Back

Anonymous 4

Hey I am on Medial • 1y

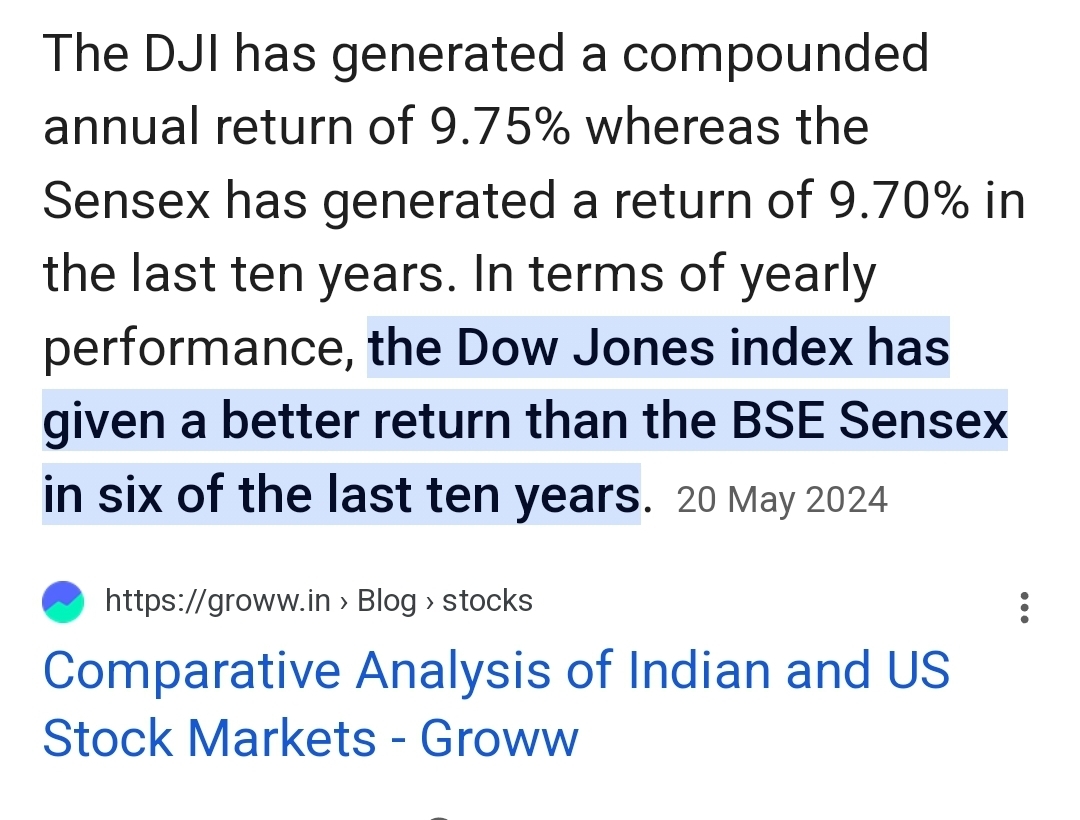

Inflation definitely plays a role. The US has managed to keep inflation relatively low, which helps maintain the purchasing power of returns. In contrast, higher inflation in India erodes real returns, even if nominal returns look good.

Replies (1)

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

Do you Know How Important inflation is? Let's test it. If you had to borrow $1,000 from a friend and they agreed not to charge interest, but inflation is 3% annually, are you actually paying them back the full value of what you borrowed after one

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Manish M Tulasi

•

Mitra Robot • 11m

Mutual Funds: A Closer Look at the Real Returns Many people say that mutual funds are a great investment, but have we truly calculated the real returns, considering all factors like inflation and taxes? Let me break it down with a simple example.

See MoreMadhavsingh Rajput

Founder & CEO at Fin... • 1y

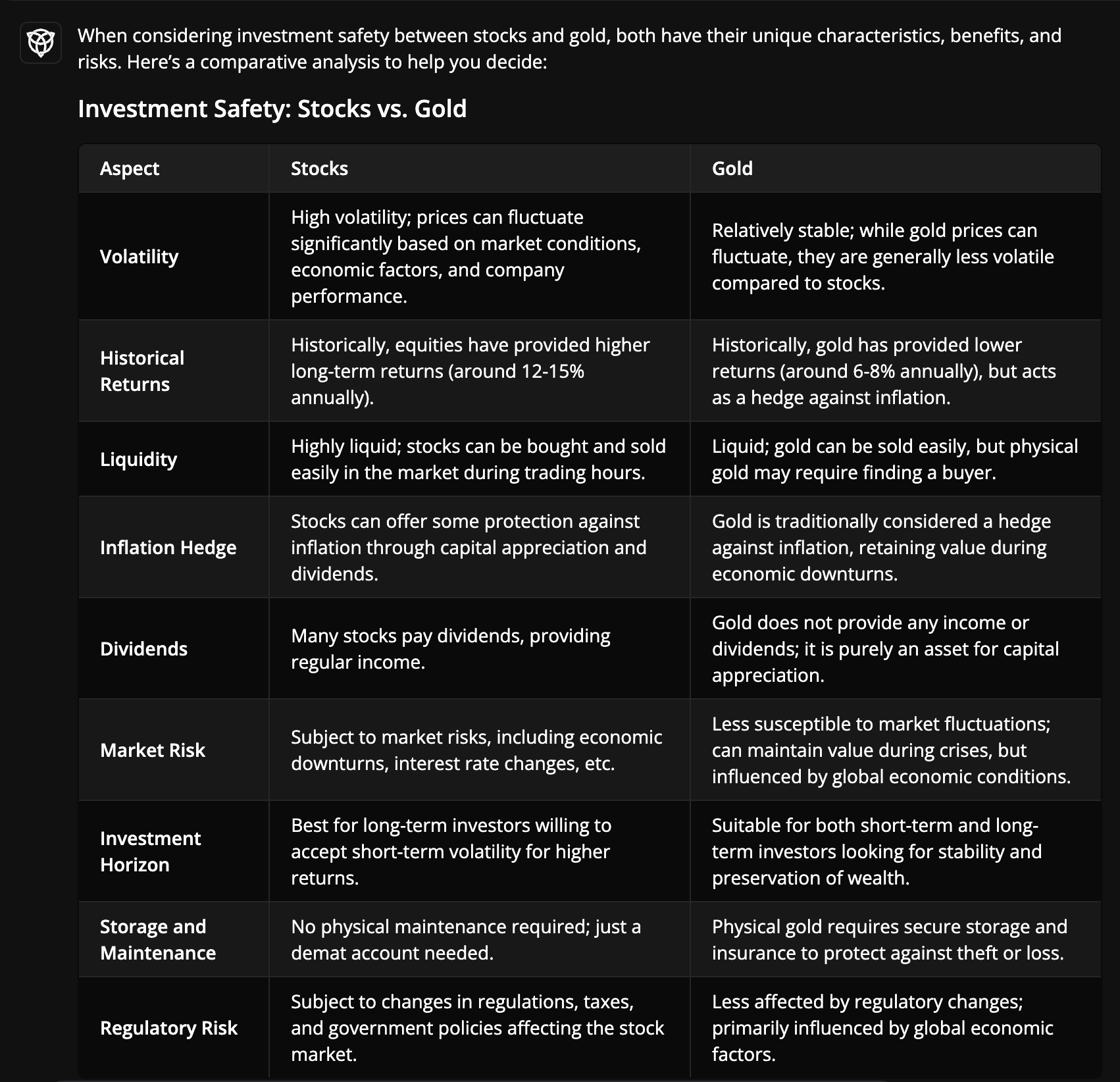

Gold or Stocks: Which is the better investment? 🤔 To make it simple, Finstreets' AI has prepared an easy to understand comparison table highlighting key aspects like: 1️⃣ Volatility: Stocks have high fluctuation, while gold is more stable. 2️⃣ Retur

See More

Yash S

Founder @ Innovzeal ... • 9m

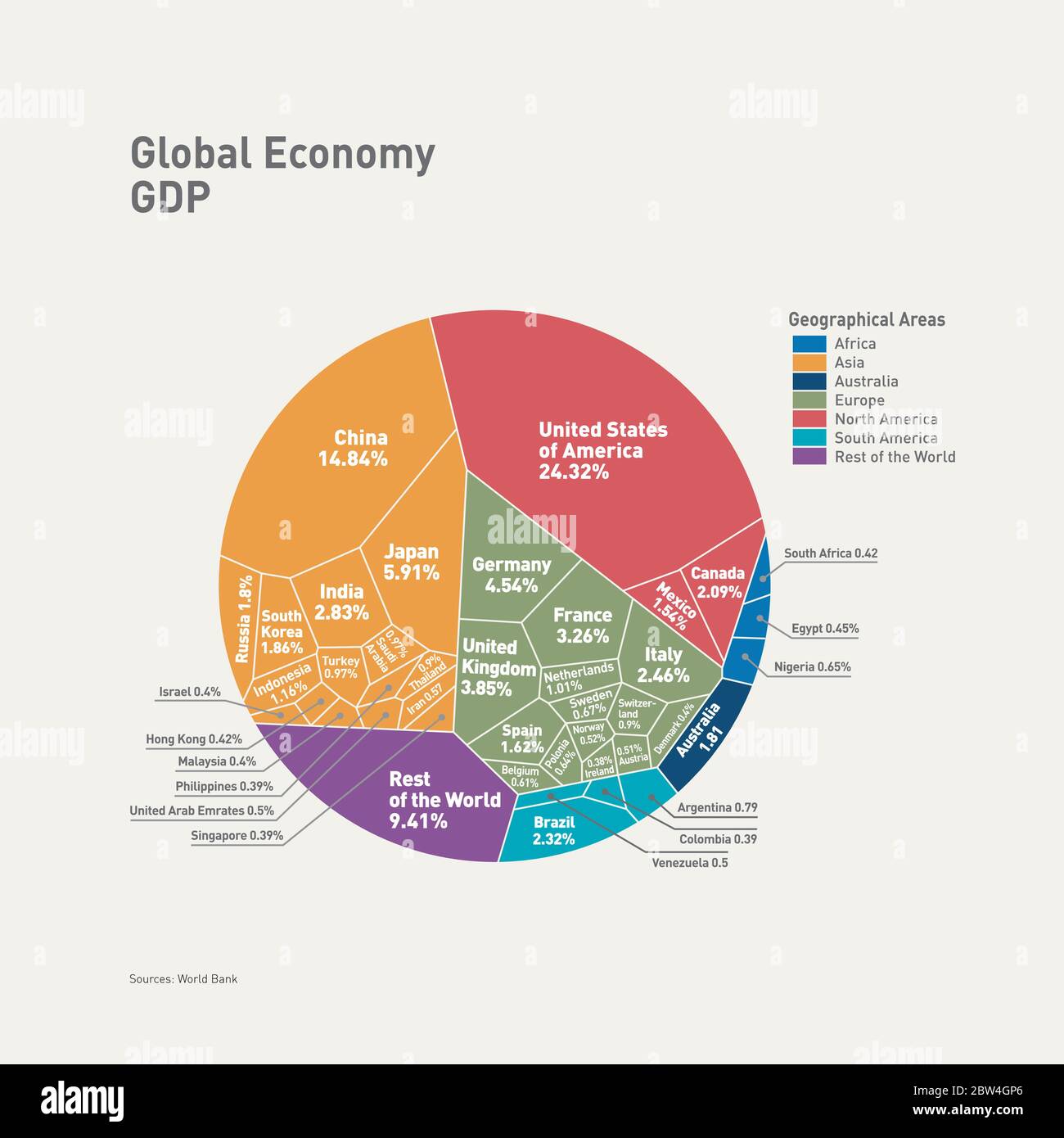

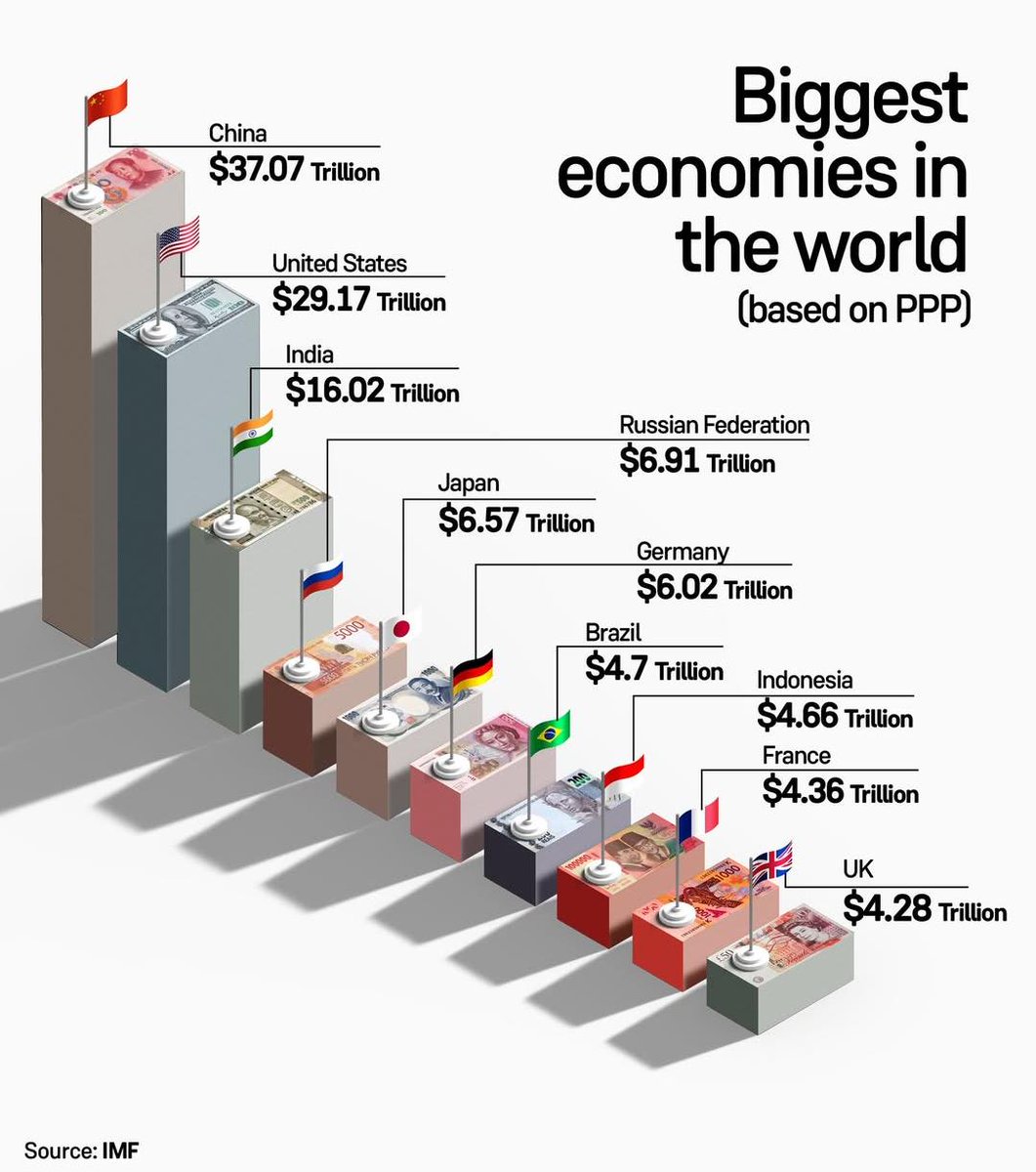

In 2025, India officially became the world’s fourth-largest economy by nominal GDP, overtaking Japan. For those who recall similar headlines from the 2009–2014 period, the distinction lies in what’s being measured. Back then, India rose to third plac

See More

Rajan Paswan

Building for idea gu... • 1y

Bad News: Rupee falls to record low 83.60/$ Here are negative impacts of falling Rupee: 1) Increased Costs for Imports: Many Indian businesses rely on imported goods and raw materials. A weaker rupee means they will have to pay more for these impor

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)