Back

Ayush saxena

Money is time and mo... • 1y

Here are a few key points about the "one nation, one tax" concept in India. :1.Goods and Services Tax (GST): The "one nation, one tax" refers to the implementation of the Goods and Services Tax (GST) in India. GST is a comprehensive indirect tax that replaced multiple indirect taxes like excise duty, VAT, service tax, etc. 2.Uniform Tax Structure: The goal of "one nation, one tax" is to have a uniform tax structure across the country, replacing the earlier fragmented indirect tax system. This was aimed at creating a common national market and improving ease of doing.

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreAASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Aditya Arora

•

Faad Network • 5m

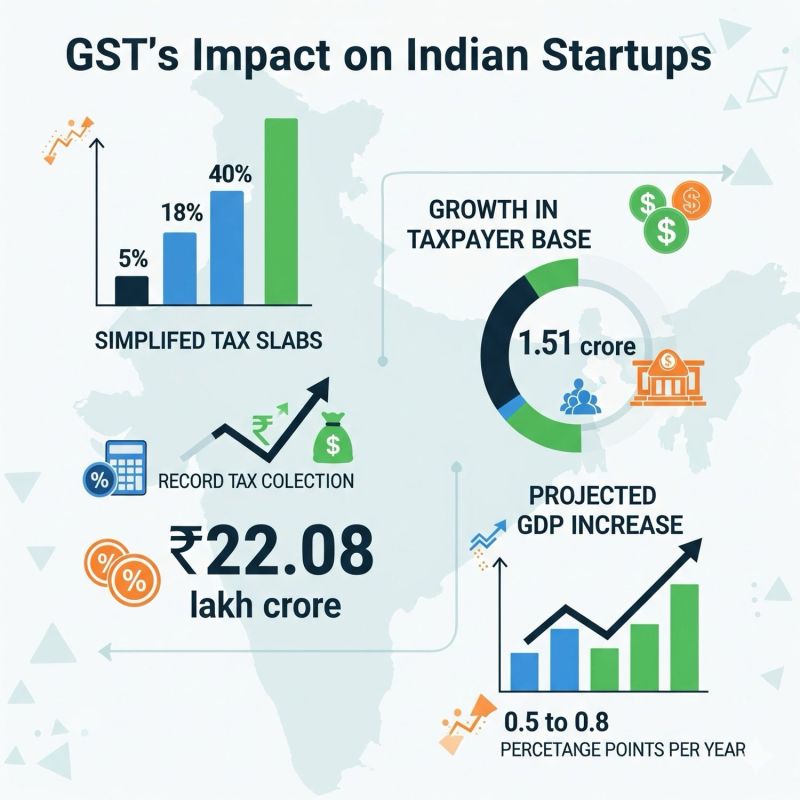

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)