Back

Vrishank

Startups/VC/tech • 1y

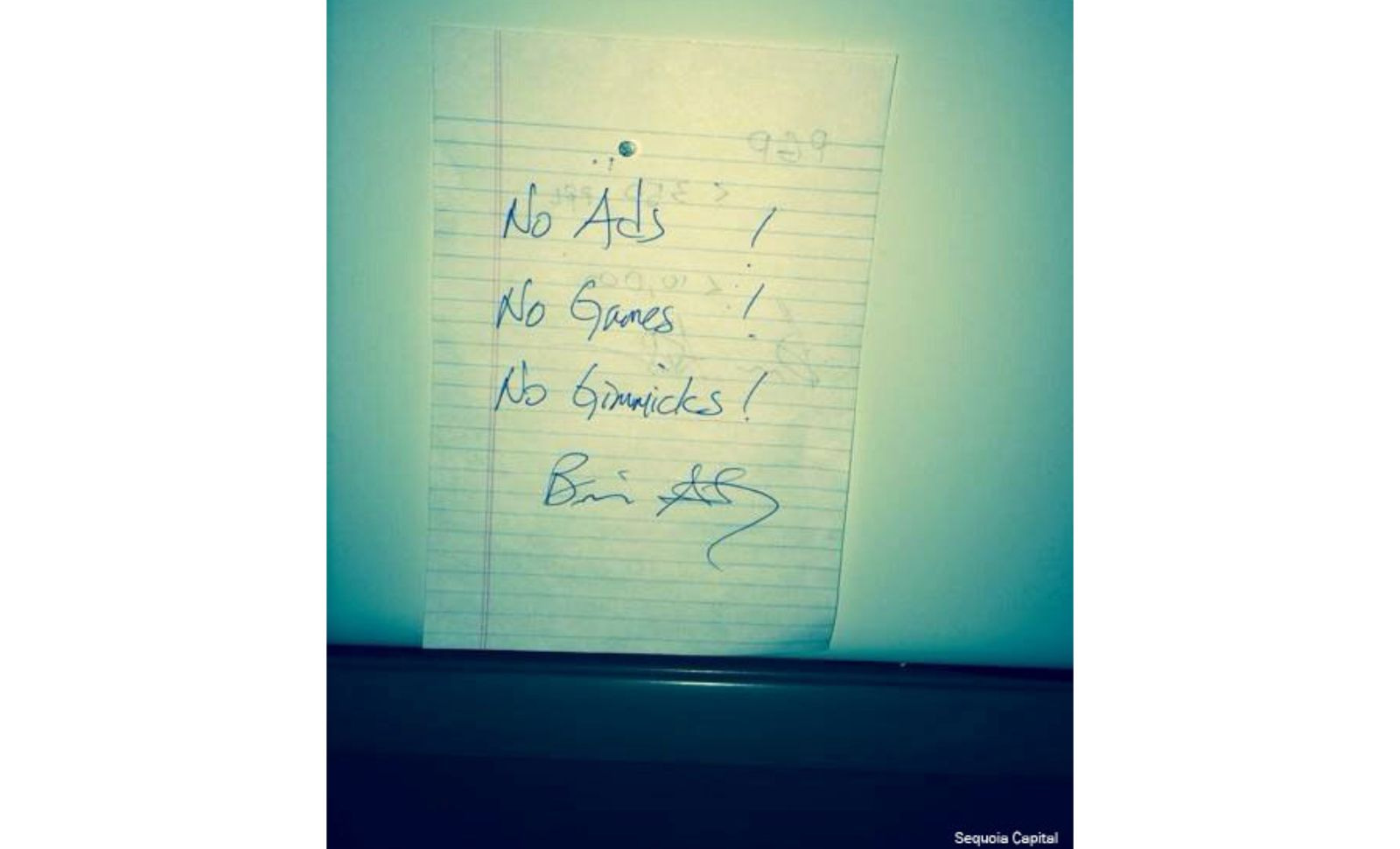

How sequoia took a billion dollar revenge on Mark Zuckerberg 👇 In 2004, Sequoia approached Mark, they wanted to invest in Facebook, but Mark was not really interested to raise funds from them, so he decided to go to meet the partners in a pyajma and made a ppt which read "10 reasons you should not invest in our startup". Partners at sequoia were not really happy with his behaviour. Fast forward to 2014, Facebook acquired WhatsApp for a whooping 19 billion dollars. And guess who was the only investor in WhatsApp? None other than Sequoia. 😀 Sequoia invested around 61 million dollars in WhatsApp in exchange for 18 percent stake and in 2014 when Facebook acquired WhatsApp, they had to pay Sequoia $3 billion for that 18 percent stake in the company. Which is a 50x return btw. Not just with WhatsApp, but sequoia also got a little revenge when Facebook acquired Instagram in 2012. They again had to pay Sequoia millions of dollars. Finally, Sequoia had the last laugh in this saga. 😀

Replies (15)

More like this

Recommendations from Medial

Rajan Paswan

Building for idea gu... • 1y

WhatsApp's $19 Billion Acquisition by Facebook Explained!! On February 19, 2014, Facebook acquired WhatsApp for $19 billion, making it the largest purchase of a venture-capital-backed company at that time. This acquisition followed WhatsApp's $1.5 b

See MoreKrish Jaiman

Passionate about tec... • 1y

Imagine tomorrow morning 🌄, you wake up and WhatsApp ask you to pay if you want to message your friend.Will you pay or you will just uninstall WhatsApp. If you would have been WhatsApp user before 2016, you might have paid for it .Yes, WhatsApp char

See MoreSaurav Singh

Building plany.space... • 4m

Jan Koum – From poverty to $19B > Born in a small village in Ukraine, grew up poor. >Migrated to the US with his mother, cleaned floors & worked as a janitor. Couldn’t even afford phone calls to his father back home. >Built WhatsApp in 2009. >In 201

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)