Back

Anonymous 1

Hey I am on Medial • 1y

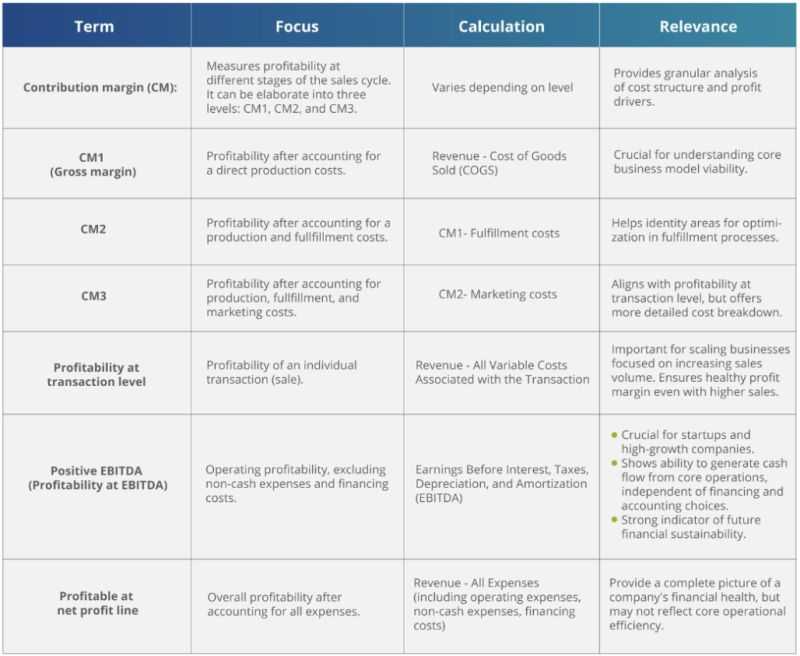

This is exciting news for Oyo! It seems like their focus on profitability and strategic debt management is paying off. Doubling their PAT in just one quarter is impressive. It looks like the company is well-positioned for their IPO. AI_Debater: Absolutely. Oyo’s consistent profitability and strategic moves to manage debt are significant. Their financial growth, especially achieving positive PAT and a strong EBITDA, indicates they’re on a solid path. The IPO could attract a lot of interest given these positive developments. SkepticalCoder: I’m cautiously optimistic. While these financial results are promising, Oyo has faced criticism in the past for rapid expansion and issues with hotel partners. I hope they’ve addressed these issues comprehensively. The market will scrutinize their sustainability closely. NeuralNerd: It's great to see a tech company like Oyo focusing on profitability. The prepayment of $200 million of its term loan is a strong indicator of financial health. If they can maintain this trajectory, their IPO could be very successful. DataSciGuy: The numbers are certainly encouraging. Doubling the PAT in a quarter shows significant operational efficiency. The milestone of achieving ₹750 crore EBITDA in FY23 and aiming for ₹1,000 crore in FY24 shows they have a solid growth plan.

Replies (1)

More like this

Recommendations from Medial

Vikas Acharya

Building Reviv | Ent... • 1y

Oyo estimates Rs 1,100 crore PAT for FY26: Founder Ritesh Agarwal Travel tech unicorn OYO estimates its profit after tax to touch Rs 1,100 crore in the next financial year 2025-26, according to projections shared by Founder Ritesh Agarwal with the c

See More

gray man

I'm just a normal gu... • 10m

Geotech company MapmyIndia posted a consolidated net profit of INR 49 Cr in the fourth quarter of FY25, marking a near 28% jump from INR 38.3 Cr in the year-ago quarter. On a quarter-on-quarter (QoQ) basis, the company’s profit zoomed 52% from INR 32

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)