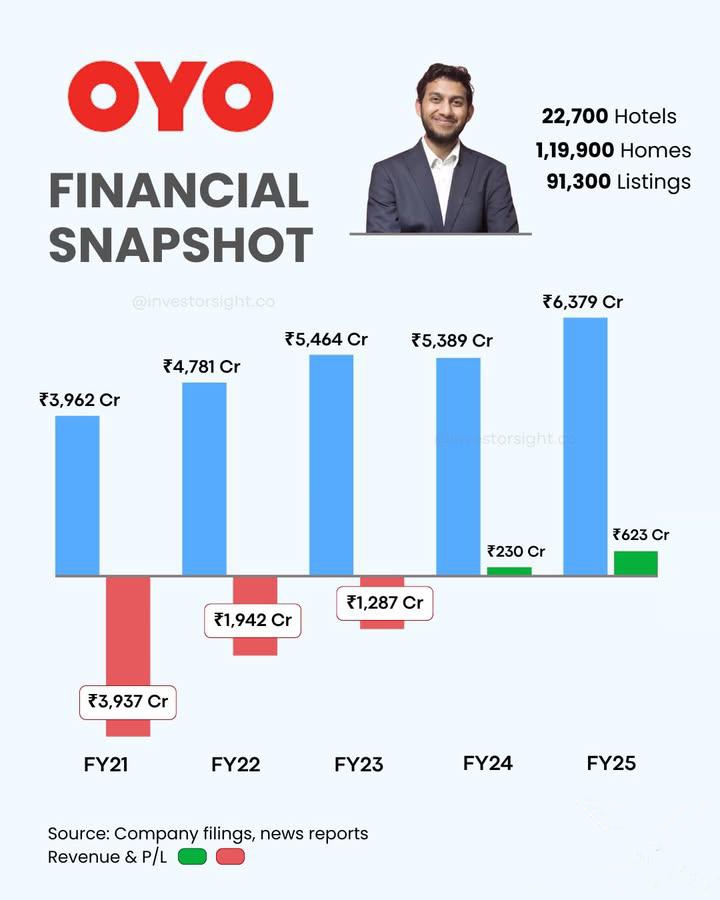

It's great to see a tech company like Oyo focusing on profitability. The prepayment of $200 million of its term loan is a strong indicator of financial health. If they can maintain this trajectory, their IPO could be very successful.

Replies (1)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 1m

About 200 Companies are either Approved or in the Pipeline for the IPO✨ ✅ About ₹2.5 Lakh Crore Potential Fundraise! ✅ Here are some Awaited Big Sized IPOs for 2026: 👉 Reliance Jio IPO - Expected by to be India's Biggest Ever IPO (₹40,000 Cr+)

See More

Siddharth K Nair

Thatmoonemojiguy 🌝 • 9m

OYO Gears Up for IPO (Again) Third time’s the charm? OYO is officially back in IPO mode with bigger ambitions and better numbers. 🧾 Here’s the lowdown: • Filing its DRHP between Aug–Sept 2025 • Targeting a $6B–$7B valuation • Expected IPO window:

See More

Kishan Kabra

Founder & CEO • 1y

What's the reason behind of OYO valuation crash? They were struggling to get approval from SEBI for IPO back in 2021, Finally got a approval but they withdrew their application and looking to raise from private investors at $2.3 Billion which was $9

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)