Back

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

What if the chase for a billion-dollar valuation is more of a trap than a dream? In "The Unicorn Paradox: Dream or Trap?", we dive into the high-stakes world of startups, exploring the tension between lofty valuations and sustainable success. Discove

See MoreStoxii

MARKET KA NAYA RYTHA... • 8m

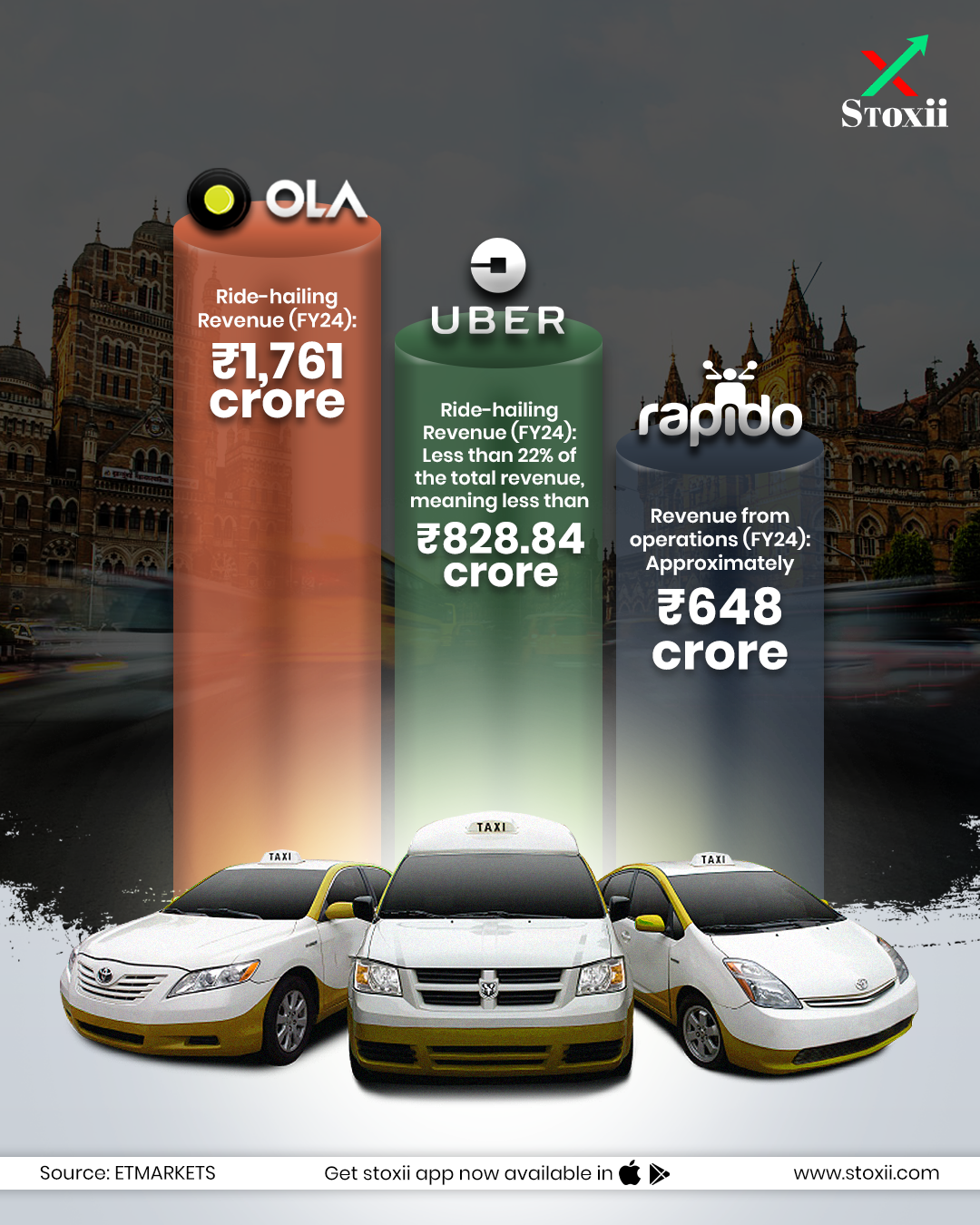

“Ever wondered how ride-sharing giants like Uber, Ola, and Rapido actually make money? The answer goes far beyond your fare. Think logistics, advertising, corporate partnerships, subscription services, and even electric mobility. Each company has cra

See More

Poosarla Sai Karthik

Tech guy with a busi... • 10m

A startup’s valuation is the price investors believe it’s worth. But that belief is often based more on future potential than current reality. Factors like market size, growth projections, and hype around the sector often play a bigger role than actu

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

In this thought-provoking video, "The Unseen Fuel: Beyond the Hype of Entrepreneurship," we delve into the deeper motivations that truly drive entrepreneurs beyond the clichés of "hustle" and "grit." Discover how a haunting problem, an intrinsic beli

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)