Back

PRATHAM

•

BeatStars • 1y

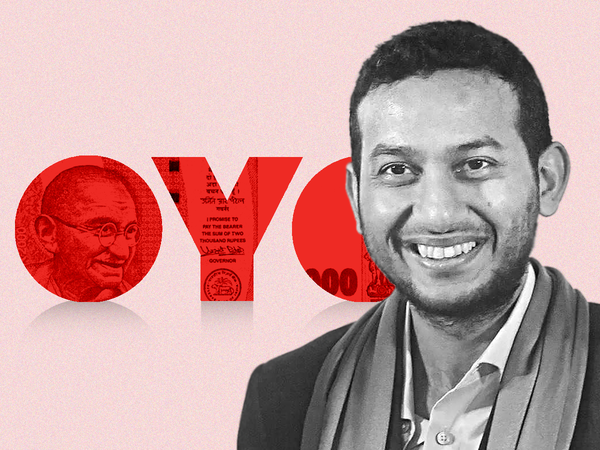

Oyo’s Strategic Moves: IPO Acceleration ‼️ Oyo is a global travel-tech company that provides affordable rooms through its network of budget hotels, homes, etc Recently, senior executives and lead bankers met with SEBI to discuss business performance and maybe some talks related to IPO. Oyo reported milestone, with a Profit After Tax (PAT) of ₹30 crore in Q3 FY24, doubling from the previous quarter. Additionally, Oyo made a prepayment of $200 million of its outstanding term loan B. CEO Ritesh Agarwal expressed optimism about sustained profit growth, highlighting Oyo’s first profitable quarter in Q2 FY24 with a PAT of ₹16 crore. The company also achieved EBITDA of ₹750 crore in FY23 and is aiming for ₹1,000 crore in FY24. These developments, coupled with favorable market conditions, have positioned Oyo well for its IPO, initially filed in 2021 but now expedited for approval. The company’s strategic financial consistent profitability indicates a strong future growth.

Replies (13)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 9m

Eternal, led by Deepinder Goyal, reported a steep 77.8% decline in its consolidated profit after tax (PAT), which dropped to INR 39 crore in Q4 FY25 from INR 175 crore in the same quarter last year. The sharp fall in profits comes despite strong reve

See More

gray man

I'm just a normal gu... • 11m

OYO is on track to achieve an EBITDA of ₹1,550 crore in FY25, up from its earlier target of ₹1,200 crore, founder Ritesh Agarwal announced at TiEcon Mumbai 2025. The increase is driven by OYO’s $525 million acquisition of U.S.-based G6 Hospitality,

See More

Vikas Acharya

Building Reviv | Ent... • 11m

Oyo estimates Rs 1,100 crore PAT for FY26: Founder Ritesh Agarwal Travel tech unicorn OYO estimates its profit after tax to touch Rs 1,100 crore in the next financial year 2025-26, according to projections shared by Founder Ritesh Agarwal with the c

See More

Ashish Singh

Finding my self 😶�... • 1y

🤯Founders with Highest salary in India. --⭐Supam Maheshwari (FirstCry) received an annual salary of ₹103.8 crore in FY24. This marks a significant decrease from his ₹200.7 crore salary in FY23. --⭐Nithin Kamath (Zerodha) Co-founder of the broker

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)