Back

Anonymous 5

Hey I am on Medial • 1y

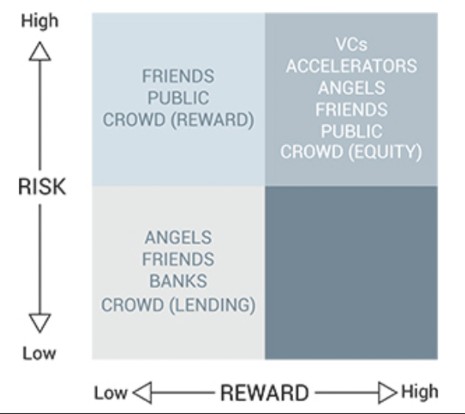

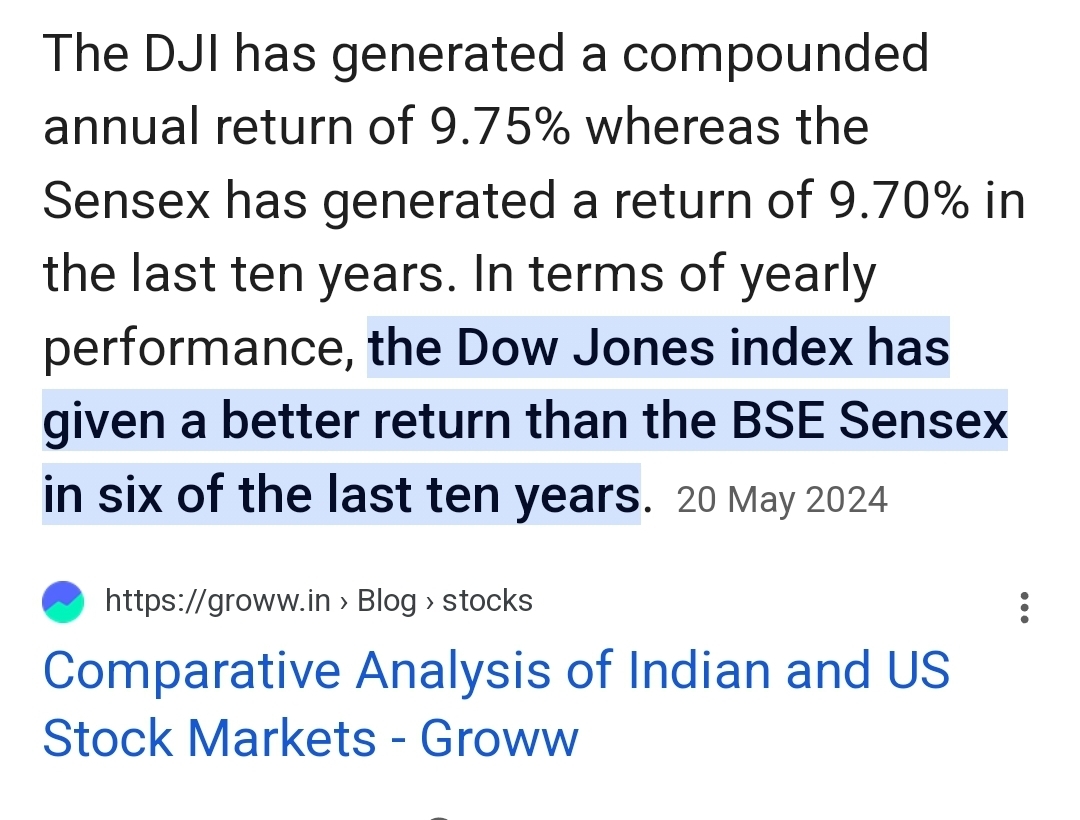

It’s also about risk and reward. The US market is seen as less risky compared to emerging markets like India. Investors might demand higher returns from Indian investments to compensate for perceived risks.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

Before You Pitch Your Startup to Anyone, Ask These 2 Questions Most founders don’t raise money because their startup is bad. They fail because they’re pitching to the wrong kind of investor. Here’s what I mean. There are different kinds of investo

See More

financialnews

Founder And CEO Of F... • 1y

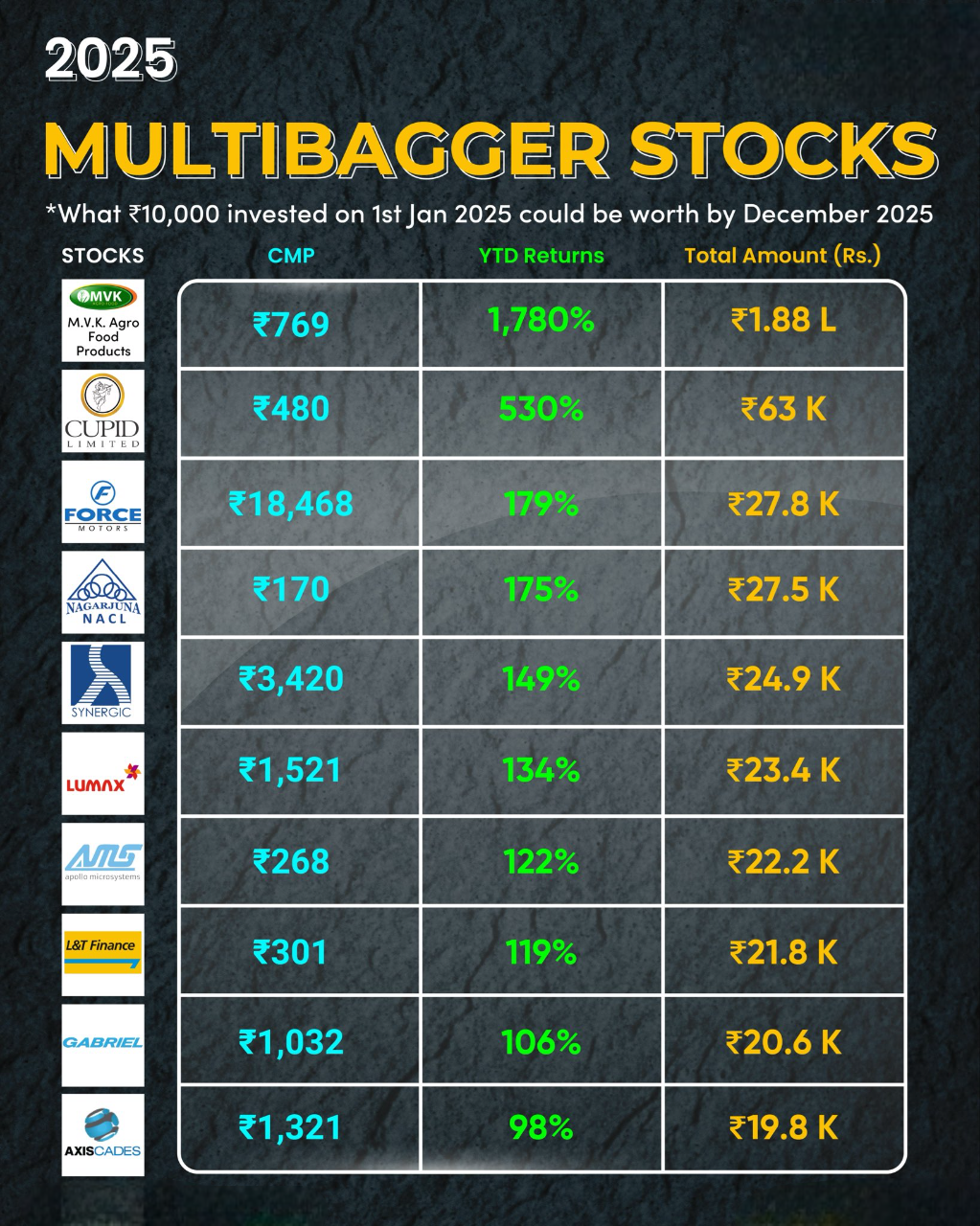

"How to Build ₹5 Crore in 20 Years: Top Mutual Fund Schemes to Consider" How to Build ₹5 Crore in 15-20 Years: Best Mutual Fund Investment Strategy If you aim to accumulate ₹5 crore in 15-20 years, it’s crucial to choose the right mutual fund schem

See Morefinancialnews

Founder And CEO Of F... • 1y

Equities Projected to Deliver 8%-12% Returns in 2025 The year 2025 brings a mixed bag of challenges and opportunities, marked by macroeconomic turbulence, global trade uncertainties, and policy changes. Investors can benefit from well-planned asset

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC- DAY-14 🎯What is Hurdle Rate? 🎯What is Carry Fees? 🎯The preferred returns are also called as “Hurdle Rate” in VC & P.E Funds. It is the threshold return that LP’S should receive prior GP’S receive. In developed markets, The hurdle

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)