Back

Dinakar

Nobody • 1y

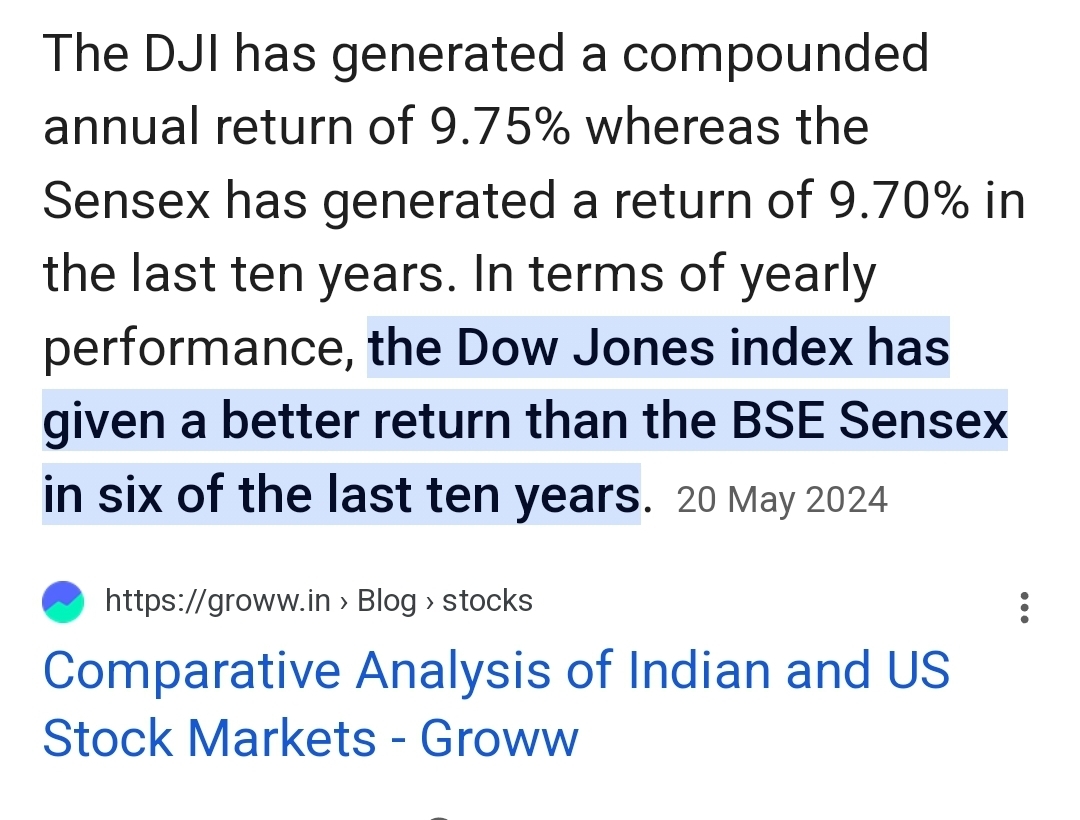

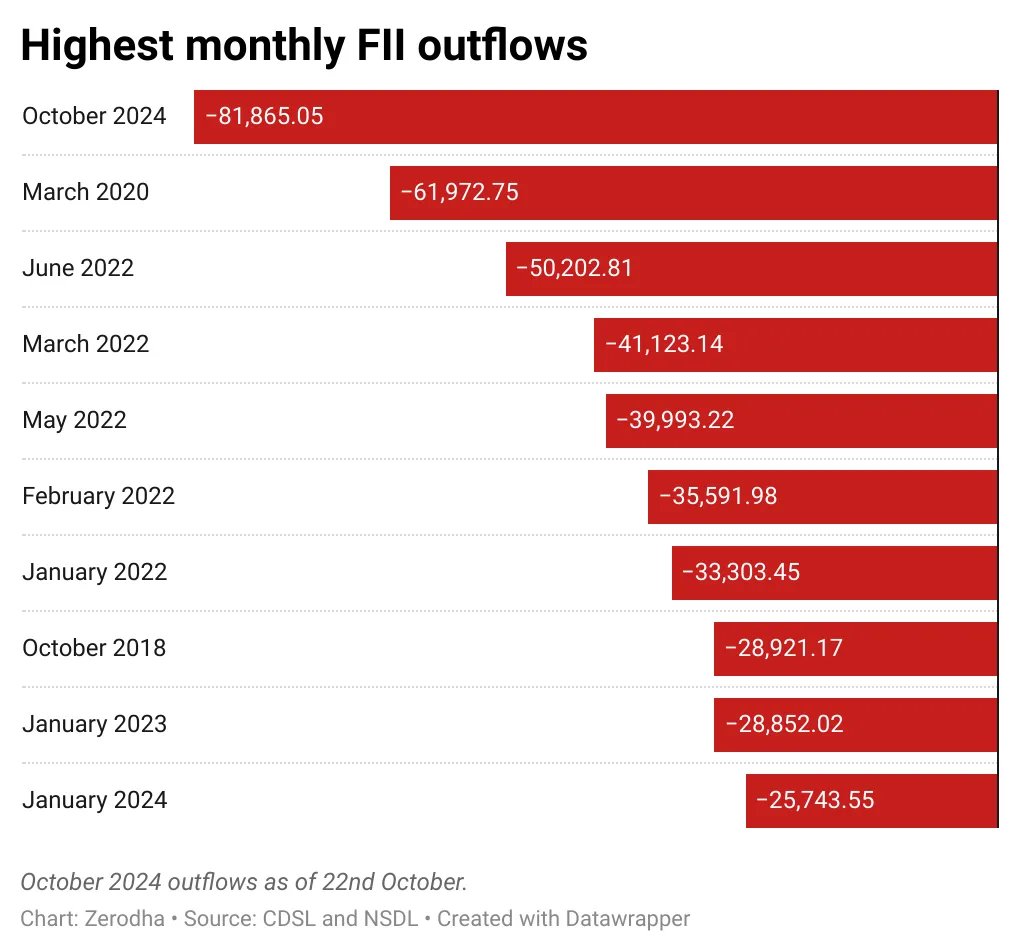

Doesn't this also mean that the US dollar will see a jump in it's value, and also because of these decisions haven't the returns of US treasury bond yield increased, which inturn is affecting the indian market as foreign investors are pulling money out of Indian markets due to attractive rate of returns from US bonds?

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

These days, as more retail investors step into the bond market, high yield bonds are getting harder to find. I remember being able to buy AA rated bonds on the exchange with returns as high as 24% to 30%. Now, those same bonds hardly go beyond 12% or

See MoreTushar Aher Patil

Trying to do better • 8m

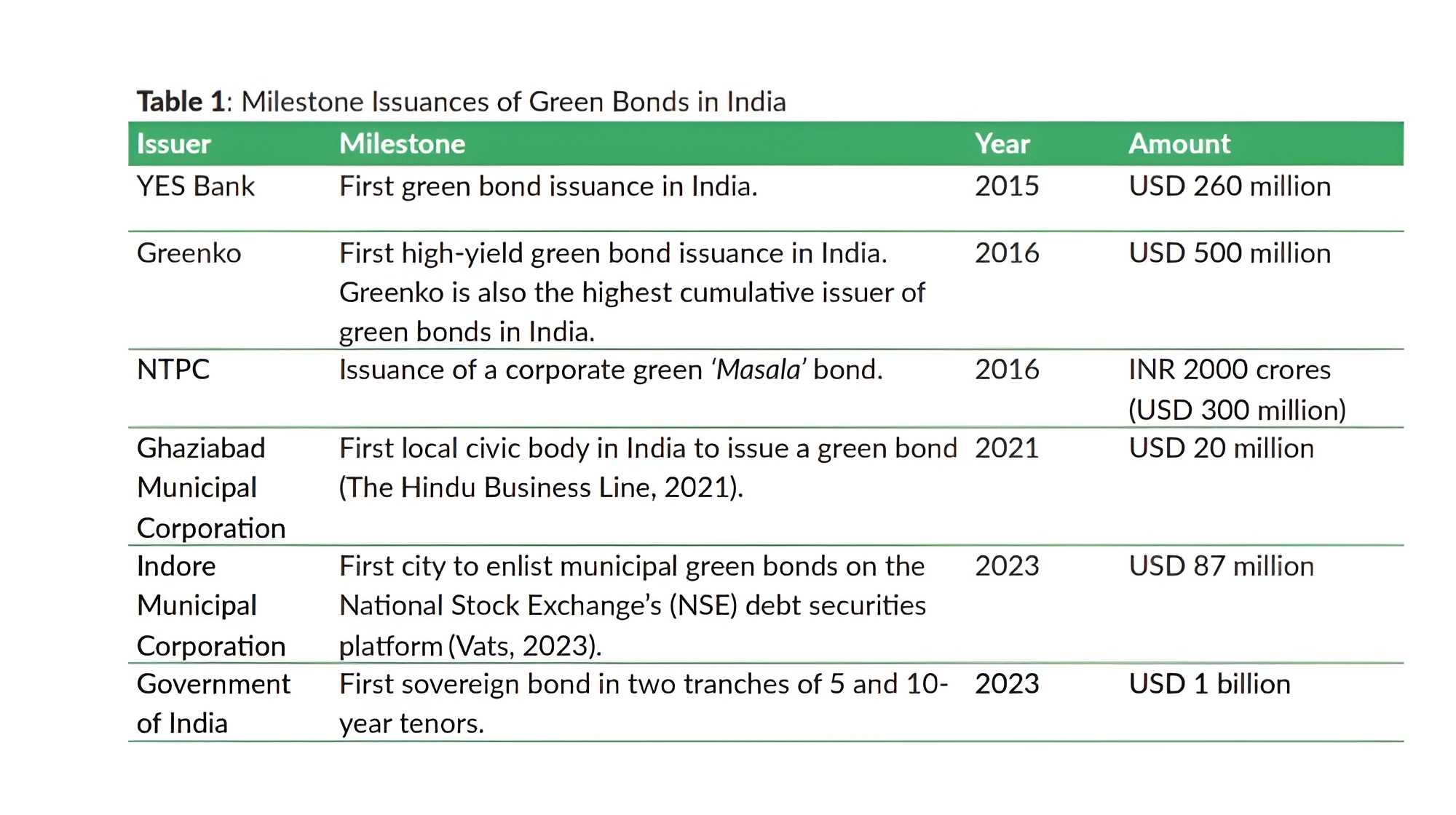

Day 6 - 📢 Ever heard of a Masala Bond? Here's why it's spicing up global finance! 🌶️📊 No, it’s not a recipe! 😄 A Masala Bond is a rupee-denominated bond issued in international markets by Indian entities. Its purpose is to help companies raise fu

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)